Invoicing in Accounting: Master Your Invoices and Cash Flow

Discover invoicing in accounting best practices to streamline workflows, get paid faster, and reduce mistakes.

Payly Team

January 26, 2026

Let's be honest, invoicing is more than just sending a bill. It’s the official starting line for getting paid. Think of it as the legal handshake that turns your hard work into actual revenue, setting your entire financial engine in motion.

An invoice is the critical piece of paper (or, more likely these days, the digital file) that connects your sales efforts to your bank account. It's the trigger that transforms a completed job or a delivered product into income you can officially count.

What Invoicing Really Means in Your Business

Forget seeing an invoice as a simple request for money. It's the starting gun for your revenue cycle. It’s the moment you formally log a sale in your financial system, creating a clear, traceable path from the work you did to the cash you're owed. Without an invoice, a sale is just a handshake deal; with one, it becomes a legal IOU and a trackable asset.

This single document pulls double duty. On one hand, it’s a straightforward demand for payment, telling your client exactly what they bought, what it costs, and when you expect to be paid. On the other, it's a source document, the raw data that fuels your bookkeeping and keeps your financial records straight.

The Role of an Invoice in Bookkeeping

Every time you send an invoice, you’re doing more than just asking for payment. You're creating a crucial record that feeds directly into your business's financial health reports. This one document is the cornerstone for managing one of your most vital assets: your accounts receivable.

Here’s what’s happening behind the scenes:

- It Creates Accounts Receivable: The invoice officially logs the money owed to you. This debt sits in your "accounts receivable" ledger until the cash lands in your bank.

- It Recognises Revenue: Invoicing allows you to formally recognise the income when you’ve earned it (not just when you get paid), giving you a true snapshot of your performance.

- It Provides an Audit Trail: Each sequentially numbered invoice builds a clean, clear history of every transaction. This is non-negotiable for keeping track of things internally and staying on the right side of the tax office.

In short, invoicing is the process that turns your daily grind into numbers on a spreadsheet. It’s the bridge between doing the work and seeing that work reflected on your balance sheet.

For businesses here in Australia, getting invoicing right is even more critical. A proper tax invoice is essential for tracking and reporting Goods and Services Tax (GST). Every invoice needs to clearly show the GST component, as this information is used directly for lodging your Business Activity Statement (BAS) with the Australian Taxation Office (ATO). Nailing this from day one is fundamental to healthy cash flow and keeping your books accurate and compliant.

