How to Calculate GST in Australia A Guide for Small Business

Learn how to calculate GST in Australia with our straightforward guide. Master GST formulas, invoicing, and compliance for your small business.

Payly Team

February 16, 2026

Working out GST in Australia is actually more straightforward than most people think. For most businesses, it's a simple case of adding 10% to the price of your goods or services. If your business turns over $75,000 or more a year, this little calculation will quickly become second nature.

Understanding GST Basics for Your Business

Getting your head around the Goods and Services Tax (GST) is one of the first hurdles for any new business owner in Australia. Essentially, GST is a 10% tax that gets added to most things sold or consumed in the country. If you're registered for GST, you’re essentially collecting that tax for the Australian Taxation Office (ATO) from your customers.

The main thing that determines whether you need to deal with GST is your annual turnover.

- The Registration Threshold: The magic number is $75,000. If your gross business income hits this amount (or you expect it to), you're required to register for GST. For non-profits, the threshold is a bit higher at $150,000.

- Registering Voluntarily: What if you're under the threshold? You can still choose to register. This can be a smart move if you have a lot of business expenses, as it means you can claim back the GST you pay on your own purchases.

Before you even start crunching the numbers, the first step is knowing how to register for GST in Australia.

Taxable, GST-Free and Input-Taxed Sales

Now, here's where it gets a little more nuanced. Not everything you sell is treated the same way under GST law. While most sales are "taxable" (meaning you add GST), some fall into different categories.

For example, basic foods, certain medical services, and some education courses are GST-free. You don't charge your customers GST on these items, but the good news is you can still claim credits for the GST you paid on any business expenses related to them.

Then there are input-taxed sales, like providing financial services or renting out a residential property. You don't add GST to these, but you also can't claim any GST credits for the expenses you incur to make those sales. Understanding the difference is key to getting your calculations right.

