A Guide to Invoice payment terms australia

Master invoice payment terms Australia. This guide covers legal requirements, standard terms, and best practices to help your small business get paid on time.

Payly Team

January 25, 2026

If you're running a business in Australia, you know the feeling. Chasing up late payments can feel like a full-time job, and it's one of the biggest headaches for small businesses and freelancers alike. Your best defence isn't an angry email; it's rock-solid invoice payment terms. Think of them less as fine print and more as the foundation for a healthy cash flow.

Why Clear Invoice Payment Terms Are Non-Negotiable

Your payment terms are essentially a mini-contract that dictates how and when you get paid for your hard work. When those terms are fuzzy, or worse, completely missing, you're inviting confusion, delays, and a whole lot of frustration. It’s a common trap many freelancers fall into, leading to unpredictable income just because the expectations weren't set from day one.

This kind of ambiguity doesn't just hurt your bank account; it can strain client relationships. A client might genuinely not realise a payment is due, while you're left wondering if they're intentionally holding back. This guide is your playbook for getting paid on time, every time, by mastering the art of clear payment terms.

The Foundation of Financial Stability

Getting your terms right does more than just tack a due date onto an invoice. It signals professionalism and puts you in the driver's seat of your finances. Before we dive into the specifics for Australia, it’s worth getting a handle on the general principles of terms of payment that apply everywhere. Nailing these core concepts is the first step.

Well-defined terms are a game-changer, helping you:

- Improve Cash Flow: When payments come in like clockwork, you can manage your expenses and plan for future growth with confidence.

- Reduce Admin Headaches: You’ll spend far less time sending "just checking in" emails and more time doing the work that actually makes you money.

- Set Professional Boundaries: Clear, firm expectations show clients you're a serious business, which earns you respect.

By defining your terms upfront, you transform the payment process from a hopeful waiting game into a structured business transaction. This simple shift is critical for long-term financial health.

Ultimately, getting your invoice payment terms right is about protecting your income. It ensures the effort you pour into your work is respected with prompt, predictable payment. Let's walk through everything you need to know, from legal must-haves to handling disputes, so you can take back control.

Meeting Your Legal Invoicing Obligations in Australia

Before we even get to payment terms, let’s talk about the invoice itself. Getting your invoice right is the absolute first step to getting paid in Australia. Think of it this way: a legally compliant invoice is your ticket to entry. Without it, you're not even in the game, and your client’s payment system won't let you through the door.

The Australian Taxation Office (ATO) has a clear set of rules for what makes a valid tax invoice. This isn't just about looking professional; it's what makes your request for payment legally enforceable. If you miss a key detail, you’re giving your client a legitimate reason to delay, question, or even reject the payment. That means unnecessary headaches and a direct hit to your cash flow.

The Anatomy of a Compliant Tax Invoice

So, what does a proper tax invoice look like? For any sale over $82.50 (including GST), your invoice needs to tick a few specific boxes. These details are non-negotiable and provide total transparency for you, your client, and the tax man.

Here are the must-haves for every invoice you send:

- The words “Tax Invoice” need to be clear and prominent, usually right at the top.

- Your business identity, whether it’s your legal name or trading name.

- Your Australian Business Number (ABN), this one is absolutely critical.

- The date you issued the invoice, which starts the clock on your payment terms.

- A clear description of what you sold, including the quantity and the price.

If you want to nail this every single time, it’s worth checking out how to build a rock-solid GST invoice template for Australia. Getting a good template sorted means you'll never have to worry if your invoice is up to scratch.

Why Your ABN is Non-Negotiable

Forgetting to put your ABN on an invoice is a surprisingly common and very costly mistake. Under ATO rules, if your ABN is missing, your client is legally required to withhold a massive 47% of your payment and send it straight to the tax office. It’s a system called “no ABN withholding.”

Imagine you've just finished a $5,000 job. You're expecting a nice payment to land in your account, but instead, you only receive $2,650. The other $2,350 is sitting with the ATO, all because you forgot to add your 11-digit ABN.

You can eventually claim that withheld money back when you file your tax return, but the immediate damage to your cash flow can be brutal. This rule is in place to make sure everyone is paying their fair share of tax.

For you, it means that double-checking for your ABN should be a final, essential step before you hit 'send'. By making sure your invoices are legally sound from the get-go, you protect your income and make the entire payment process smoother for you and your client. It’s this solid foundation that makes enforcing your payment terms so much easier down the track.

Choosing the Right Payment Window for Your Business

Picking the right payment window is a classic balancing act. On one side, you've got your own cash flow to protect, the lifeblood of your business. On the other, you want to set terms that your clients find fair and can actually meet. It's a decision that directly impacts both your finances and your client relationships.