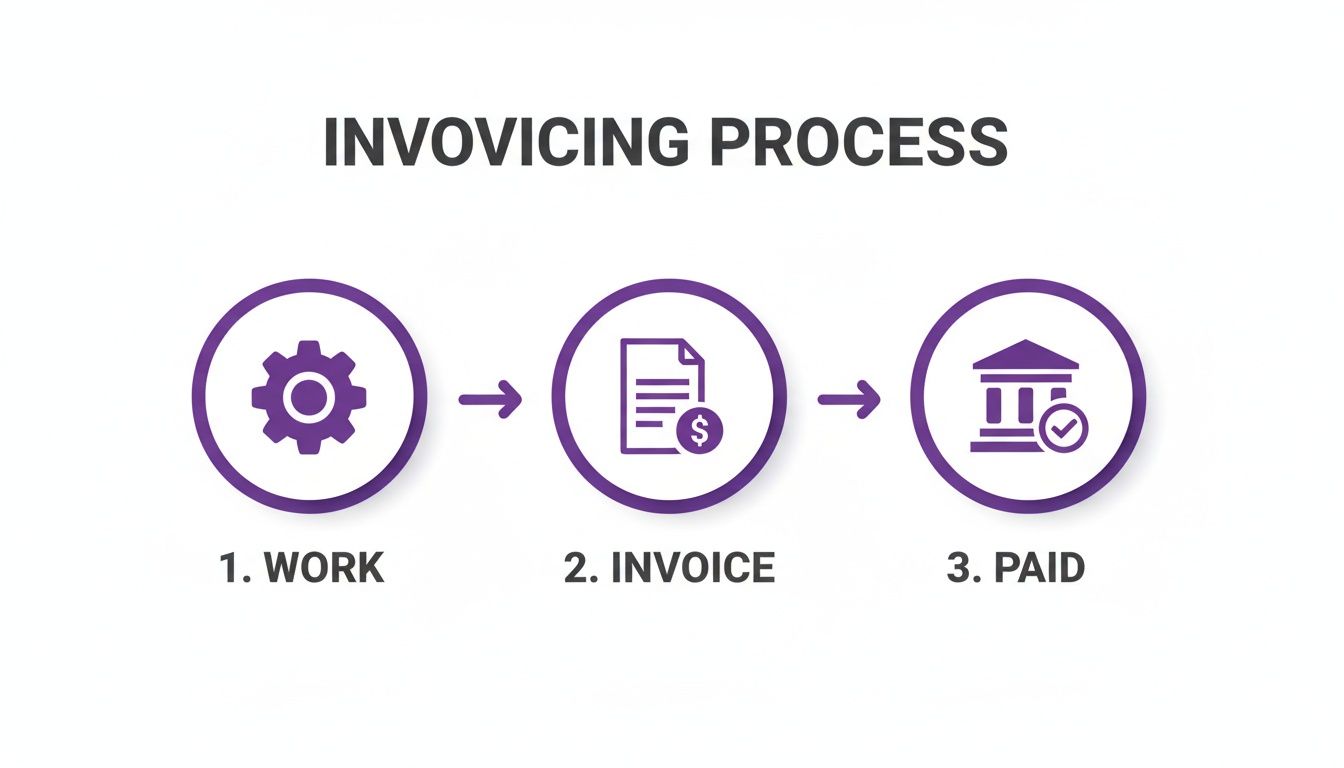

Your Invoice Workflow: From Creation to Cash

A solid invoicing process isn't just about sending a bill. It's a reliable, repeatable system that takes you from a finished job to money in your bank account. Get it right, and it becomes the healthy heartbeat of your business. But a disorganised approach? That’s a fast track to late payments, unhappy clients, and hours of admin headaches you just don't need.

The whole journey really boils down to three simple steps: do the work, send the invoice, and get paid.

Each of these stages has its own set of critical actions. Nailing them is what keeps the cash flowing smoothly into your business without hitting any roadblocks.

Crafting a Compliant and Professional Invoice

First things first, you need to create an invoice that looks professional and ticks all the legal boxes. This document is a direct reflection of your brand, so it has to be clear, easy to understand, and contain every piece of information your client needs to pay you promptly.

For any Australian business, a compliant tax invoice isn't optional, it's a must. It needs to include:

- Your Business Details: Your business name and, crucially, your Australian Business Number (ABN).

- Clear Identification: The words "Tax Invoice" must be clearly stated, usually near the top.

- Essential Dates: The date you issued the invoice.

- A Unique Number: A sequential invoice number is vital for tracking and auditing.

- Client Information: The client’s name or ABN.

- Goods and Services: A simple, clear description of what you’re charging for.

- GST Information: The total price including GST, with the GST amount shown as a separate line item.

Using a proper template or good invoicing software is the easiest way to make sure you never miss these details, which is absolutely vital when it comes time to do your BAS.

Sending the Invoice and Managing Follow-ups

Once the invoice is ready, how and when you send it can make all the difference. Don't wait around. Send it the moment the work is done or as soon as your contract allows. It shows you're on the ball and gets the payment clock ticking straight away.

The follow-up is where so many business owners stumble. It can feel awkward chasing money, but a structured, automated approach takes the emotion out of it and simply gets the job done. Late payments are a massive problem for Australian SMEs. In fact, invoices are paid an average of 6.4 days late, which ties up a staggering $1.1 billion in working capital across the country's 2.6 million small businesses.

