GST Invoice Template Australia - Free ATO-compliant invoices

GST Invoice Template Australia: download a free, ATO-compliant template for Word, Excel, and PDF to create compliant invoices quickly.

Payly Team

November 27, 2025

A professional GST invoice template is much more than just a pre-made document. Think of it as your secret weapon for getting Australian invoicing right, every single time. It's specifically designed to include every mandatory field the Australian Taxation Office (ATO) demands, ensuring your invoices are always legally compliant. This lets both you and your clients account for Goods and Services Tax without any guesswork.

Ultimately, using a solid template is the simplest way to nail your invoicing from day one.

Crafting Your First ATO-Compliant Invoice

Getting your invoices right isn't just about getting paid-it's a core part of your legal responsibilities as an Aussie business owner. A correctly formatted invoice is the key to claiming GST credits and keeping your financial records clean and audit-proof. Get it wrong, and you risk creating compliance headaches for both yourself and your clients.

The ATO has very clear rules about what makes a valid 'tax invoice'. It's not just any bill; it's a specific legal document that needs to contain certain information. Its main job is to clearly show the GST component of a sale, which is absolutely critical for any business registered for GST.

What's the Difference Between an Invoice and a Tax Invoice?

This is a really common point of confusion, but the distinction is vital. A standard 'invoice' is simply a request for payment. A 'tax invoice', on the other hand, is an official document that a GST-registered business must issue for any taxable sale.

Here's how they differ:

- Purpose: A standard invoice is just for billing. A tax invoice is for billing and for substantiating GST claims with the ATO.

- Requirement: Any business can send a standard invoice. Only GST-registered businesses can (and must) issue a tax invoice for sales that include GST.

- Content: A tax invoice has legally required fields, like your ABN and the clear words "Tax Invoice" at the top.

Why does this matter so much? Because your clients who are also registered for GST can't claim a credit for the GST they paid you without a valid tax invoice. Failing to provide one can strain business relationships and hold up your payments. We cover the entire process in our guide on how to properly send an invoice.

The Must-Have Elements on Your Invoice

To be compliant, your GST invoice needs to have several non-negotiable details. Think of this as your checklist for every single bill you send out. For businesses with an annual turnover of $75,000 or more, registering for GST and issuing compliant tax invoices isn't optional-it's mandatory.

This legal framework is all about ensuring transparency and accountability. For instance, tax invoices for sales over $1,000 must also show the buyer’s identity or ABN. This small detail helps prevent disputes down the line and makes tax audits much simpler.

A compliant invoice does more than just ask for money. It acts as a legal record, validates your GST reporting, and provides the professional documentation your clients need for their own tax obligations.

To make this crystal clear, I've put together a quick-reference table outlining every mandatory component. Double-check that your invoice template has a spot for every single one of these.

Mandatory Elements of an ATO-Compliant Tax Invoice

This table breaks down the essential information required on any GST tax invoice in Australia.

| Component | Description & ATO Requirement |

|---|---|

| Document Title | Must be clearly stated as "Tax Invoice". |

| Your Business Identity | Your legal business name or trading name. |

| Your ABN | Your Australian Business Number must be clearly displayed. |

| Invoice Date | The date the invoice was issued (not the date of service). |

| Item Description | A brief but clear description of each good or service supplied. |

| GST Amount | Can be shown as a separate total or noted with a statement like "Total price includes GST". |

| Total Amount | The final, GST-inclusive amount payable by the client. |

| Buyer's Identity | The buyer's name or ABN is mandatory for any sale over $1,000. |

Having these elements in place isn't just about ticking boxes; it's about running a professional, compliant business that clients can trust.