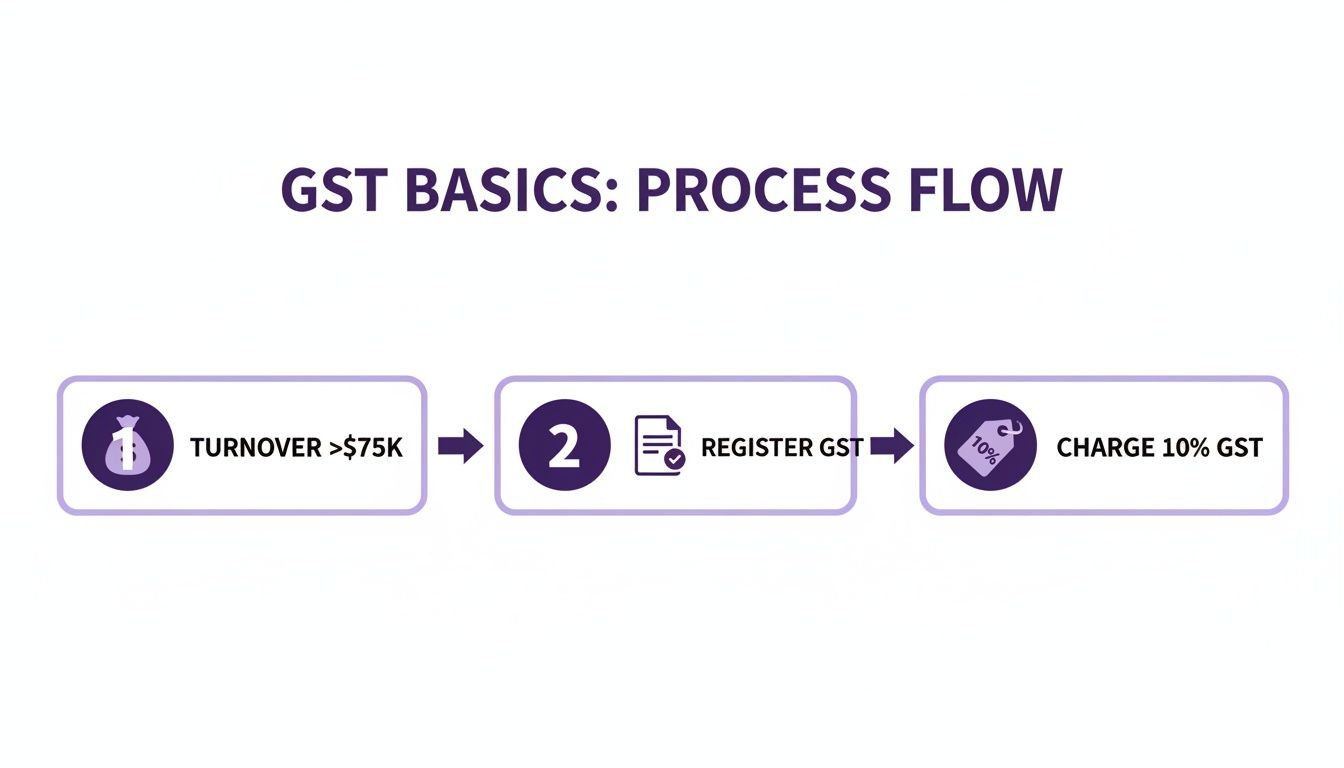

This flowchart gives you a simple visual of the process.

As you can see, hitting that turnover threshold is really what kicks the whole GST process into gear for most businesses. From there, it's about registering and then consistently applying the tax.

Getting to Grips with the GST Formulas

When you're running a business in Australia, you'll find yourself doing two things with GST all the time: adding it to your prices or figuring out how much is hiding in a total cost. Getting these two core calculations right is non-negotiable for keeping your books straight and staying on the right side of the ATO.

The good news? It's not complicated stuff. You don't need to be a maths whiz; you just need to know which formula to use and when.

Adding GST to a Price (GST-Exclusive)

This is your bread and butter when you're creating a quote or an invoice. You've worked out your price for a product or service, and now you need to add the 10% GST on top for your customer.

The simplest way to do this is with one quick multiplication.

The Formula: Price (ex. GST) × 1.1 = Total Price (inc. GST)

This does the heavy lifting for you: it calculates the 10% GST and adds it to your original price in a single step. The result is the final figure your client owes you.

Let's See it in Action: A Web Designer's Quote

Say you’re a freelance web designer, and you’ve quoted $2,000 (plus GST) for a new website build. To get the final invoice amount, you just multiply that by 1.1.$2,000 × 1.1 = $2,200

The total invoice you send to the client is $2,200. Of that amount, $200 is the GST component you'll need to put aside for the tax office.

Finding the GST in a Price (GST-Inclusive)

Now for the flip side. You've just paid a supplier or bought some new equipment, and the receipt shows a total price. To claim the GST credit on your Business Activity Statement (BAS), you need to isolate the exact GST amount included in that total.

A common mistake is trying to subtract 10% from the total. That won't work and will give you an incorrect figure. Instead, there's a different, just as simple, formula.

The Formula: Total Price (inc. GST) ÷ 11 = GST Amount

Dividing by 11 neatly extracts the GST portion from the total price. If you want to know the original price before tax was added, just subtract this GST amount from the total you paid.

Real-World Scenario: An Agency's Software Bill

Imagine your agency pays $330 a month for a project management tool. The subscription confirmation says this price is GST-inclusive. To work out the GST credit you can claim, you divide that total by 11.$330 ÷ 11 = $30

You can claim a $30 GST credit for that business expense on your next BAS.

GST Calculation Formulas at a Glance

For a quick reference, here are the two formulas you'll need day-to-day.

| Calculation Type | Formula | When to Use It |

|---|---|---|

| Adding GST | Price (ex. GST) × 1.1 | When you're creating an invoice and need to add GST to your price. |

| Extracting GST | Price (inc. GST) ÷ 11 | When you have a final price and need to find the GST amount included. |

Nailing both of these calculations is fundamental for accurate quoting and lodging your BAS correctly. Given the GST rate has been a steady 10% since it was introduced back in 2000, it’s a core part of doing business in Australia.

If you ever need to double-check your numbers on the fly, a tool like our online GST calculator gives you instant, accurate answers.

Applying GST Calculations to Your Invoices

Knowing the formulas is one thing, but getting it right on your invoices is where the rubber really meets the road for your business's cash flow and compliance. A simple slip-up on an invoice can easily cause payment delays or create a headache for your clients when they try to claim their GST credits. Nailing this from the get-go keeps the whole process professional and smooth for everyone.

The first crucial detail to get your head around is the difference between a standard invoice and a proper tax invoice. While both are essentially a request for payment, only a valid tax invoice gives a GST-registered business the green light to claim a credit for the GST they've paid. If your sale is for more than $82.50 (including GST), you are legally required to provide a tax invoice if your customer asks for one.

What a Valid Tax Invoice Must Include

The Australian Taxation Office (ATO) is pretty specific about what makes a tax invoice legitimate. If you miss any of these details, it could be deemed non-compliant. I always treat it like a pre-flight checklist before hitting 'send'.

