Small business billing software: Compare Top Aussie Tools

Discover small business billing software for Australian businesses. Compare features, pricing, and invoicing tools to streamline your workflow.

Payly Team

January 27, 2026

If you’re running a service business in Australia, you know the drill. Chasing up late payments, drowning in a sea of admin, and making educated guesses about your cash flow: it’s exhausting. It feels a bit like trying to fill a leaky bucket; for every bit of progress you make, inefficiency drains your time and money. The right small business billing software isn't just another subscription to manage; it's the tool that plugs those leaks for good.

Why Smart Billing Software Is a Game Changer

For so many Australian small and medium businesses (SMEs), managing the money side of things feels like a constant battle. You're juggling everything from creating invoices and tracking hours to sending out payment reminders. Before you know it, the admin work has swallowed up the time you should be spending on your actual business. This is exactly where dedicated software comes in, taking the entire process: from timesheet to payment: and putting it on autopilot.

Modern cloud-based tools replace that messy collection of spreadsheets and manual data entry with one clean, automated system. This simple switch helps businesses get paid faster, gives them a crystal-clear view of their cash flow, and cuts down on the human errors that can lead to costly mistakes.

The Growing Demand for Efficiency

This shift towards automation isn’t just a passing trend. It's a fundamental change in how smart businesses are run. In Australia, SMEs are the driving force behind the massive growth in the billing software market, all looking for clever ways to get more done with less effort. The market was valued at AUD 121.09 million in 2025 and is tipped to explode to AUD 525.04 million by 2035, growing at a healthy 15.80% each year. This boom is all thanks to SMEs realising they can slash their admin workload and get cash in the bank faster with these tools. You can dig into more insights on the Australian billing software market here.

This rapid uptake tells an important story, especially for service-based businesses. When your income is directly linked to the hours you bill, being efficient and accurate isn't a nice-to-have: it's absolutely critical to your bottom line.

For a service business, every untracked minute or delayed invoice is lost revenue. Billing software transforms this vulnerability into a strength by ensuring every second of work is captured, billed, and paid on time.

Moving Beyond Simple Invoicing

Sure, creating invoices is the main event, but the best platforms do so much more. They create a connected system that looks after the entire client journey, from the first quote to the final payment.

Picture a setup where:

- Time tracking flows directly into invoices. Every single billable hour is automatically logged and assigned to the right client's invoice, which means no more manual calculations or mistakes.

- Payment reminders are sent automatically. The system gently nudges clients about overdue payments without you having to do a thing, drastically improving how quickly you get paid.

- Your financial data is always current. With a real-time dashboard, you can make sharp decisions based on today's cash flow, not last month's outdated figures.

By linking all these crucial jobs together, an integrated platform like Payly starts solving these core problems from day one. It hands you back the time you need to focus on what you're truly passionate about.

Understanding the Core Features of Billing Software

Diving into small business billing software can feel a bit much at first. You're hit with long lists of features that all start to sound the same. But here's the secret: the real value isn't about having the most features. It's about having the right ones working together to solve the real-world headaches you face in your service business.

Let's cut through the jargon and look at what these tools actually do for your day-to-day operations.

Think of this software as your financial command centre. It’s designed to replace that messy patchwork of spreadsheets, clunky manual timers, and a calendar full of payment reminders. Instead, you get a single, automated system that captures every billable moment, accounts for every dollar, and helps you get paid without the constant administrative chase.

This shift to smarter, cloud-based tools is really changing the game for Australian businesses. The local billing software market is booming, expected to jump from AUD 104.57 million in 2025 to a massive AUD 453.41 million by 2034. That's a growth rate of 15.80% every year, fuelled by businesses just like yours wanting the real-time updates and security that only cloud platforms can offer. You can see more data on this trend here.

Automated Invoicing From Timesheets

For any service-based business, time really is money. The biggest financial leak often comes from billable hours slipping through the cracks because of clunky, manual tracking. This is where good software starts to feel like magic.