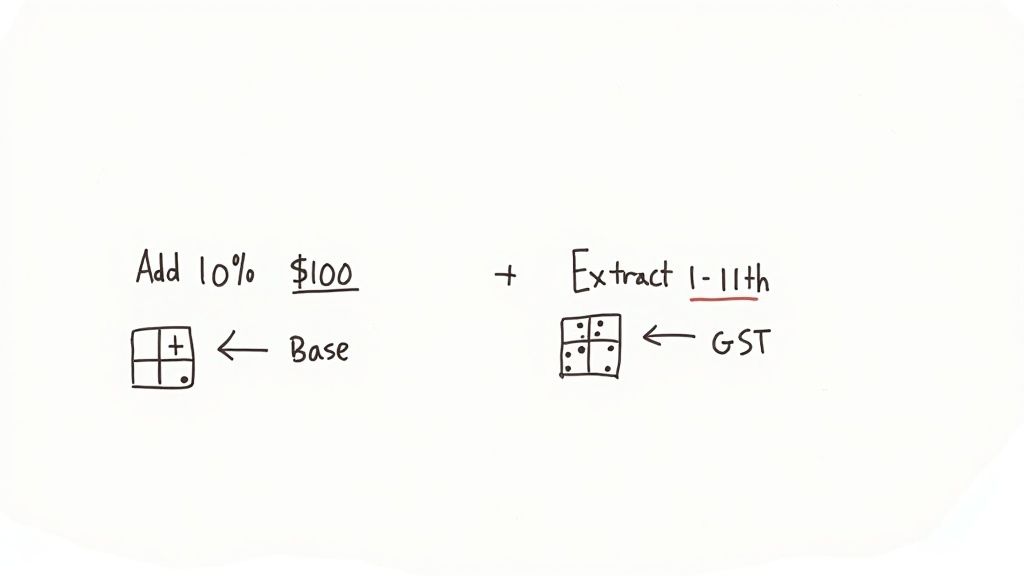

Calculating GST Correctly Every Time

Getting your GST calculations right isn't just good practice; it's a non-negotiable part of doing business in Australia. It might seem a bit tricky at first, but honestly, it all boils down to two simple methods that cover nearly every invoice you'll ever send.

Once you get the hang of these, you'll feel confident that your numbers are spot-on, keeping your books clean and the ATO happy. It all depends on your starting point: are you building up from a base price, or working backwards from a total?

Adding 10% GST to a Base Price

This is the most common scenario you'll face. You have your price for a service or product, and you need to add GST on top. It’s the standard way to go when you've given a client a quote that's "plus GST".

Let's run through a quick example. Say you're a freelance graphic designer who has quoted $500 for a logo design.

- Base Price: $500.00

- Calculate GST: $500.00 x 10% (or 0.10) = $50.00

- Total Invoice Amount: $500.00 + $50.00 = $550.00

On a proper gst invoice template australia businesses use, you’d clearly list the subtotal ($500), the GST amount ($50), and the final total ($550). This transparency shows your client exactly what they're paying for.

Extracting GST from an Inclusive Price

Sometimes you need to work the other way. You've been given a final price that already includes GST, and you need to figure out how much of that total is actually tax. This is super common when you're logging supplier invoices or claiming expenses for retail purchases.

The magic number here is 11. To find the GST component in a total price, you simply divide that total by 11. Why? Because the standard 10% GST rate means the tax portion is always exactly 1/11th of the final price.

Imagine you just bought new office equipment for $880 (GST inclusive).

- GST-Inclusive Price: $880.00

- Calculate GST Component: $880.00 / 11 = $80.00

- Original Base Price: $880.00 - $80.00 = $800.00

This calculation is absolutely critical for claiming your GST credits on your Business Activity Statement (BAS). If you mistakenly calculated 10% of the total ($88), you’d be over-claiming and could run into trouble. If you’re ever in doubt, our free Australian GST calculator will give you the right figures in seconds.

Here's the golden rule I always tell people: add 10% to build the price up, but divide by 11 to pull the GST out. Nail that distinction, and your accounting will be bang on.

Invoicing with Mixed GST Items

Of course, the real world is messy. It's rare that every single item on an invoice is taxable. Many businesses deal with a mix of taxable and GST-free goods or services-think basic food, some health services, or certain educational courses.

When this happens, you can't just slap 10% on the subtotal. You need to handle each line item correctly.

Scenario: A Cafe's Catering Invoice

Let's say a local cafe caters an office lunch. The order includes:

- Gourmet Sandwiches (GST-free basic food): $150.00

- Bottled Soft Drinks (taxable): $50.00

- Delivery Service (taxable): $20.00

Here’s how they'd correctly calculate the total:

- First, identify the taxable items. In this case, it’s the soft drinks ($50) and the delivery fee ($20). Their combined base value is $70.

