Solving Cash Flow Problems in Small Business

Struggling with cash flow problems in small business? Learn to spot the signs, apply quick fixes, and build long-term strategies for financial stability.

Payly Team

December 30, 2025

When you hear about a small business having "cash flow problems," what does that actually mean? In simple terms, it's when you don't have enough cash on hand to pay your bills, even if your business is technically making a profit.

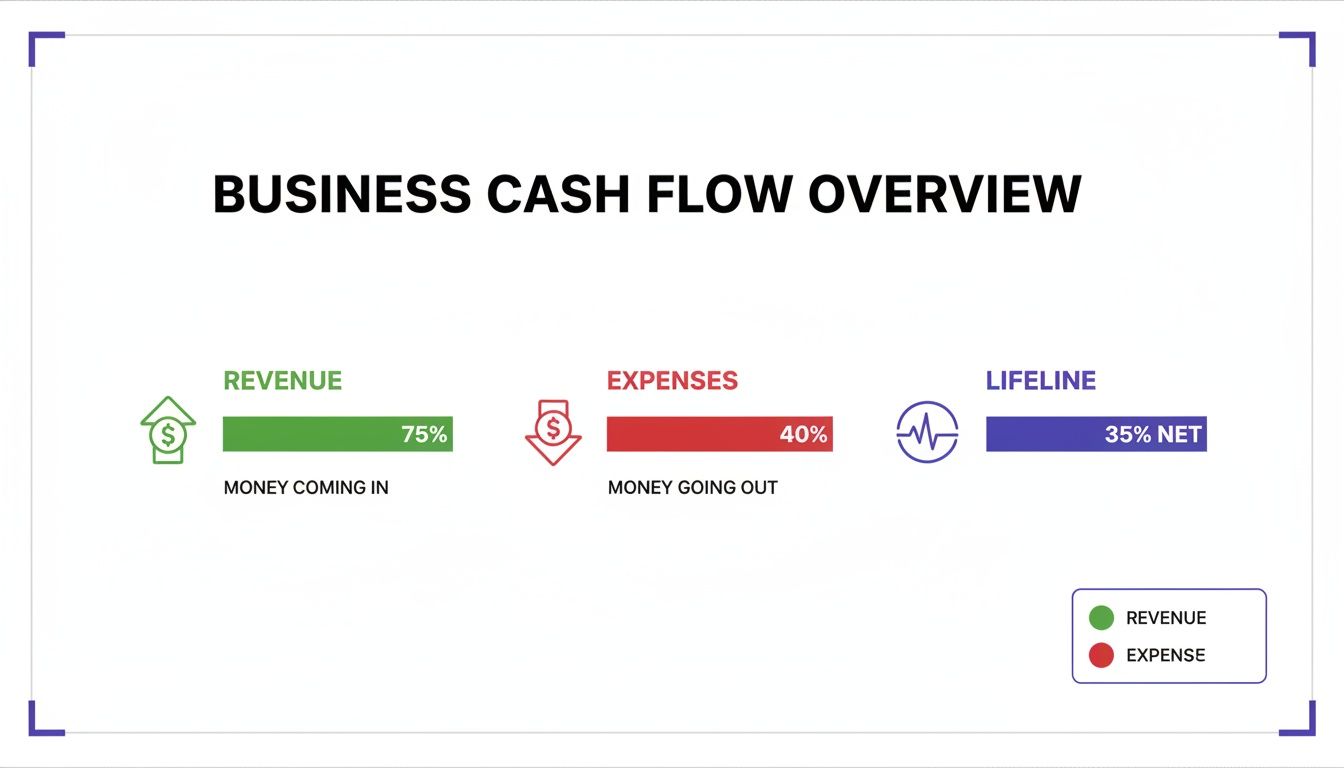

It’s all about timing. The money going out (your expenses) is due before the money coming in (your revenue) actually hits your bank account. This creates a gap, and if that gap gets too wide, it can be fatal for the business.

Understanding Why Cash Flow Is Your Business Lifeline

Think of cash flow as the lifeblood of your business. The money coming in from customers is like oxygen, fuelling everything from paying your staff to keeping the lights on. The money going out is what keeps the whole system moving. When the inflow and outflow are in sync, your business is healthy and can grow.

