A Guide to Invoicing as a Freelancer in Australia

Stop chasing payments. Our guide to invoicing as a freelancer in Australia covers ATO rules, smart workflows, and proven tips to help you get paid faster.

Payly Team

December 31, 2025

Getting paid should be simple, but let's be honest: for most Aussie freelancers, it's anything but. Nailing your invoicing as a freelancer is a skill that directly shores up your financial stability. Too often, sole traders find themselves trapped in a cycle of chasing payments and wrestling with messy spreadsheets, which is basically a second, unpaid job.

This admin grind pulls you away from the billable work that actually pays the bills and grows your business.

Why Freelance Invoicing in Australia Is So Tough

When you're starting out, an invoice seems like a simple request for money. You do the work, send a document, and cash flows in. But the reality for freelancers in Australia is often far more complicated and frustrating, turning what should be a straightforward task into a major headache that stalls your cash flow.

The heart of the problem is a combination of inconsistent payment cultures and clinging to inefficient, manual processes. It’s tempting to rely on familiar tools like Word or Excel spreadsheets because they seem easy, but it quickly becomes a risky habit. These manual systems are breeding grounds for errors, lack a professional touch, and give you no way to track payment status or send reminders without constant, manual effort.

The Real Cost of Delayed Payments

Late payments aren't just an annoyance; they're a genuine threat to the health of your business. Here in Australia, freelancers face a particularly tough reality: on average, our invoices are paid 26.4 days past their due date. That statistic officially makes Aussie freelancers the last to get paid globally. With over 1.1 million independent contractors in the country, that's a huge community struggling with unpredictable income. You can learn more about the challenges of Australian freelancer payments and discover how to navigate them.

This delay isn't just a number, it creates a real-world ripple effect. It forces you to dip into your savings, stops you from investing back into your business, and adds a massive amount of mental stress. Every hour spent chasing money you've already earned is an hour you can't bill to another client.

Invoicing isn't just paperwork; it's a core business function. A messy, disorganised approach sends a message that your business is disorganised, which can erode client trust and delay payments even further.

Moving Beyond Manual Methods

To really thrive in Australia's competitive freelance scene, you need a smarter system. Effective invoicing means creating a professional, repeatable process that makes it easy for you to send and for your clients to pay.

Think about the classic problems with doing it all by hand:

- Lack of Professionalism: A basic template can look amateurish and might be missing key details the ATO requires.

- It's a Time Sink: Building every single invoice from scratch is a massive time drain that eats into your billable hours.

- Tracking is a Nightmare: Without a central system, it’s almost impossible to know at a glance which invoices are outstanding, due, or paid.

- Prone to Errors: Manually typing in dates, amounts, and client details often leads to small mistakes that cause big payment delays.

What Goes Into a Compliant Australian Freelance Invoice?

Getting paid on time often comes down to one simple thing: getting the details right on your invoice. A professional, compliant invoice does more than just look good, it signals that you’re a serious operator and makes it dead simple for your client’s accounts team to pay you.

Think of it as the final, crucial step in your project. Nailing your invoice is non-negotiable, especially when it comes to meeting the Australian Taxation Office (ATO) requirements. Every single element, from your Australian Business Number (ABN) to how you list the Goods and Services Tax (GST), has a purpose. Getting this right from the start means fewer questions, faster payments, and no compliance headaches down the track.

Let’s break down exactly what you need to include.

Your Business and Client Details

First things first, make it crystal clear who the invoice is from and who it's for. This information should be right at the top, bold and easy to find. Don't make the accounts department hunt for it.

- Your Business Name and ABN: Display your registered business name and your 11-digit ABN. The ABN is the unique identifier that proves you're a legitimate business in Australia. No ABN, no payment.

- Your Contact Information: Add your business address, a contact phone number, and a professional email address. If they have a question, you want to make it easy for them to ask.

- Client’s Name and Address: Double-check you have the client’s full legal name and their current address. Getting this wrong can send your invoice on a detour through the wrong department, delaying payment.

If you’re registered for GST, you have one more critical job: the document must be clearly labelled “Tax Invoice”. This isn't a suggestion; it's an ATO rule. For a perfectly formatted example, check out our GST invoice template for Australia.