- Next, calculate the GST on just those items: $70.00 x 10% = $7.00.

- Finally, calculate the grand total: $150 (GST-free) + $70 (taxable items) + $7.00 (GST) = $227.00.

Your invoice template needs to make this crystal clear. It should show which items are GST-free and which are taxable, leading to an accurate final GST amount. This detail isn't just for compliance; it gives your clients complete confidence in your billing.

Grab Your Free Australian GST Invoice Templates

Alright, you've got the theory down pat – you know what needs to be on an invoice and how to crunch the GST numbers. Now it's time to put it all into action.

To save you the headache of building an invoice from scratch, I've put together a set of free, fully customisable GST invoice templates made specifically for Australian businesses. These aren't just some generic forms; they're designed to be ATO-compliant right out of the box, covering all the mandatory fields we just went over.

You can pick the format that works for you, pop in your business details, and start billing clients professionally in minutes. No more second-guessing if you’ve forgotten something important.

Which Template Format Should You Use?

I've made the templates available in three of the most common formats. Your choice really comes down to what software you're comfortable with and how you like to work.

-

Microsoft Excel: Perfect if you love the power of a good spreadsheet. The Excel version has all the formulas built-in, so it automatically calculates your subtotals, GST, and the final amount. This is a massive time-saver and seriously cuts down the risk of making a simple maths mistake, especially when you have a bunch of line items.

-

Microsoft Word: If you want more creative control over the look and feel, the Word template is your best bet. It’s much easier to add your logo, tweak the colours to match your branding, and write detailed descriptions for your services without being stuck inside a spreadsheet cell.

-

PDF: A PDF gives you a clean, non-editable final document that looks professional on any device. It's the most secure way to send an invoice, as it prevents any accidental changes after you've sent it. A common workflow is to fill out the Word or Excel version first, then save it as a PDF before emailing it to your client.

My Take: A solid template is the cornerstone of a smooth invoicing system. When you start with a compliant, pre-built document, you're not just saving time-you're freeing up mental space to focus on what you actually do best.

Putting Your New Template to Work

Getting started is simple. I’ve designed these to be as straightforward as possible so you can spend less time faffing about with admin and more time getting paid.

First, you'll want to grab the format you prefer. You can download one or all of them to see which you like best.

- Download the Excel GST Invoice Template

- Download the Word GST Invoice Template

- Download the Blank PDF GST Invoice Template

Once you have the file, open it up and start customising. Swap out the placeholder text with your business name, ABN, contact info, and bank details. Now’s the perfect time to drop your logo into the header to make it look sharp and professional.

Here’s a pro tip: After you've added all your own business details, save this version as your "Master Template." That way, you’re not re-entering the same information over and over again for every new invoice.

Then, for each new client or job, you just open your master file, fill in their details, list the products or services provided, and save it with a unique invoice number like "INV-001_ClientName.pdf". Done. It’s ready to attach to an email and send off.

How to Handle Tricky Invoicing Scenarios

Business rarely runs in a straight line, and your invoicing needs to keep up with the twists and turns. A standard invoice is simple enough, but what about when a customer returns something? Or you’re selling services overseas? What if you need to bill for a mix of taxable and GST-free items on the same invoice?

These situations pop up all the time, and each one requires a specific tweak to your invoice to keep your records clean and compliant with ATO rules.

Getting these details wrong can throw your GST reporting out of whack and cause headaches later. But once you get the hang of the logic, handling them becomes second nature.