But if that flow gets choked off, things can go south very quickly. It’s a harsh reality that many profitable Australian businesses go under, not because they weren't selling enough, but simply because they ran out of cash. In fact, a widely-referenced study found that a staggering 82% of small business failures are a direct result of poor cash flow management.

Profit Is Not the Same As Cash

This is probably the single most important lesson for any business owner to learn. Profit is an idea on paper; cash is the reality in your bank account.

Your profit and loss statement might show you had a brilliant month. But profit is just revenue minus expenses. Cash is the actual money you have available to spend right now.

Let’s say you’re a marketing consultant and you finish a $10,000 project in May. Fantastic! You’ve "earned" that profit. But your client is on 60-day payment terms, meaning you won’t see a cent of that cash until July. Meanwhile, your rent, software bills, and your own salary are all due in June. That gap between earning the profit and getting the cash is exactly where businesses get into trouble.

A business can be wildly profitable but still go broke if all its cash is tied up in unpaid invoices. Keeping money flowing is just as critical as making sales.

The Timing Mismatch Explained

At its heart, a cash flow problem is a timing mismatch. You have fixed, non-negotiable deadlines for paying your suppliers, your staff, and the Australian Taxation Office (ATO) for things like GST and PAYG. These bills have to be paid on time.

On the other hand, the money you’re expecting from your customers can be anything but predictable. Invoices get paid late. Projects get delayed. It's rarely a smooth, consistent stream.

This puts you in a constant juggling act. All it takes is one big client paying 30 days late, or an unexpected equipment failure, to completely wipe out your cash buffer. Without that safety net, you’re left scrambling: putting off your own suppliers, dipping into personal funds, or taking on high-interest loans just to stay afloat. Getting your head around this dynamic is the first step to building a business that can weather any storm.

Recognising the Early Warning Signs of Cash Flow Trouble

Financial trouble rarely hits a business like a lightning bolt. It's usually more like a slow leak: small, subtle cracks that start to form in your financial foundation. If you can spot these cracks early, you can often fix them with a bit of sealant. Ignore them, and you might find yourself in a full-blown crisis.

These warning signs often start with small compromises. Maybe you start pushing supplier payments out by a few days, then a week. Before you know it, you're playing a stressful game of "who gets paid this week?", which can quickly burn through the goodwill you've built with your suppliers.

It’s all about maintaining that delicate balance between money coming in and money going out.

As you can see, even healthy revenue can get chewed up by expenses. The real test is managing what’s left and ensuring it’s there when you need it.

From Subtle Symptoms to Serious Issues

A huge red flag is struggling to meet your tax obligations on time. Things like your quarterly GST or Pay As You Go (PAYG) instalments are non-negotiable and entirely predictable. If you're finding it hard to cover them, it means your cash buffer has worn dangerously thin.

Another tell-tale sign is when you start dipping into your personal savings or skipping your own paycheque just to cover business costs. This is a slippery slope. While it feels like you're doing what it takes to survive, you've moved past a warning sign and into a serious problem that puts both your business and your personal finances in jeopardy.

In fact, an alarming 27% of Australian SMB owners have had to use their own money or go without pay to keep their business running, a stark indicator of just how common this strain is.

So, what are the specific things you should be looking for? We've put together a quick checklist to help you identify where you might stand.

Early Warning Signs of Cash Flow Trouble

| Warning Sign | What It Looks Like | Severity Level |

|---|---|---|

| Delaying Supplier Payments | You're consistently paying invoices right on the due date or a few days late. | Mild |

| Slow Customer Payments | Your accounts receivable report shows a growing number of invoices in the 30-60 day column. | Mild |

| Struggling with Payroll | You're anxious as payday approaches, needing a big client payment to land just in time. | Moderate |

| Missing Tax Deadlines | You've had to arrange a payment plan with the ATO for your GST or PAYG. | Moderate |

| Credit Card Balances Creeping Up | You're using credit to cover regular operational costs, not just for one-off purchases. | High |

| Using Personal Funds | You're transferring money from your personal savings to cover business bills or skipping your own salary. | High |

| Hitting Your Overdraft Limit | Your bank account is regularly sitting in the red, and you're paying overdraft fees. | Severe |

Seeing one or two items from the 'Mild' column might just require a few tweaks. But if you're ticking boxes in the 'Moderate' or 'High' categories, it's time to take immediate and decisive action.