Essential Numbers and Dates for Tracking

Once the "who" is sorted, you need to cover the "when" and "what". These numbers and dates are your best friends for keeping records straight and tracking what's owed. Without them, chasing an overdue payment turns into a real mess.

Having a unique invoice number for every single invoice you send is non-negotiable for good financial housekeeping. It creates a clean, traceable paper trail for both you and your client, wiping out any confusion about which payment is for which job.

Make sure these are on every invoice:

- A Unique Invoice Number: A simple sequential system like INV-001, INV-002 works perfectly. It prevents duplicates and makes talking about a specific invoice a breeze.

- The Invoice Date: This is simply the date you’re sending the invoice.

- The Payment Due Date: Be explicit. "Due in 14 days" or a specific date like "Due 15 July 2024" leaves no room for doubt.

An Itemised Breakdown of Your Services

Now for the main event: a clear, detailed list of what you're actually charging for. Vague descriptions like "Consulting work" are a recipe for follow-up emails and payment delays. Your client needs to see exactly what they’re paying for.

Break down the work into line items that mirror your original quote or agreement. Each line should include a short description of the task, the quantity (like hours or project milestones), your rate, and the subtotal for that item.

At the bottom, provide a clean summary: the subtotal for all services, the separate GST amount (if you're registered), and the final, bolded Total Amount Due. This transparency builds trust and gives the client's finance team everything they need to approve the payment without a second thought.

To make sure you've got everything covered, here's a quick checklist of what the ATO expects to see on a compliant freelance invoice.

Essential Elements of an ATO-Compliant Freelance Invoice

This checklist covers the mandatory and highly recommended details to include on every invoice you send. Getting these right ensures you meet legal requirements and helps you get paid faster.

| Element | Why It's Important | Example |

|---|---|---|

| "Tax Invoice" Label | Mandatory if you are registered for and charging GST. | Displayed prominently at the top of the document. |

| Your Business Name | Identifies you as the seller/service provider. | Freelancer Pro Pty Ltd |

| Your ABN | Your unique 11-digit Australian Business Number. | ABN: 12 345 678 901 |

| Invoice Date | Establishes the date the transaction was recorded. | 1 July 2024 |

| Unique Invoice Number | Essential for tracking and record-keeping for both parties. | INV-0142 |

| Client's Name/Business Name | Identifies who the invoice is for. | Awesome Client Co. |

| Client's ABN or Address | Helps correctly identify the recipient for tax purposes. | 123 Main Street, Sydney NSW 2000 |

| Itemised List of Services | Clearly describes what is being sold. Essential for clarity. | "Website copy - About Us page (5 hours)" |

| GST Amount | If applicable, shows the GST amount for each item or the total. | GST: $150.00 |

| Total Amount Due | The final, total figure including GST (if applicable). | Total: $1,650.00 |

Sticking to this structure doesn't just keep the tax office happy, it reinforces your professionalism and makes the entire payment process smoother for everyone involved.

Creating an Efficient Invoicing Workflow

Let’s be honest, manually creating invoices is a drag. It’s one of those admin tasks that eats into time you could be spending on actual client work, you know, the billable stuff. The secret to getting paid faster and with less hassle is building a smart, modern workflow that turns your hard work into a professional invoice with almost zero effort.

Think of it as building a bridge between doing the work and seeing the money hit your account.

It all starts with how you track your time. Whether you’re billing by the hour, charging per project, or working on a monthly retainer, that timesheet is your source of truth. It's the raw data that feeds your invoice, so getting it right is non-negotiable.

From Timesheet to Invoice, Automatically

The ultimate goal here is to stop copying and pasting information from one app to another. When you connect your time tracking tool directly to your invoicing system, you pretty much eliminate the chance of human error and can pump out an accurate invoice in minutes. Every single billable minute is captured without you lifting a finger.