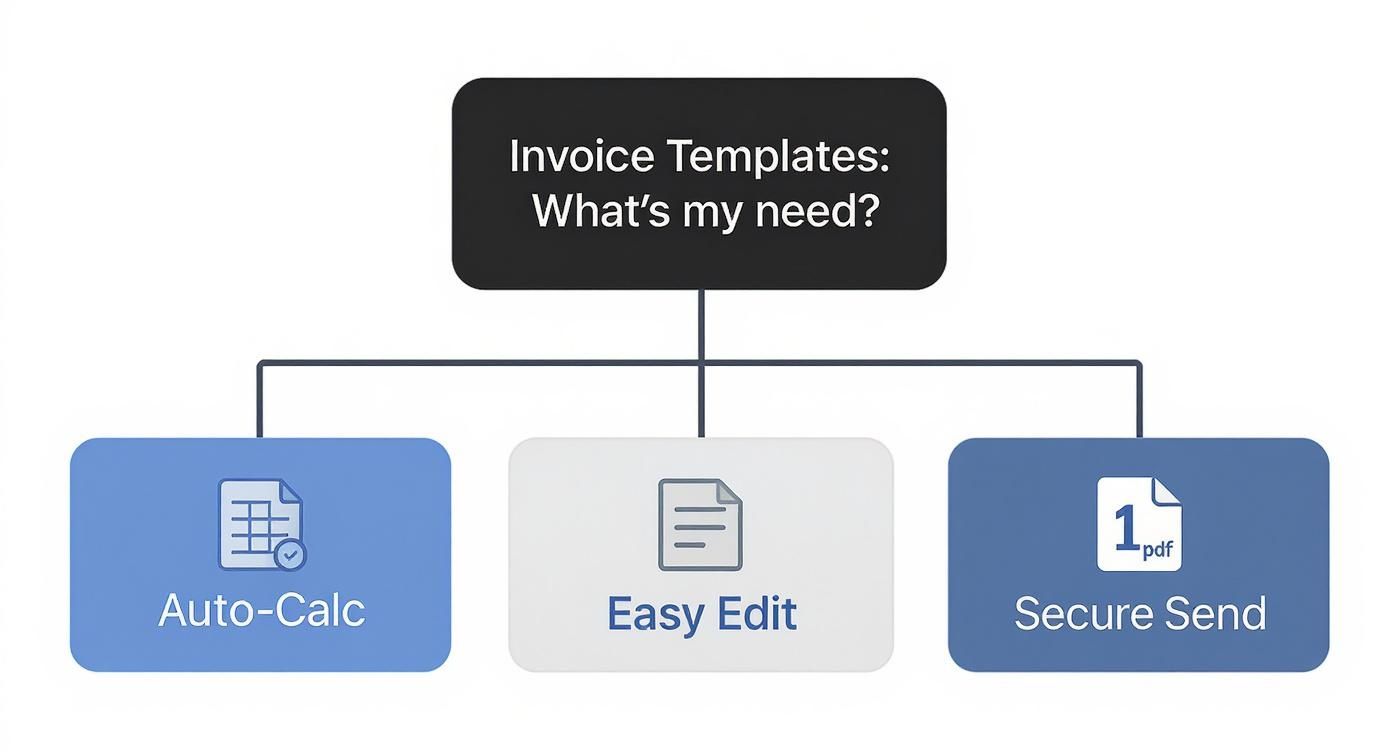

The right template can make all the difference. Are you after automatic calculations, easy editing, or secure sending? This flowchart can help you decide which format fits your workflow best.

As you can see, spreadsheets are great for auto-calculations, Word docs offer flexibility for customisation, and PDFs provide security when sending. It all comes down to what you prioritise.

Issuing Credit Notes for Returns and Refunds

When a customer sends goods back or you need to refund a service, you can't just hit 'delete' on the original invoice. The ATO requires a clear paper trail to show that the transaction was reversed or changed. That’s what a credit note is for.

Think of a credit note as a "negative invoice." It officially cancels out some or all of the value of the original tax invoice. Most importantly, it adjusts the GST amount you recorded from that first sale.

To be compliant, your credit note must tick these boxes:

- Be clearly labelled "Adjustment Note" or "Credit Note".

- Show your business name and ABN.

- Reference the original invoice number it's linked to.

- Briefly explain why you're issuing it (e.g., "Return of faulty goods").

- Show the total amount being credited, including the specific GST component.

For example, say you sent an invoice for $220 (including $20 GST) and the customer returned the product. You’d issue a credit note for -$220, which includes -$20 GST. This simple step corrects your sales figures and ensures you don't overpay GST on your next BAS.

Invoicing for GST-Free Exports

Selling to international clients is a common scenario that trips people up. The good news is that most goods and services exported from Australia are GST-free. This means you don’t charge your overseas customer the 10% GST, but you can still claim GST credits on your business expenses related to making that sale.

Your invoice needs to reflect this clearly.

When invoicing an overseas client, you must explicitly show the sale is GST-free. A simple line item showing "GST: $0.00" or a note like "GST-free export" is all you need. This avoids confusion and keeps you compliant with the ATO.