Imagine this: your team logs their hours on a project. Instead of someone having to manually collect those entries, add them up, and then type everything into a separate invoice template, the software handles it all. With just a few clicks, it pulls every tracked minute from the digital timesheets and generates a perfectly accurate, professional invoice.

This direct link cuts out human error, stops you from accidentally under-billing clients, and frees up hours of mind-numbing admin work every single month. We break down what to look for in our guide on the best invoicing software for small businesses.

Recurring Billing for Predictable Revenue

Are you juggling clients on monthly retainers or ongoing service contracts? Creating and sending the same invoice month after month is a tedious job. It’s also dangerously easy to forget, which leads to late payments and a lumpy cash flow.

Recurring billing puts this entire process on autopilot. You set up a client's billing schedule just once, say, on the 1st of every month. From then on, the software takes over, automatically sending them the invoice on that date without you having to think about it again. It's a game-changer for building a predictable revenue stream.

Integrated Time and Expense Tracking

A project’s real cost goes beyond just the hours your team puts in. It includes all the little things, like software subscriptions, travel, or materials you bought specifically for a client. If you aren't tracking these properly, your profit margins suffer.

Good billing software brings time and expense tracking under one roof. Your team can log their hours while also uploading receipts or noting down expenses, all tied to the same project or client.

When it's time to send the bill, the system lets you pull those billable expenses straight onto the invoice. This makes sure you recoup every cost and get a crystal-clear financial picture of every job you do.

At its heart, billing software exists to forge an unbreakable link between the work you do and the money you earn. Every feature is designed to shorten the path from a billable hour to cash in your bank account.

How to Choose the Right Billing Software for Your Business

Choosing the right billing software for your small business isn't just about picking a tool; it's like hiring a new, hyper-efficient team member. You need something that gets the unique rhythm of your Australian service business: a solution that does more than just spit out invoices. The secret is to stop focusing on a long checklist of technical features and start thinking about what you actually need to get through your day.

For businesses here in Australia, that means looking for specific, localised features. It’s not just about handling Australian dollars. It’s about making compliance effortless and ensuring the software slots perfectly into our local business ecosystem.

Start With Your Local Needs

Before you even book a demo, take a moment to map out your non-negotiables. A great place to begin is with the tools your business already runs on. The right software should feel like it was always meant to be there, not another isolated app holding your data hostage.

For any Australian service business, these three criteria are absolute must-haves:

- Australian Accounting Software Integration: Your billing platform has to play nicely with local accounting giants like Xero and MYOB. A seamless connection means your invoices, payments, and client details sync up automatically. No more mind-numbing double entry, just clean, accurate books.

- Built-in GST Compliance: Trying to calculate and apply Goods and Services Tax manually is just asking for trouble. Look for software that handles GST automatically. It keeps your invoices compliant from day one and makes lodging your Business Activity Statement (BAS) so much simpler.

- Local Data Security Standards: You're handling sensitive client and financial data. It's absolutely critical to pick a provider that follows Australian data privacy laws and uses serious security measures, like bank-level encryption, to keep that information safe.

All-In-One Platform or a Stack of Tools?

One of the biggest forks in the road is deciding whether to go for an all-in-one platform or cobble together a 'stack' of different specialised tools. The stacked approach might mean using one app for time tracking, another for invoicing, and a third for signing contracts. It sounds flexible, but it often comes with hidden costs and big headaches.

Juggling multiple subscriptions means you’re managing multiple bills and forcing your team to learn different interfaces. Worse, you’re constantly worrying if they all talk to each other properly. Data gets trapped in silos, meaning you’re stuck manually copying information from one system to another: a surefire way to waste time and make mistakes. If you're looking to keep costs down, it's worth exploring the best free accounting software for small businesses, as many of these now include great billing tools.

An all-in-one platform is designed to be a single source of truth for your business operations. It connects every step, from tracking time to getting paid, creating a seamless workflow that a stacked solution can rarely replicate.

An integrated platform like Payly brings everything under one roof. Time tracking flows straight into your invoices, proposals can be signed and stored in the same place you bill from. This doesn't just make your workflow smoother; it gives you a complete, real-time picture of your business's financial health, all in one dashboard.