What Your Accounting Software Is Telling You

Your accounting software, whether it’s Xero or MYOB, is your best friend here. The story is all in the numbers. The one report you need to watch like a hawk is your accounts receivable ageing report. If you see more and more invoices creeping into the 60 or even 90-day overdue columns, your collection process isn't keeping up with your expenses. Simple as that.

And you're not alone if this is happening. Nearly 80 per cent of Australian SMBs have faced cash flow issues recently. A detailed report on small business challenges found the biggest culprits were declining revenue (35%) and just not having enough cash in the bank (30%), forcing owners to make some tough decisions.

The key is to get proactive. Don’t wait for your bank balance to flash red. Use these leading indicators to spot vulnerabilities before they spiral out of control and put the future of your business at risk.

Getting to the Root of Cash Flow Gaps

Spotting the warning signs is one thing, but actually fixing your cash flow means you have to play detective and find the real culprits. For most Australian service businesses, the problems aren't just about spending too much. They're usually tangled up in the way we work with clients and the unique quirks of our local business environment.

One of the biggest offenders is the all-too-common practice of long payment terms. Think about it: every time you send an invoice with "net 30" or "net 60" terms, you're essentially giving your client an interest-free loan. You've done the work, but you're waiting a month or two for the money. Your own rent, software subscriptions, and payroll don't hit pause, creating a gap that can be incredibly stressful.

This problem is often made worse by the classic "feast or famine" cycle that’s so common in project-based industries. You might have a brilliant month where you're invoicing huge amounts, only for it to be followed by a quiet spell. That unpredictable income makes it a nightmare to budget and plan ahead, leaving you feeling exposed even after a run of great work.

The Double Whammy: Delayed Payments and Uneven Income

The rollercoaster of inconsistent revenue is felt even more sharply thanks to the Australian tax system. Those big, chunky expenses like your quarterly Goods and Services Tax (GST) and Pay As You Go (PAYG) instalments don't care if your clients paid on time. If a couple of large invoices are late, you can find yourself in a real bind, scrambling to cover a massive tax bill for income you've earned but haven't actually received.

Cash flow trouble isn't always about a lack of work. More often, it's a mismatch between when you do the work and when the money for that work actually lands in your bank account.

This kind of volatility is hitting businesses across the board. The latest data from Xero's small business insights report shows that sales growth for Aussie small businesses slowed to just 3.0% in the June quarter, the weakest it’s been since 2020. For consultancies, agencies, and sole traders, that slowdown means a sale you make today might not turn into actual cash for weeks or even months, stretching your finances to the limit.

When Your Own Processes Are the Problem

While the economy and client behaviour play a big part, sometimes the call is coming from inside the house. Small hiccups in your own operations can create major bottlenecks that slow down how quickly you get paid. These little bits of friction add up, stretching out your cash conversion cycle; that’s the time between doing the work and having the money in your account.

Here are a few common internal culprits:

- Saving Invoicing for 'Later': If you wait until the end of the month to batch-create and send all your invoices, you're already starting on the back foot. That administrative delay just gives your clients extra time before their payment clock even starts ticking.

- Letting Billable Hours Slip Through the Cracks: It's so easy to forget to track a quick 15-minute call, a small revision, or an urgent email. Without a solid system, those unbilled minutes are lost revenue, and that directly eats into your cash flow.

- The Awkward Chase: Let's be honest, nobody enjoys chasing late payments. But if you don't have a clear, consistent process for following up, overdue invoices can just sit there for weeks, silently draining the cash you need to run your business.

By digging in and identifying which of these issues are affecting you, you can stop just putting out fires and start building a more resilient business. Figuring out if the problem is slow-paying clients, clunky internal systems, or just the nature of the market is the first step to putting the right fix in place.

Quick Fixes to Improve Your Cash Flow Immediately

When you realise you’re facing a cash shortfall, you need to act fast. Think of it as financial first-aid, a kit filled with practical steps you can take right now to stop the bleeding and get your business back on stable ground. While these aren’t long-term cures, they are crucial actions to get cash flowing in the right direction again.

The most powerful lever you can pull is getting paid for the work you’ve already done. Those outstanding invoices represent money that is rightfully yours, just waiting to land in your bank account. Don't let them gather dust.

Speed Up Your Invoicing and Collections

Your first move should be to systematically follow up on every single overdue invoice. I always suggest starting with the largest amounts and the oldest debts first; they'll make the biggest impact. A polite but firm phone call often works wonders and is much harder to ignore than an email.