If you forget, your client might question the total amount. It also creates a mess in your own books, showing GST collected that you aren't legally required to send to the ATO. A good gst invoice template australia designed for exports will have a dedicated section to make this distinction clear.

Managing Mixed Supplies on a Single Invoice

Many businesses sell a mix of taxable and GST-free things. A classic example is a health food shop selling taxable vitamins alongside GST-free fresh fruit. Or a consultant who bills for a taxable service fee plus a GST-free travel reimbursement.

When this happens, you have to itemise everything properly on the invoice. You can't just add 10% GST to the total. The financial impact here is massive; Australia collects around AUD 70 billion in GST revenue annually, and the rules are strict. Industries like health, food, and exports frequently deal with GST-free items and need immaculate records, which the ATO requires you to keep for at least five years. For more detail, you can read about the requirements for GST-free sales for Australian businesses.

Here’s the right way to structure an invoice with mixed supplies:

- List every item separately. Each product or service gets its own line.

- Tag the GST status. Next to each line, indicate if it's taxable or GST-free. A simple note like (GST) or (Free) is perfect.

- Calculate GST correctly. The GST should only be calculated on the subtotal of the taxable items.

- Show clear totals. Your invoice should clearly display separate subtotals for taxable and GST-free items, the total GST amount, and the final grand total payable.

This level of detail makes it easy for your client to understand the charges and ensures your records are perfectly aligned for your BAS lodgement.

Taking Your Invoicing to the Next Level with Automation

https://www.youtube.com/embed/tXrssFdywgQ

Having a solid GST invoice template is a great start, but let's be honest-the real game-changer is automation. Manually creating, sending, and then chasing up invoices eats into time you could be spending on what you do best: running your business. It’s also a breeding ground for human error, whether that’s a typo in an ABN or a miscalculation of the GST.

Moving from a static template to an automated invoicing system is the logical next step for any Aussie business serious about efficiency. It’s about shifting from a reactive, admin-heavy chore to a proactive workflow that actively improves your cash flow.

Modern invoicing platforms take all the essential, compliant parts of a good template and build them into a smart, dynamic system. This means every single invoice you send out isn't just professional-it’s supercharged with features designed to get you paid faster.

Get Your Invoices Looking Professional and On-Brand

Your invoice is often the last touchpoint a client has with your business, so make it count. It’s much more than just a request for payment; it’s a reflection of your brand. A generic, plain-looking document simply doesn't scream professionalism like one that’s consistent with your business identity.

Good platforms make this incredibly easy. You can usually get it sorted in minutes:

- Pop your logo in: The first thing you should do is upload your logo. It goes right at the top for instant recognition.

- Match your colours: Tweak the colour scheme to align with your brand palette, reinforcing your visual identity.

- Set your details once: Plug in your ABN, contact info, and bank details so you never have to type them out again.

Once that’s done, every invoice the platform generates will automatically feature your professional branding. This kind of consistency builds trust with your clients and turns a simple document into a powerful brand asset.

Think of it this way: an automated, branded invoice does the work of both your accounts department and your marketing team. It keeps you compliant while presenting a polished, professional image every time.

Put Recurring Invoices and Payment Reminders on Autopilot

If you run a service-based business, you know the grind of managing retainers or recurring client work. Creating the same invoice month after month is mind-numbingly repetitive and, worse, it's easy to forget, which can throw your cash flow into chaos. This is where automation really shines.

You can set up recurring invoices for any ongoing work. Just define the client, the amount, and the schedule-say, the 1st of every month-and the system takes over. The invoice gets created and sent automatically, without you lifting a finger.

Even better is the magic of automated payment reminders. Chasing late payments is awkward for everyone and a massive time-suck. We know from experience that polite, automated follow-ups can dramatically speed up how quickly you get paid. You can set up a sequence that works for you, for example:

- A gentle nudge 3 days after the due date.

- A firmer reminder at 14 days overdue.

- A final notice when it hits 30 days overdue.

This system ensures you’re consistently following up without the manual effort or uncomfortable phone calls, directly boosting your cash flow by cutting down your average payment times.