Comparing the True Costs

Don't be fooled by the low sticker price of individual apps. To get the real story, you need to compare the total cost and what you actually get from a stacked solution versus an all-in-one platform. It's not just about money, either. One study found that a business owner can burn over 18 hours a week on accounting tasks alone when using disconnected tools. A unified system gives you that time back.

Let's look at how the costs and features stack up for a small Australian agency.

Software Stack vs All-In-One Platform Cost Comparison

| Feature | Stacked Tools (e.g., Harvest, QuickBooks, DocuSign) | All-In-One Platform (e.g., Payly) | Key Difference |

|---|---|---|---|

| Time Tracking | ~$12 AUD per user/month | Included in flat account fee | Cost multiplies with every new team member. |

| Invoicing & Billing | ~$30 AUD per month (limited users) | Included in flat account fee | Often has user limits that force expensive upgrades. |

| E-Signatures | ~$40 AUD per month for basic plan | Included in flat account fee | A completely separate, pricey subscription. |

| Data Syncing | Requires manual work or paid connectors | Data flows seamlessly between features. | Eliminates errors and saves hours of admin time. |

| Total Monthly Cost | $82+ AUD (and increases per user) | One predictable, flat fee for the team. | Delivers significant cost savings and budget certainty. |

As you can see, the all-in-one approach offers clear savings and a much smarter way to operate. By bringing all your essential functions together, you get rid of subscription chaos and make sure your whole team is working from the same page. That’s how you build a foundation for real efficiency and growth.

Thinking Beyond Invoicing with an Integrated Platform

True efficiency in a service business isn't just about sending a bill; it's about seeing the entire client journey from start to finish. While getting that invoice out the door is obviously critical, it’s really just one stop on a much longer road. The best small business billing software gets this. It acts less like a simple tool and more like a central hub, managing everything from the initial proposal to the final payment, all in one spot.

This is a shift away from just "billing" and towards managing your entire operational workflow. Imagine a system where your client proposals, legally binding contracts, purchase orders, and even team onboarding documents all live together. When these functions talk to each other, you get rid of the messy data silos that cause so many headaches for small business owners.