A proactive follow-up isn't nagging; it's smart cash flow management. A simple, automated reminder a few days before the due date, on the due date, and a week after can dramatically reduce overdue payments without straining client relationships.

Processing Payments and Reconciliation

This is the final step that closes the loop. As soon as a payment hits your account, you need to record it against the correct invoice in your accounting system. This process is called reconciliation, and it’s the cornerstone of accurate financial records.

Proper reconciliation ensures your accounts receivable is up-to-date and your cash balance is correct. This is where modern tools really shine. Platforms that integrate directly with accounting software like Xero, MYOB, or QuickBooks make this part effortless by automatically matching payments to invoices. It saves you from hours of tedious manual data entry.

If you want to dive deeper into the nuts and bolts of getting your invoice out the door, check out our guide on how to send an invoice effectively.

Here's the rewritten section, crafted to sound completely human-written with a natural, expert tone.

How Invoices Shape Your Financial Story

Every invoice you send out does more than just ask a client to pay up. It’s a building block, laying the foundation for your business's entire financial picture. Think of your accounting system as the story of your business; each invoice is a critical entry that pushes the narrative forward, feeding directly into the reports that tell you whether you're winning or losing.

The moment you create an invoice, it sets off a chain reaction in your books. First, the total amount pops up in your Accounts Receivable on the Balance Sheet. This line item is your real-time scorecard of who owes you money, a key asset for your business.

At the exact same time, that sale adds to your Revenue on your Profit and Loss (P&L) Statement. This is so important because it shows you what you've earned for a specific period, even if the cash hasn't hit your account yet. This is the heart of accrual accounting, giving you a much truer sense of your profitability than just looking at your bank balance.

The Australian GST and BAS Connection

If you're running a business in Australia, invoicing carries even more weight because of the Goods and Services Tax (GST). Each tax invoice you issue is more than a record for you and your client; it’s an official document for the Australian Taxation Office (ATO).

The GST you charge isn't your money, you're just collecting it for the government. That’s why you need to track it perfectly. When it’s time to lodge your Business Activity Statement (BAS), your accounting software will pull the GST figures straight from your invoices to calculate what you owe the ATO. Get this wrong, and you're in for a headache.

Your invoice is the official source of truth for your BAS. Nailing the details, like your ABN and the exact GST amount, is non-negotiable for staying compliant and out of trouble with the tax office.

Let’s make this real. Say you're a freelance graphic designer. In a single month, you invoice three clients:

- Client A: $2,000 + $200 GST

- Client B: $5,000 + $500 GST

- Client C: $3,000 + $300 GST

From these three simple documents, your accounting system tells a powerful story. Your P&L now shows $10,000 in revenue. Your Balance Sheet lists $11,000 in Accounts Receivable. And crucially, you know you've collected $1,000 in GST that you need to put aside for your next BAS lodgement.

This isn't just about record-keeping. This is intelligence. With this snapshot, you can see how you're tracking against your sales goals, forecast your incoming cash, and stay on top of your tax obligations. It’s this clarity that lets you decide whether it’s the right time to hire help, invest in new software, or rein in your spending. Your invoices aren't just paperwork; they're the data that fuels smart business decisions.

Common Invoicing Mistakes That Hurt Your Cash Flow

Even the most buttoned-up businesses can trip up on invoicing. These aren't just little admin slip-ups; they're genuine roadblocks that can stall payments, sow confusion, and drain your time. Getting paid promptly really begins with sidestepping a few common pitfalls.

So many problems boil down to simple omissions with surprisingly big consequences. Forgetting to include your ABN, a unique invoice number, or a clear due date gives clients a reason, or an excuse, to put your payment on the back burner. Even worse, it can make your invoice non-compliant for tax purposes here in Australia, which is a headache you definitely don't need.

Vague or Missing Payment Terms

One of the single biggest mistakes is being fuzzy about when and how you expect to get paid. An invoice that just says "Due upon receipt" is way too ambiguous. Does that mean today? This week? Your client shouldn't have to play a guessing game.