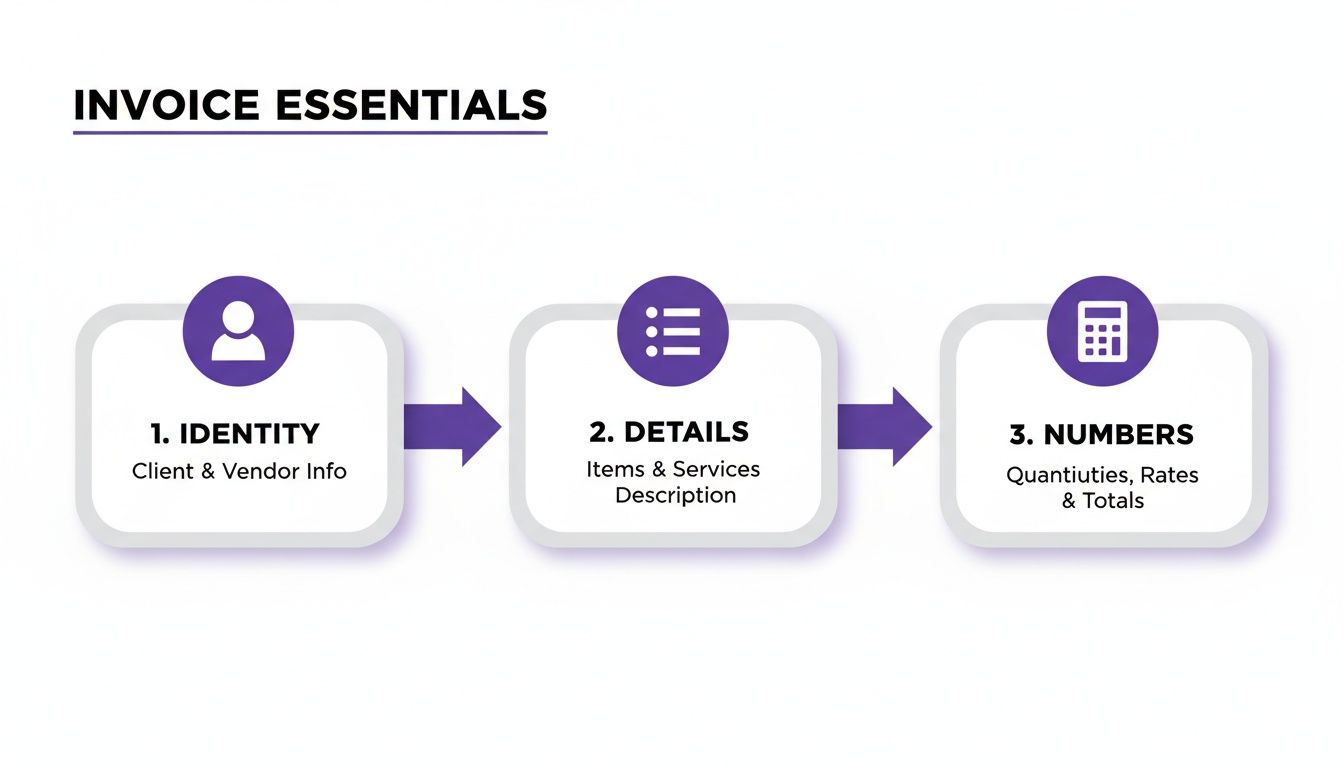

So, what does this actually look like in practice? It’s about pulling three core pieces of information together seamlessly.

This process of establishing who you are, detailing what you did, and calculating the final numbers is exactly what a good automated system handles for you.

You might be surprised how many freelancers are still doing this the hard way. A recent study found a staggering 38% of freelancers still build their invoices from scratch in Word or Google Docs, and another 21% are just using basic templates they've downloaded. Meanwhile, the 40% who’ve made the switch to proper invoicing software are saving themselves a world of pain. With the Aussie freelance market continuing to boom, clunky, manual processes are a direct threat to your cash flow.

Choosing the Right Tools for the Job

Switching to dedicated software is the single biggest leap forward you can make. Sure, a Word doc feels easy for your first invoice, but it quickly becomes a bottleneck, creating a mountain of admin that can genuinely hold your business back.

When you start looking at software, the magic word is ‘integration’. You want a platform that brings time tracking and invoicing under one roof.

Here’s what to look for:

- Integrated Time Tracking: Can you log hours against a specific client or project and then, with a single click, pull that data directly into an invoice? That’s the dream.