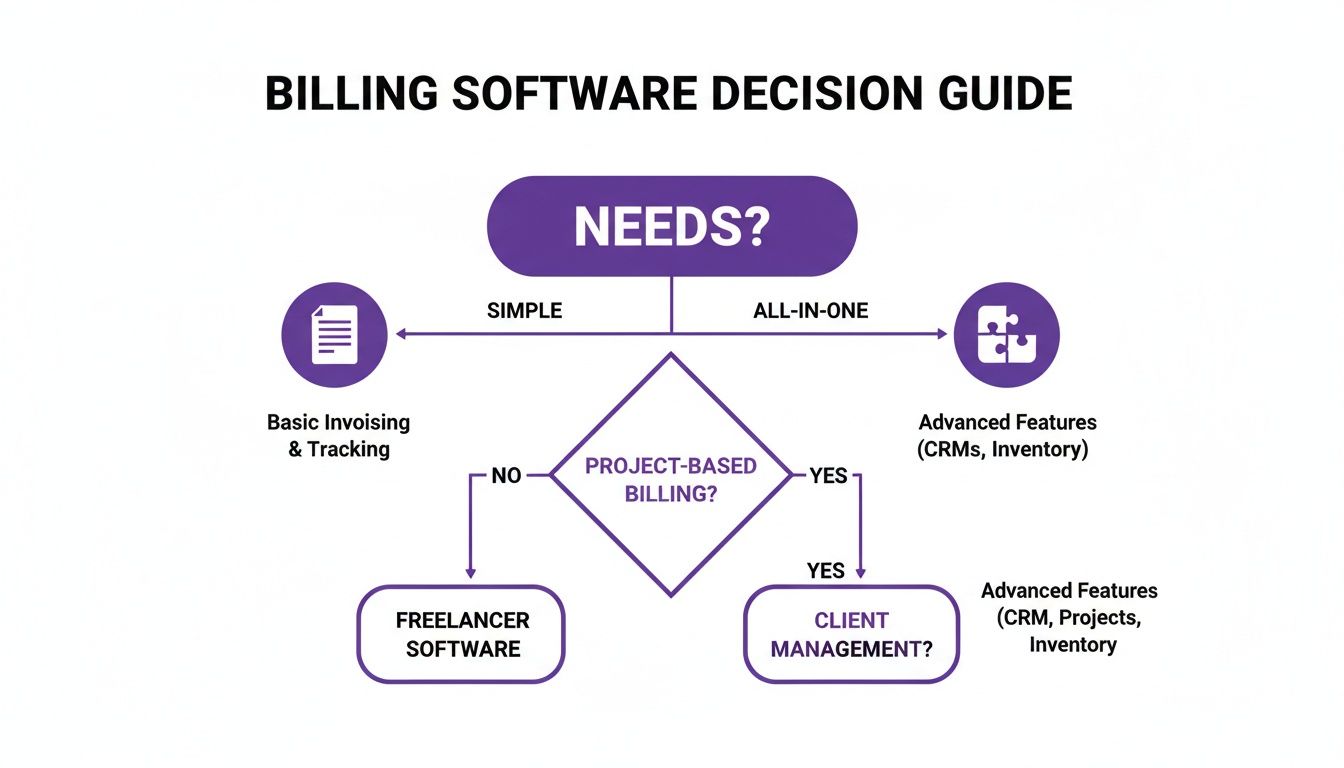

This decision tree can help you visualise whether a simple invoicing tool or an all-in-one platform is the right fit for your business.

The key takeaway is pretty clear: if your work involves more than just firing off a single invoice, an integrated platform is built to handle that complexity far more effectively.

Creating a Single Source of Truth

When you juggle separate apps for proposals, contracts, and invoicing, you create disconnected islands of information. The client details you put in your proposal software might not quite match what's in your billing system. This fragmentation forces you into the soul-crushing routine of manual data entry: a process that’s not only slow but also a prime suspect for costly mistakes.

An integrated platform solves this by creating a single source of truth. Every bit of client information, from the signed contract to the payment history, is stored and managed in one system. This means your data is consistent, accurate, and always up-to-date across your entire business. No more guesswork.

From Proposal to Paid: A Digital Agency Case Study

Let's walk through a real-world scenario. A small digital agency in Sydney has just landed a new client. In the past, their process was a chaotic jumble of different tools and manual steps.

Here’s how they used to do things:

- Proposal: Drafted in a Word doc, saved as a PDF, and then emailed off to the client.

- Contract: A totally separate document sent via a third-party e-signature service, which came with its own monthly subscription fee.

- Onboarding: Client details were then manually typed into their accounting software and project management tool.

- Invoicing: Invoices were built from scratch each month, cross-referencing a spreadsheet where they tracked project milestones.

This disjointed workflow was incredibly slow and riddled with opportunities for error. Information was often copied incorrectly, and just checking the status of a contract meant logging into a completely different system.

Now, let's see how this exact same process works using an integrated platform like Payly.

By connecting the entire client lifecycle, an integrated platform does more than save time. It creates a professional, seamless experience for your clients and gives you a complete, real-time overview of your business relationships.

The agency now follows a much cleaner, more automated process:

- Step 1: Proposal and Contract: They build a combined proposal and contract right inside the platform. The client can review it and provide a legally binding e-signature directly in the same system.

- Step 2: Automatic Onboarding: As soon as the contract is signed, the client’s details automatically create a profile, ready for project tracking and invoicing. There is zero manual data entry.

- Step 3: Integrated Invoicing: When a project milestone is hit, an invoice is generated from the project data with just a couple of clicks. The system automatically pulls the correct rates and details straight from the signed contract.

- Step 4: Centralised Records: The signed contract, project notes, and all past and present invoices are stored together under the client's profile, accessible to the whole team.