Next, think about giving your clients a reason to pay you sooner. Offering a small early-payment discount, like 2% off for payment within 10 days, can be a surprisingly effective nudge. The cost of that discount is almost always less than the stress and financial strain of a cash crunch. When you're issuing new invoices, make sure your payment terms are crystal clear from the get-go. Learning how to professionally send an invoice can make a huge difference here.

Taking immediate action on your accounts receivable is the fastest way to inject cash into your business without taking on new debt. It’s all about turning promised revenue into real, spendable funds.

Get a Handle on Your Outgoing Cash

While you’re pushing to get money in faster, you also need to slow down the money going out. It's time to comb through your expenses, line by line, and find any non-essential spending that can be paused or cut immediately.

Have a chat with your suppliers. If you’ve been a reliable customer, many will be open to extending your payment terms from 30 days to 45 or even 60. That simple conversation can free up a surprising amount of cash to cover more urgent bills.

Here are a few things you can do today:

- Audit Subscriptions: Get rid of any software or services you aren't actually using.

- Pause Discretionary Spending: That new piece of equipment or marketing campaign can probably wait. Delay any non-critical purchases.

- Renegotiate Terms: Reach out to your key suppliers and ask for a temporary extension on your payment due dates.

Look at Short-Term Financing Options

Sometimes, even after chasing payments and slashing costs, you might still have a gap to fill. This is where short-term financing can be a lifesaver, acting as a bridge to keep your operations running.

Options like invoice financing (where a lender advances you a percentage of your unpaid invoices) or a business line of credit can provide the liquidity you need right now. Yes, these tools come with costs, but they can be a necessary lifeline to avoid missing payroll or defaulting on rent, giving you the breathing room to put more permanent solutions in place.

Building Long-Term Strategies for Predictable Cash Flow

Getting past the immediate stress of a cash crunch isn’t about quick fixes; it’s about making a fundamental shift in how you think about your finances. You need to build a business that’s financially resilient by design, not just by luck. Real, lasting success comes from future-proofing your operations, turning unpredictable income into a steady, reliable stream.

This is all about moving from reactive firefighting to proactive financial planning. The aim is to create a system where you have a crystal-clear picture of your finances not just for today, but for the weeks and months ahead.

Create a Simple Cash Flow Forecast

Think of a cash flow forecast as your financial crystal ball. It doesn't need to be some overly complex accounting monster; a simple spreadsheet that tracks your expected cash in and cash out over the next three months can be incredibly powerful. This gives you foresight, letting you spot potential shortfalls weeks in advance so you can act before they ever become a crisis.

When you get into the habit of updating this forecast regularly, you start making much smarter decisions. You'll know exactly when it's safe to invest in that new piece of equipment or when you need to knuckle down and chase late payments. It replaces gut-feel guesswork with data-driven confidence.

Build a Cash Reserve for a Rainy Day

Of course, no forecast is perfect. Unexpected costs are just part of the game when you're in business. That’s why a dedicated cash reserve, your 'rainy day' fund, is completely non-negotiable for long-term stability. This isn’t money for growth; it’s a buffer designed to protect you from sudden shocks.

Your goal should be to set aside enough to cover three to six months of essential operating expenses. Sure, building this fund takes time and discipline, but it’s the ultimate safety net. It gives you the peace of mind to navigate a quiet period or a major client's delayed payment without hitting the panic button.

Optimise Your Entire Invoicing Process

Your invoicing process is one of the most powerful levers you can pull to improve your cash flow. Seemingly small tweaks here can have a massive impact on how quickly you get paid. It’s not just about sending an invoice; it’s about creating a seamless, frictionless payment experience for your clients.

Start by putting these best practices into action:

- Invoice Immediately: Don't wait until the end of the month. Send that invoice the moment a project is finished or a key milestone is reached. The sooner it’s sent, the sooner it’s paid.

- Set Clear Terms: Your payment terms need to be front and centre, with no room for confusion. State the due date clearly and mention any late payment fees upfront.

- Automate Reminders: Use software to automatically send out polite reminders for upcoming and overdue payments. This keeps your follow-up professional and saves you from having those awkward conversations. Integrating your systems is key here, and you can learn more about the Stripe and Xero integration to see how powerful this can be.