- Customisable Templates: You need to be able to create professional, on-brand invoices that automatically include all the ATO-compliant details we covered earlier.

- Automated Reminders: Does the tool have an option to send polite, automated follow-up emails when an invoice is overdue? This feature alone is worth its weight in gold, saving you from having to play debt collector.

An efficient workflow isn’t a nice-to-have; it's essential for any serious freelancer. It protects your time, slashes your stress levels, and keeps your cash flow healthy and predictable. That's the stability you need to grow.

The right platform takes invoicing from a chore you put off for weeks to a simple, two-minute task. It’s worth spending a bit of time finding a system that clicks for you. To get started, check out our guide on the best invoicing software in Australia to compare your options. The goal is to build a system that lets you focus on what you’re actually good at.

Setting Clear Payment Terms to Get Paid Faster

Sending out a perfectly crafted invoice feels good, but let's be honest, it's only half the battle. The real mission is getting that money into your bank account, and that rarely happens by accident. Your first line of defence against late payments and chaotic cash flow is setting firm, crystal-clear payment terms.

Never leave payment deadlines open to interpretation. Standard terms like NET 7 or NET 14 are your best friend because they mean payment is due within 7 or 14 days of the invoice date. These aren't just casual suggestions; they should be a non-negotiable part of your initial contract and repeated on every single invoice. It sets a professional tone from the get-go.

Make Paying You Ridiculously Easy

The easier you make it for clients to pay, the faster you'll get paid. It's that simple. If a client has to jump through hoops, your invoice is going straight to the bottom of their to-do list. That’s why offering a range of payment methods is one of the smartest things you can do for your business.

While a standard bank transfer (EFT) is common in Australia, it’s not always the most convenient for everyone. Give your clients more modern, flexible ways to settle up.

- Online Payment Gateways: Integrating a platform like Stripe lets clients pay instantly with a credit or debit card, right from the digital invoice.

- Direct Debit: This is gold for retainer clients. Setting up a direct debit automates the whole process, so you get paid on time, every time, without lifting a finger.

When you provide options, you eliminate the classic excuses for late payment. You're making it a one-click process to send you the money you've earned, a small change that can seriously shrink your payment cycles.

The Art of the Polite Nudge

Even with the clearest terms and simplest payment methods, some invoices will still drift past their due date. It happens. How you follow up is what really matters. You need to be persistent without torching the client relationship. This is where automation is an absolute lifesaver.

A great invoicing system can send automated reminders that are polite but firm. Think of it as a gentle nudge a day after the due date, followed by a slightly more direct message a week later if needed.

Following up on an invoice isn't being pushy; it's just good business. You've held up your end of the bargain by delivering the work. You are absolutely entitled to be paid for it on time, as you both agreed.

For example, a tool like Payly lets you flick a switch to turn on automated reminders right inside your invoicing workflow.

Setting up these sequences lets the system handle the awkward job of chasing payments for you. It ensures you never forget and always maintain a professional tone, keeping your cash flow healthy without you having to manually track every due date and send awkward emails.

Advanced Invoice Management and Record Keeping

When your freelance business starts to take off, the simple admin tasks you once managed easily can quickly snowball. Suddenly, you're drowning in paperwork instead of doing the work you love. This is the point where shifting to smarter, more advanced practices for your invoicing as a freelancer isn't just a nice-to-have, it’s essential for survival.

Solid record-keeping is more than just good organisation; it's a legal must. The Australian Taxation Office (ATO) is very clear: you need to keep all your business records, including every invoice and financial document, for at least five years. Simply "losing" them isn't an option and can land you in serious trouble.

Future-Proofing Your Operations

To stay compliant and sane, you need a system that captures everything securely and logically. It’s time to ditch the chaotic mix of folders scattered across your desktop and move towards a single source of truth for your business finances.

A brilliant way to start is by creating a clear audit trail for every single project. Using PDF e-signatures to get quotes and proposals approved before you even start working is a game-changer. This simple step creates a legally binding agreement on the scope and cost, heading off those painful "scope creep" conversations and payment disputes down the line.