This unified approach dramatically cuts down their admin workload. More importantly, it ensures every step is documented and connected, which is invaluable for maintaining clear financial records and strong client relationships. For businesses using Xero, understanding how these systems link up is a game-changer; you can explore the benefits of a Stripe and Xero integration to see just how powerful these connections can be.

Your Non-Negotiable Security and Integration Checklist

Whenever you’re looking at new software for your business, two big questions always come up: how safe is my data, and will this tool actually talk to everything else I use? These aren't just minor details; they're the absolute foundation for making a smart choice on billing software.

Think of it this way: without proper integrations, your new billing software is like a remote island. All your crucial data is stuck there, and you’re forced to manually row information back and forth between it and your other systems. It’s slow, tedious, and a recipe for mistakes. For any Australian business, this means finding a tool with solid, ready-to-go connections is a must.

Must-Have Australian Integrations

Your billing software needs to slot neatly into your existing business setup. It has to connect effortlessly with the tools you already count on to manage your finances and day-to-day operations.

Here’s your essential checklist:

- Accounting Software: This is the big one. The link to your accounting platform is non-negotiable. You need direct integrations with Australian favourites like Xero and MYOB. This is what ensures your invoices, payments, and client details sync up automatically, keeping your books spotless and saving you from hours of painful admin.

- Payment Gateways: If you want to get paid faster, you have to make it dead simple for clients to pay you. A direct connection to a payment gateway like Stripe lets your clients pay invoices instantly online with their credit card. No more chasing cheques.

- Cloud Storage: Being able to link to services like Google Drive or Dropbox is incredibly handy. It lets you attach important project files, contracts, or documents right to a client’s record, keeping everything organised and accessible in one spot.

If you skip these core integrations, you’re just signing yourself up for more manual work, which completely defeats the purpose of getting the software in the first place.

Understanding Data Security and Compliance

When you're handling client invoices and payment information, you're holding their sensitive financial data in your hands. Handing this over to a cloud provider can feel like a bit of a leap, but the truth is that reputable platforms offer security far beyond what most small businesses could ever build themselves.

You’ll often see the term bank-level encryption. This isn't just marketing fluff. It refers to a specific, high-powered standard of data protection called AES-256. It essentially scrambles your information, making it completely unreadable to anyone without authorisation. It's the same security technology the big banks use.

Always choose a provider that’s upfront and transparent about its security practices. This isn’t just about encryption; it’s also about complying with Australian data privacy laws that dictate how your business and client data must be stored and managed. You can see what this looks like in practice by reviewing our guide on Payly's comprehensive security protocols.

A secure, well-integrated billing platform isn't a 'nice-to-have'. It’s the bedrock of an efficient, trustworthy, and scalable business.

Making a Smooth Switch to New Billing Software

The thought of switching your billing software can feel like a mammoth task. It’s easy to get bogged down by the "what ifs": what if we lose data? What if it disrupts our cash flow? These are valid concerns, but with a bit of planning, you can turn a potentially massive headache into a smooth and manageable upgrade.

The secret is all in the prep work. Before you even think about migrating, take a moment to tidy up what you already have. This is your chance to clean out that messy client list, update contact details, and chase up any old, unpaid invoices still lingering in your current system. Think of it as a financial spring clean; starting with a clean slate makes everything that follows ten times easier.

Switching billing software isn't just a technical task; it's a chance to reset your financial processes. Use it as an opportunity to clean up old data, streamline workflows, and set your business up for greater efficiency.

Your Four-Step Migration Plan

A good plan is everything. Instead of trying to tackle the whole project in one go, break it down into a simple, logical sequence. This way, you minimise the stress and make sure nothing important falls through the cracks.

Here’s a straightforward, four-step process to guide you through the switch:

- Get Your Data Ready: Start by exporting all your critical info: client lists, outstanding invoices, and payment histories. Most software will let you download this as a CSV file, which is a universal format that’s easy to work with.