Sync Everything with Your Accounting Software

Keeping accurate books is non-negotiable, especially when it’s time to lodge your BAS. Manually punching invoice details from your templates into accounting software like Xero, MYOB, or QuickBooks isn't just tedious; it’s an open invitation for data entry mistakes.

This is where a good invoicing tool really proves its worth. The best ones integrate seamlessly with the major accounting platforms. When you send an invoice or a client pays, the information is automatically pushed straight to your accounting software. This constant sync means your financial records are always up-to-date and perfectly balanced.

It means no more double entry, fewer headaches during reconciliation, and a crystal-clear view of your finances whenever you need it. By connecting your systems, you create a single source of truth for your income, making tax time and financial reporting so much simpler. To see how these features come together, you can learn more about Payly's smart invoicing solutions. This integration is the final piece of the puzzle, moving you from a manual GST invoice template to a fully streamlined, automated system.

Your Top GST Invoice Questions Answered

Even with the best systems in place, it’s easy to get tangled up in the specifics of GST invoicing. One minute you think you have it all figured out, and the next, a tricky situation pops up. To help clear the air, we've pulled together some of the most common questions Australian business owners have about their invoicing obligations.

Think of this as your quick-reference guide for those nagging queries that can hold you up. Here are the clear, straightforward answers you need.

When Does a GST Invoice Need the Buyer's ABN?

This is a big one and it catches a lot of people out. For any sale that totals $1,000 (including GST) or more, you are legally required to include the buyer's identity or their Australian Business Number (ABN) on the tax invoice.

For sales under that $1,000 threshold, it's not strictly mandatory. But honestly, it's a great habit to get into, particularly for your B2B sales. Including the ABN makes it dead simple for your client to claim their GST credits, which means fewer questions and faster payments for you.

What’s the Difference Between an Invoice and a Tax Invoice?

People often use these terms interchangeably in conversation, but in the eyes of the Australian Taxation Office (ATO), they're worlds apart. A standard 'invoice' is just a request for payment-any business, whether registered for GST or not, can send one.

A 'tax invoice', on the other hand, is an official document with specific legal weight in the Australian GST system.

- Who can issue it? Only a business registered for GST has the right to issue a tax invoice.

- What must it include? It needs to have specific, ATO-required details, like the words 'Tax Invoice', your ABN, and a clear breakdown of the GST amount.

- What is its purpose? This is the key part: only a valid tax invoice lets another GST-registered business claim a credit for the GST they paid on a purchase.

If you aren't registered for GST, you should only ever issue a standard invoice, never a tax invoice.

The real takeaway is this: a tax invoice is the only legal proof your clients can use to claim GST credits. A regular invoice just asks for payment. Nailing this distinction is fundamental for keeping both you and your customers compliant.

How Long Should I Hang Onto My GST Invoices?

Good record-keeping isn't just a suggestion; it's a non-negotiable part of running a business in Australia. The ATO mandates that you must keep copies of all tax invoices you issue and receive for a minimum of five years.

This applies whether you store them as paper copies in a filing cabinet or as digital files in the cloud. These documents are your evidence to back up the income you report and the GST credits you claim on your Business Activity Statement (BAS). If the ATO ever comes knocking for a review or audit, you’ll be glad you have everything organised and accessible.

Can I Claim a GST Credit Without a Tax Invoice?

The short answer is almost always no. The golden rule of the GST system is that you need a valid tax invoice to claim a GST credit on a business purchase. Without that document, you have no proof that GST was even paid.

There is, however, one very practical exception for those small, everyday expenses. You’re allowed to claim a credit without a tax invoice for any business purchase that costs $82.50 (including GST) or less.

Even for these small purchases, you still need some proof, like a cash register docket or a receipt. But for any business expense that tips over that $82.50 mark, getting a proper, compliant tax invoice is absolutely essential if you want to claim back the GST.

Ready to stop juggling templates and start automating your business operations? Payly combines smart invoicing, time tracking, e-signatures, and document management into one powerful platform for Australian businesses. Streamline your workflow and get paid faster. Start your free trial at Payly.

Payly Team

Sharing insights and strategies to help service businesses thrive. Follow Payly for more tips on time tracking, invoicing, and business operations.

Related Articles

Ready to streamline your business?

Join thousands of freelancers and agencies who use Payly to track time, send invoices, and get paid faster.