This lack of clarity is a direct route to payment delays. The fix is simple: spell out your terms clearly and give people multiple ways to pay you.

- Specify a Clear Due Date: Use a concrete date like "Due 15 October 2024" or a clear timeframe like "Due within 14 days".

- Outline Accepted Payment Methods: Make it easy. List your bank transfer details, include a credit card payment link, and mention any other methods you accept. The less friction, the faster the money hits your account.

- State Your Late Fee Policy: Don't be shy about mentioning any penalties for late payments. It’s not aggressive; it’s a professional boundary that encourages people to pay on time.

A huge blind spot for many businesses is not tracking what’s outstanding. Using an accounts receivable aging report is a brilliant way to stay on top of things. This simple tool shows you exactly who owes you money and for how long, stopping small delays from turning into big cash flow gaps.

Inconsistent and Manual Follow-ups

Not following up on overdue invoices is essentially leaving money on the table. Let’s be honest, many business owners hate this part. It can feel awkward or even confrontational. But without a system, invoices get forgotten, and your cash flow takes the hit.

Trying to manually track and chase every late payment is a recipe for inefficiency and human error. This is where dedicated invoicing software really proves its worth. It can automate the entire follow-up process, sending polite, professional reminders on a schedule you control. You never have to be the "bad guy" again, which saves you heaps of time and helps preserve your client relationships.

If this feels all too familiar, it might be worth digging into the root causes of cash flow problems in small business for some deeper insights.

By locking in clear terms and automating your follow-ups, you're not just sending invoices, you're building a reliable system that turns your hard work into timely payments and keeps your business on solid financial ground.

Using Technology to Automate Your Invoicing

If you’re still wrestling with spreadsheets and Word documents for your invoices, you’re essentially bringing a horse and cart to a motorway. Sure, it might get the job done eventually, but it’s slow, clunky, and riddled with opportunities for human error. It’s time to upgrade your engine.

Modern invoicing technology takes the grunt work out of getting paid. Instead of manually copying client details, calculating GST, and chasing payments, the right software automates the entire workflow. This frees you up to focus on the work that actually brings in the money.

This isn’t just a minor tweak; it’s a massive opportunity for Australian businesses. Each year, a staggering 1.2 billion invoices are exchanged in Australia, yet around 90% of that processing is still done manually, at least in part. Moving to an automated system isn't just about efficiency, it's about gaining a real competitive advantage.

From Timesheets to Payments in a Few Clicks

For any service-based business that bills by the hour, this is where technology really shines. The ability to connect your team’s time tracking directly to your invoicing is a total game-changer.

Think about it. Your team logs their hours on a project, and with a properly integrated system, you can turn that timesheet data into a polished, itemised invoice in just a few clicks. No more manual calculations, no more second-guessing hours, and no more accidentally under-billing a client. Every single billable minute is captured and accounted for.

The automation doesn't stop once the invoice is sent. You can also automate invoice reminders using accounting software, which takes the awkwardness out of chasing payments and dramatically improves your cash flow.

By automating the path from timesheet to paid invoice, you’re not just saving administrative hours. You’re also building a more professional, reliable system that gives your clients a better experience.

Seamless Integration with Your Accounting Software

While standalone invoicing apps are a good start, the real power lies in platforms that integrate directly with your accounting software. Tools that talk to Xero, MYOB, and QuickBooks create a single, reliable source of truth for your business finances.

This kind of integration is what keeps your books clean and your reporting accurate.

- No More Double Entry: When you send an invoice, the system automatically creates the corresponding entry in your accounting ledger. Simple.

- Effortless Reconciliation: As payments come in, they’re automatically matched to the right invoice, making your bank reconciliation a breeze instead of a headache.

- A Real-Time Financial Snapshot: Your revenue, accounts receivable, and cash flow reports are always current, giving you an accurate, up-to-the-minute view of your business's health.