- Set Up Your New Home: Once your data is imported, it’s time to make the new system your own. This is where you’ll set up your branded invoice templates, fine-tune the automated payment reminders, and securely connect your bank accounts.

- Train the Team: A shiny new tool is only useful if everyone knows how to drive it. Schedule a quick training session to walk your team through the basics, like how to track their time or send an invoice. Following proven SaaS customer onboarding best practices here is a great way to help everyone get up to speed quickly and feel confident using the new system.

- Run a Brief Parallel Test: For the first week or so, it’s a smart idea to run both your old and new systems at the same time. This acts as a safety net, allowing you to spot any little issues and build confidence before you make the final leap.

Test the Waters with a Free Trial

One of the best ways to calm any nerves about migrating is to simply try before you buy. Most modern platforms, Payly included, offer a free trial. This is your no-strings-attached chance to get in there and see how it all feels.

Use the trial period to play around. Import a small sample of your client data, create a few test invoices, and click every button. This hands-on experience shows you exactly how the platform will work for your business, long before you have to commit a single dollar.

Frequently Asked Questions About Billing Software

Diving into the world of billing software for your small business can definitely bring up a few questions. To help you feel confident in your choice, we’ve put together straight-up answers to the queries we hear most often from Australian business owners.

How Much Does Small Business Billing Software Cost in Australia?

This is a big one, and the pricing models can be all over the place. It's really important to think about the total cost, not just the starting price. Some providers will charge you per user, which might look cheap at first, but the bill can climb surprisingly fast as you bring on more team members. It’s a model that almost punishes you for growing.

A much better approach, in my experience, is a flat-fee subscription for the whole team. You know exactly what you’re paying each month, no nasty surprises. When you're weighing up your options, do a quick calculation of what you're currently spending on separate tools for time tracking, e-signatures, and invoicing. You’ll often find that an all-in-one platform saves you a significant amount compared to stacking a bunch of different subscriptions.

Is Cloud-Based Billing Software Secure?

Yes, absolutely. Any reputable cloud software provider takes security incredibly seriously. The top players use what’s known as bank-level encryption to shield your sensitive financial data, both when it’s sitting on their servers and when it’s moving across the internet. Honestly, it’s a level of security that’s far beyond what most small businesses could manage on their own.

Just make sure you choose a platform that’s open about its security practices and complies with Australian data privacy laws. That’s your guarantee that your client and business information is being handled correctly and kept safe from prying eyes.

When you go with a cloud provider that has certified security, you’re essentially hiring a team of dedicated specialists to protect your data. It frees you up to focus on running your business.

Can I Switch if I Already Use Xero or MYOB?

Of course. In fact, any billing software worth its salt for Australian service businesses is built to work hand-in-glove with accounting platforms like Xero and MYOB. This isn’t just a nice-to-have feature; it’s a non-negotiable for a smooth operation.

A good integration automatically pushes your invoices, payments, and client details from your billing software straight into your accounting system. It completely gets rid of the soul-destroying (and error-prone) task of entering everything twice, making sure your books are always accurate and up to date. When you're looking at different options, check that they shout about these local integrations.

What Is the Main Benefit of an All-in-One Platform?

It comes down to this: a basic invoicing tool just makes invoices. An all-in-one platform, on the other hand, handles the entire journey that ends with you getting paid.

Think of it as a connected ecosystem. Your time tracking flows straight into an invoice, your contracts are signed and stored right there with the client’s file, and all your important documents live in one central spot. This unified approach saves countless hours of admin, slashes the risk of human error, and gives you a crystal-clear, real-time view of your entire business from one screen.

Ready to stop juggling multiple subscriptions and get your workflow under control? Payly brings time tracking, invoicing, e-signatures, and document management together in one simple, powerful platform built for Aussie businesses. Start your free 14-day trial today and see the difference for yourself.

Payly Team

Sharing insights and strategies to help service businesses thrive. Follow Payly for more tips on time tracking, invoicing, and business operations.

Related Articles

Ready to streamline your business?

Join thousands of freelancers and agencies who use Payly to track time, send invoices, and get paid faster.