Your tax invoice must clearly show:

- The words 'Tax Invoice' prominently displayed.

- Your business name and Australian Business Number (ABN).

- The date you issued the invoice.

- A brief description of what you sold, including the quantity and price.

- The GST amount. You can show this as a separate line item, or if the GST is exactly one-eleventh of the total, a simple statement like "Total price includes GST" will do.

Key Takeaway: The single most important element is your ABN. Without it, your client cannot claim a GST credit, and they are legally required to withhold a whopping 47% from their payment to you and send it straight to the ATO. Trust me, that's a cash flow nightmare you want to avoid at all costs.

Real-World Example: A Service Business Invoice

Let's walk through a common scenario. Imagine a marketing consultant has just wrapped up a project. The agreed-upon fee was $1,500 plus GST. Here’s exactly how they’d put together a compliant tax invoice.

First, they calculate the GST:

- $1,500 (Service Fee) × 0.10 (GST Rate) = $150 (GST Amount)

Then, they work out the final invoice total:

- $1,500 (Service Fee) + $150 (GST Amount) = $1,650 (Total Payable)

On the invoice itself, the "Marketing Strategy Project" would be listed as a line item for $1,500. The GST would be clearly shown as a separate $150 charge, leading to a final total of $1,650. Of course, it would also feature the consultant's ABN, business details, and the date.

By following this structure, the client gets a crystal-clear document, and the consultant meets all their ATO obligations, making the payment process painless. For a deeper dive into structuring your documents, you can check out our guide on creating a GST invoice template for Australian businesses.

Getting Your Head Around GST-Free and Input-Taxed Sales

Not every dollar you earn is treated the same by the Australian Taxation Office (ATO), especially when it comes to GST. Some of what you sell might be GST-free, while other income could be input-taxed. Getting this right is absolutely critical for accurate BAS reporting and knowing what GST credits you can actually claim.

This is a classic tripwire for so many businesses. If you misclassify a sale, you could end up overpaying the ATO or, just as bad, claiming credits you weren't entitled to. Both scenarios can lead to some serious compliance headaches down the track.

What Does GST-Free Mean?

When you make a GST-free sale, it's exactly what it sounds like: you don't add GST to the price. But here's the best part: you can still claim GST credits for any business purchases you made to produce that sale. It’s a key advantage that helps keep your business costs down.

So, what kind of things fall into this category?

- Most basic food items for human consumption.

- Certain medical, health, and education services.

- Sales to international clients who are outside of Australia when you provide the service.

A great real-world example is a graphic designer in Melbourne who creates a logo for a client based in New Zealand. That service is generally considered an export and is therefore GST-free. The designer doesn’t charge GST on their invoice, but they can absolutely claim the GST credits on their software subscriptions and other tools used for the project.

Understanding Input-Taxed Sales

Now, input-taxed sales are a completely different beast. Just like GST-free sales, you don’t tack on GST to the final price. The crucial difference is that you cannot claim any GST credits for the business expenses related to making that sale.

This category is a bit less common for many service-based businesses but typically includes things like:

- Providing financial services, such as any interest you might earn from a business bank account.

- Selling or renting out residential properties.

- Certain fundraising activities if you’re a charity.

The core difference comes down to credits: with GST-free sales, you get to claim them; with input-taxed sales, you don’t. This directly impacts your Business Activity Statement calculation.

Juggling Mixed Income Streams

It's pretty common for a business to have a mix of taxable, GST-free, and input-taxed income. Think about a consulting firm. Most of its income might come from taxable local projects, but it could also earn a little bank interest (input-taxed) and provide some services to an overseas client (GST-free).

When this happens, you have to be diligent about apportioning your expenses. You can claim full GST credits on costs that relate to your taxable and GST-free sales. But for any expenses directly linked to your input-taxed income, you can't claim a thing. This careful tracking is essential for lodging an accurate BAS and making sure you only claim what you're truly entitled to.

Streamlining Your GST with Modern Tools

Let’s be honest, doing GST maths by hand is not just a chore; it’s an open invitation for simple mistakes that can cost you time and money. Any experienced business owner will tell you that using the right tech is the secret to handling your tax obligations without the headache. Moving away from manual spreadsheets to a dedicated tool can seriously boost your accuracy and give you back precious hours to focus on what you actually enjoy: running your business.