The current economic climate really brings this into focus. While 80 per cent of SMEs recently increased their prices to cope with rising costs, a brutal 11,000 businesses still went into insolvency. Even for those that survived, 64 per cent saw their profits shrink, hammering home the point that proactive cash management is a must-have for survival. Discover more insights about these SME challenges.

By transforming your invoicing from a monthly administrative chore into an efficient, automated system, you fundamentally shorten the time between doing the work and having the cash in your bank.

Finally, have a good think about your revenue model. If you run a service business, switching clients to retainers or recurring monthly contracts can smooth out the notorious feast-or-famine cycle. This creates a predictable baseline of income you can count on, month in and month out.

How to Streamline Your Operations to Boost Cash Flow

Planning and quick fixes are crucial, but having the right tools is what really turns a good strategy into consistently healthy cash flow. Juggling separate subscriptions for time tracking, invoicing, and getting documents signed creates a mess of admin work. That friction slows everything down, from the moment you finish a job to the day you actually get paid.

This is exactly where an all-in-one platform makes a world of difference. A tool like Payly closes the gap between doing the work and seeing the money in your account, hitting the common causes of cash flow problems right where they start. By bringing all these critical jobs into one smooth workflow, you shorten the time it takes to turn your effort into cash.

From Billable Minutes to Faster Payments

Think about it: every minute you work but don't bill is money left on the table. With precise time tracking, every moment you dedicate to a client’s project gets logged. Then, you can turn those hours into an accurate invoice with just a few clicks. This simple step stops revenue from slipping through the cracks and ensures you’re charging what you’re worth.

But the process doesn't end there. Once that invoice is ready, smart automation can kick in. You can set up automatic payment reminders that send a friendly nudge to your clients before and after the due date. No more awkward follow-up calls or emails; it’s all handled for you. This one feature alone can make a huge difference in how quickly your clients pay up.

Consolidating your operational tools doesn't just cut subscription costs; it removes the administrative delays that silently stretch out your payment cycles and strangle your cash flow.

The results are real and you’ll see them quickly. By combining these features, you spend far less time bogged down in admin and more time on the work that actually makes you money. You get paid faster, have a much clearer picture of your finances, and can finally count on a more predictable stream of income.

For any service-based business, finding the right invoicing software for your small business isn't just a nice-to-have. It's a fundamental part of building a financially strong operation. It takes a scattered, manual process and turns it into a powerful, automated system built to keep your cash flowing.

Your Cash Flow Questions Answered

Running a small business means you're constantly juggling questions, and cash flow is often at the top of the list. Let's tackle some of the most common ones that crop up.

What’s the Fastest Way to Get Cash into My Business?

When you need cash in the door yesterday, your accounts receivable ledger is the first place to look. Start by chasing up your largest and oldest unpaid invoices – that’s where you’ll get the biggest and fastest return on your time.

To sweeten the deal and get paid even quicker, you could offer a small discount, maybe 2% off, for immediate payment. If the situation is more critical, options like invoice financing can provide a rapid injection of funds, but be mindful that this speed comes with a higher price tag.

How Much Cash Should a Small Business Keep on Hand?

Think of it as your business’s emergency fund. A good rule of thumb is to have enough cash tucked away to cover three to six months of essential operating expenses.

This buffer is what will see you through a sudden sales dip, a major client paying late, or any other unexpected curveball the world throws at you. It’s the difference between navigating a tough patch calmly and making panicked decisions.

Is Taking on Debt a Bad Way to Solve Cash Flow Problems?

Not necessarily, but it all comes down to how and why you're using it. A revolving line of credit can be a fantastic, flexible tool for covering temporary gaps between paying your suppliers and getting paid by your customers. It's a bridge, not a destination.

The real danger is when you start relying on long-term loans to pay for day-to-day running costs. If that's happening, it’s a massive red flag. It often points to a more fundamental problem with your pricing, your profit margins, or your overall business model that debt will only mask, not solve.

Ready to stop juggling apps and start mastering your cash flow? Payly brings your time tracking, invoicing, and e-signatures together in one simple platform designed for Australian businesses. Start your free 14-day trial today.

Payly Team

Sharing insights and strategies to help service businesses thrive. Follow Payly for more tips on time tracking, invoicing, and business operations.

Related Articles

Ready to streamline your business?

Join thousands of freelancers and agencies who use Payly to track time, send invoices, and get paid faster.