Getting a signature on your quote transforms it from a price list into a formal agreement. It’s a small action that builds a rock-solid foundation for every invoice you send, giving you confidence and legal backup if anything goes sideways.

Integrating Your Financial Tools

The next logical step as you grow is connecting your invoicing tool with proper accounting software. If you're still manually punching invoice data into platforms like Xero or MYOB, you're not only wasting time but also opening the door to costly mistakes.

A smarter workflow is all about integration. When your invoicing platform talks directly to your accounting software, financial reporting becomes a breeze, and tax time is far less of a headache.

- Automated Data Sync: Paid invoices are automatically logged as income, and expenses are categorised on the fly. No more manual data entry.

- Simplified Reporting: Need to generate a Profit and Loss statement or lodge your Business Activity Statement (BAS)? It becomes a one-click job.

- Clear Financial Overview: You get a live, accurate snapshot of your business's financial health, which helps you make much better decisions.

This kind of organised system is what sustainable growth is built on. To dive deeper into how these systems work, it's worth exploring what makes the best document management software in Australia and how it can support your freelance career.

Common Questions About Freelance Invoicing

Getting your invoicing right can feel like navigating a maze, especially when you're just starting out. You're bound to have questions, and getting straight answers is the best way to feel confident about managing your money. Let's tackle some of the most common invoicing questions I hear from fellow Australian freelancers.

Think of this as your quick-reference guide for those moments when you're stuck on a tricky "what if" scenario.

Do I Need to Register for GST as a Freelancer in Australia?

This is a big one, and thankfully, the answer is pretty straightforward. You are legally required to register for Goods and Services Tax (GST) in Australia once your annual business turnover hits or is expected to hit the $75,000 threshold.

As soon as you cross that line, you need to start adding 10% GST to your fees and issuing proper "Tax Invoices".

If your earnings are below that magic number, registering for GST is completely optional. Just remember, if you're not registered, you can't charge GST, but you also can't claim GST credits back on your own business expenses.

What Is the Best Way to Follow Up on an Unpaid Invoice?

Chasing money is never fun, but it's a non-negotiable part of freelance life. The best strategy is to start gently. A simple, automated reminder email sent a day or two after the due date is often all it takes to jog a client's memory.

If a week goes by with radio silence, it’s time for a slightly firmer follow-up. Another email is fine, but a polite and direct phone call can often cut through the noise and get you an answer (and your money) much faster.

The key is to stay professional and calm. Be clear about the overdue amount and refer back to your original payment terms. Your goal is to get paid while keeping the client relationship intact.

For invoices that are seriously overdue, the next step is a formal letter of demand before you even think about engaging a debt collection service. Honestly, using an invoicing system with automated reminders is a lifesaver here since it handles most of the awkward follow-up for you.

Can I Charge a Late Fee on Overdue Invoices?

Yes, you absolutely can charge late fees in Australia, but there's a huge catch. This policy must be clearly spelled out in your contract, service agreement, or the initial quote the client signed off on. You can't just slap a late fee on an invoice out of the blue.

Your terms should detail exactly how the fee works, whether it's a percentage of the total invoice or a flat daily rate, and when it kicks in. This isn't just about penalising late payers; it’s a fair way to compensate yourself for the time and hassle of chasing payment.

How Long Should I Keep My Freelance Invoices for Tax Purposes?

Good records are your best friend at tax time. The Australian Taxation Office (ATO) requires you to keep all your business records, including every single invoice you've sent and received, for a minimum of five years.

That five-year clock starts after the records are prepared or the transaction is completed, whichever is later. The easiest and safest way to handle this is with a digital platform that offers secure cloud storage. It keeps everything organised, safe from being lost, and perfectly compliant with ATO rules.

Ready to take the headache out of invoicing? Payly combines time tracking, smart invoicing with automated reminders, e-signatures, and document management into one simple platform. Start your free 14-day trial and see how easy it is to get paid faster.

Payly Team

Sharing insights and strategies to help service businesses thrive. Follow Payly for more tips on time tracking, invoicing, and business operations.

Related Articles

Ready to streamline your business?

Join thousands of freelancers and agencies who use Payly to track time, send invoices, and get paid faster.