Modern platforms are built to do the heavy lifting for you. They bake GST calculations right into your day-to-day workflow. Imagine you've just tracked your billable hours. Now, with a single click, you can generate a perfect, ATO-compliant tax invoice with the GST already worked out. That’s what a smart, integrated system brings to the table.

This screenshot gives you a glimpse of how an intelligent invoicing system can automatically calculate GST on each line item.

As you can see, the software clearly separates the GST amount, making sure your invoice ticks all the compliance boxes without you having to touch a calculator.

Automation for Accuracy and Compliance

The real game-changer with modern tools is automation. When your invoicing software talks to your time tracking and accounting systems, the whole process just flows. This kind of integration drastically cuts down on the human error that inevitably creeps in when you’re juggling a dozen other tasks.

For those moments when you just need to quickly check a number, an online VAT calculator can be a handy resource. These are great for double-checking figures on the fly before you send something off.

The goal here is to build a system where being compliant is automatic, not something you have to actively worry about. When your software handles the GST rates, generates the right kind of invoices, and preps the data for your BAS, you’re not just saving time. You're building a more professional and resilient business.

Connecting Your Tools for Effortless Reporting

The perks don't stop at invoicing. When you use a platform that syncs directly with major accounting software, the benefits multiply. Once an invoice is finalised, all that financial data zips straight into your accounting ledger, primed and ready for your next Business Activity Statement (BAS).

This seamless flow of information gives you a few powerful advantages:

- Real-time financial clarity: You always have an up-to-the-minute view of your GST liabilities and credits. No more nasty surprises at the end of the quarter.

- Painless BAS reporting: Putting together your BAS becomes a quick review of auto-populated numbers instead of a mad scramble through months of receipts and spreadsheets.

- Smarter cash flow management: When you know your exact tax position at all times, you can manage your cash with much more confidence.

At the end of the day, adopting these tools is a smart investment in your own efficiency. And if you're looking to take your financial management to the next level, it's well worth learning how to better manage your expenses in Xero to create a truly seamless financial workflow.

Common Questions About Calculating GST

Even with the formulas sorted, some real-world situations can leave you scratching your head. Let's tackle a few of the most common questions that pop up for businesses getting the hang of GST in Australia, so you can handle them like a pro.

What Should I Do if I Forget to Include GST on an Invoice?

It happens to the best of us, especially when you're busy. If you’ve sent an invoice and later realised you left off the GST, the key is to act quickly. Don't just absorb the cost yourself. It's a legitimate part of the sale that you're required to collect and pass on to the ATO.

The cleanest way forward is to contact your client, explain the mistake, and issue a corrected tax invoice that includes the GST. Most professional clients will be completely fine with this, as they need a valid tax invoice to claim their own GST credits anyway. Fixing it promptly keeps things professional and ensures your books are accurate for your next BAS lodgement.

How Do Rounding Rules Work for GST Calculations?

The ATO has specific rules for this. When you have an invoice with multiple items, you should calculate the GST for each individual item first. Add all these GST amounts together to get a total GST figure.

Only then should you round that final total to the nearest cent.

For instance, if the total GST adds up to $15.755, you’d round it up to $15.76. If the total was $15.754, you’d round down to $15.75. Sticking to these standard rounding rules keeps your reporting precise and compliant.

Do I Need to Charge GST to International Clients?

This is a common point of confusion. Generally, services you "export" to clients outside Australia are considered GST-free. This means you don't add the 10% tax to your invoice, provided your customer is not in Australia when the service is performed.

The big advantage here is that even though your sale is GST-free, you can still claim the GST credits on the business expenses you paid to make that sale. It's a crucial difference from input-taxed sales, where you can't claim any credits back.

Can I Claim GST Credits if I'm Not Registered for GST?

This one is a hard no. You are only entitled to claim GST credits on your business purchases if you are registered for GST. This is actually a major reason why some businesses choose to register voluntarily, even if their turnover is below the $75,000 threshold.

If you aren't registered, you can't charge GST on your sales, and you definitely can't claim any GST back from the ATO. It’s a black-and-white rule that has a direct impact on your cash flow.

Ready to stop juggling spreadsheets and manual calculations? Payly combines smart invoicing, time tracking, and document management into one platform, making GST a breeze. Simplify your business operations and get paid faster with Payly.

Payly Team

Sharing insights and strategies to help service businesses thrive. Follow Payly for more tips on time tracking, invoicing, and business operations.

Related Articles

Ready to streamline your business?

Join thousands of freelancers and agencies who use Payly to track time, send invoices, and get paid faster.