This seamless flow of data cuts out tedious manual entry, slashes the risk of costly mistakes, and ensures your books are always ready for BAS time. If you’re trying to figure out which tool is right for you, our guide on the best invoicing software in Australia is a great place to start.

What's Next? The Future of Australian Invoicing is Already Here

The next big evolution in Australian invoicing isn't some far-off concept, it's already happening. It’s called e-invoicing, and it’s being championed by the ATO for a very good reason.

Now, this isn’t just about emailing a PDF. True e-invoicing uses the highly secure Peppol network to transmit invoice data directly from your accounting software straight into your client's system. It all happens instantly and with pinpoint accuracy.

Here’s a simple way to think about it. Sending a traditional invoice is like posting a letter. Someone on the other end has to receive it, open it, read it, and then manually type all that information into their system. E-invoicing, on the other hand, is like sending a secure digital message that their computer understands immediately.

This direct, system-to-system connection is a game-changer. It dramatically slashes the manual data entry that leads to so many frustrating errors. More importantly, it practically eliminates the risk of invoice fraud from dodgy email scams.

For your business, the advantages are massive.

- Get Paid Faster: Because e-invoices can be processed and approved almost instantly, your cash flow gets a serious boost.

- Slash Costly Errors: Removing the manual typing step means you avoid the costly mistakes that humans inevitably make.

- Lock-Tight Security: It's a far more secure way to exchange financial data than relying on vulnerable email attachments.

The Australian government is throwing its weight behind this shift, encouraging businesses of all sizes to get on board. It’s simply a more secure, reliable, and efficient way to handle invoicing, making it a smart move for any forward-thinking business.

And this isn't just a niche trend; it's gaining serious momentum. Valued at USD 445.2 million in 2024, Australia's e-invoicing market is forecast to explode, reaching USD 1,832.7 million by 2033 as more businesses ditch manual processes. You can learn more about the projected growth of Australia's e-invoicing market.

Your Top Invoicing Questions Answered

Even when you feel you've got a handle on the basics of invoicing, specific questions always seem to come up. Let's tackle some of the most common queries we hear from Australian business owners, so you can invoice with total confidence.

What’s the Difference Between an Invoice and a Receipt?

Think of it like a story with a beginning and an end. An invoice is the request for payment, it kicks things off. It's the document you send to a customer before they pay, laying out exactly what they owe you for your work. It essentially says, "Here's what I did and here's what you need to pay me."

A receipt is the proof of payment, it’s the final chapter. You provide this after the money has hit your account. It confirms the transaction is complete and says, "Thanks, payment received!" In your books, invoices track your accounts receivable (money coming in), while receipts confirm that cash has actually arrived.

How Long Do I Need to Keep Invoices in Australia?

The Australian Taxation Office (ATO) has a very firm rule here: you must keep all business records, including your invoices, for a minimum of five years.

These records are your evidence. They're what you'll rely on to back up the claims you make on your Business Activity Statement (BAS) and your annual tax return. Keeping digital copies is a smart move, it keeps them safe, organised, and ready to go if the ATO ever comes knocking.

When Do I Have to Charge GST on My Invoices?

You’re legally required to register for and charge GST once your annual business turnover hits $75,000. If you're running a non-profit, that threshold is higher at $150,000.

As soon as you're registered, you need to issue a proper tax invoice for any sale over $82.50 (including GST). This isn't just a regular invoice; it must clearly show the GST amount separately, as this is the figure you'll use for your BAS reporting.

Ready to stop juggling spreadsheets and multiple apps for your invoicing and time tracking? Payly combines smart invoicing, timesheets, e-signatures, and more into one platform built for Australian businesses. Streamline your operations and get paid faster by visiting https://www.payly.com.au to start your free trial.

Payly Team

Sharing insights and strategies to help service businesses thrive. Follow Payly for more tips on time tracking, invoicing, and business operations.

Related Articles

Ready to streamline your business?

Join thousands of freelancers and agencies who use Payly to track time, send invoices, and get paid faster.