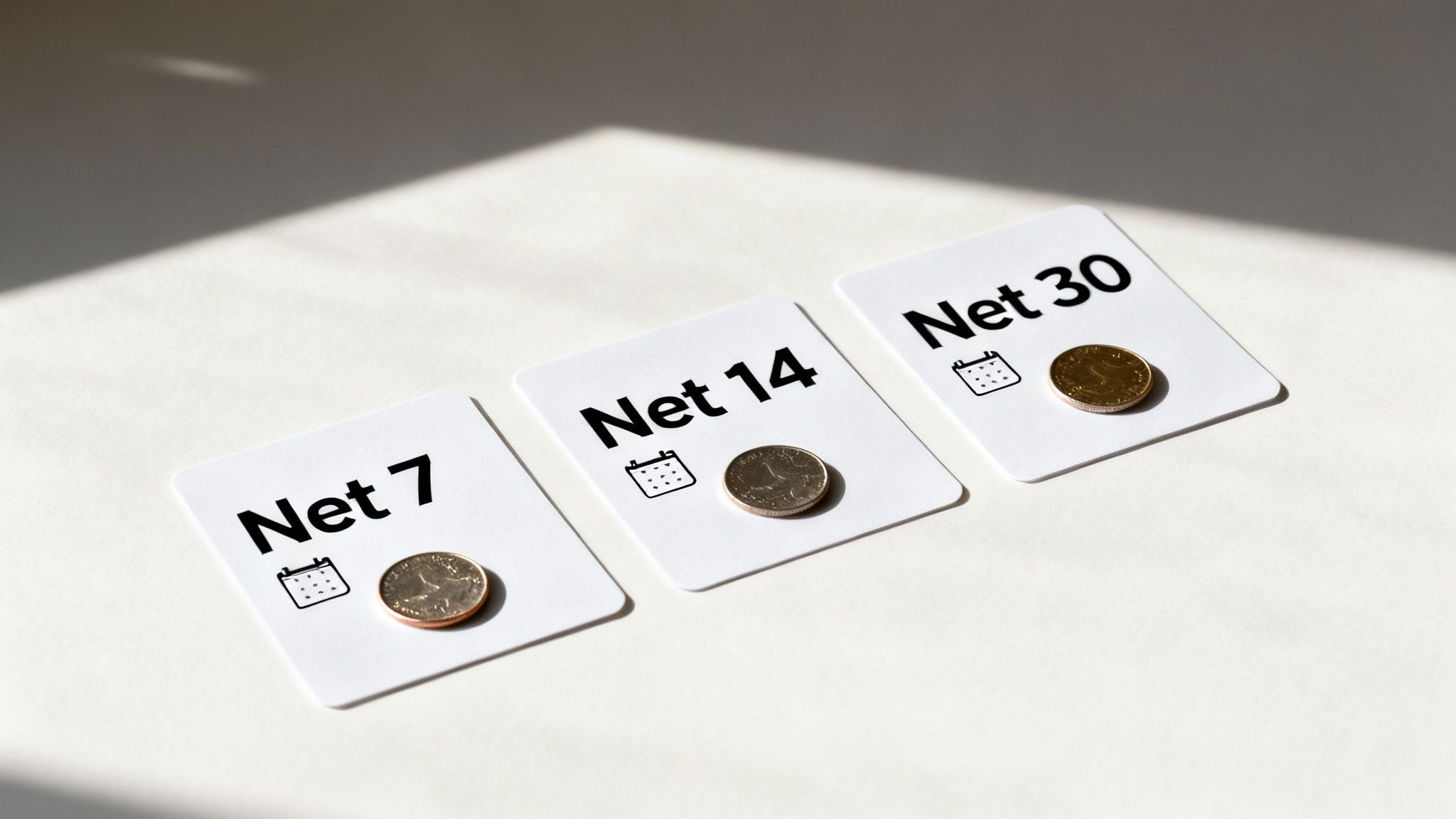

The most common terms you’ll see in Australia are Net 7, Net 14, and Net 30. The "Net" simply means the full amount is due, and the number tells you how many calendar days your client has to pay up after you issue the invoice. What works best for you really depends on your industry, who the client is, and frankly, how quickly you need the cash in your bank account.

Net 7: Shorter Terms for Faster Cash Flow

A Net 7 term means payment is due within seven days. This is your go-to for getting paid fast. It closes the gap between finishing the work and seeing the money, which can be a massive relief for your cash flow.

This approach works brilliantly for:

- New clients: It’s a low-risk way to see if a new client is a reliable payer before you get in too deep.

- Small, one-off jobs: If the project was quick, the payment should be too. It just makes sense.

- Businesses with high turnover: When you’re juggling lots of small transactions, Net 7 keeps the money flowing consistently.

But a word of caution: a seven-day deadline can feel a bit aggressive, especially for bigger corporate clients. Their accounts payable departments often run on a much slower, more bureaucratic timeline, so a Net 7 invoice might be impossible for them to process in time.

Net 30: The Australian Standard

Across Australia, Net 30 is pretty much the default, particularly for B2B work and government contracts. It gives clients a full month to get your invoice sorted, which is widely seen as professional and reasonable.

It’s a safe bet for most business relationships. You're showing trust in your client while still having a clear deadline in place. The downside? It’s all on you. Waiting up to 30 days for payment can put a real squeeze on your finances, especially if you're a freelancer or small agency with monthly bills to cover.

Choosing your payment term is a strategic business decision, not just an administrative detail. It directly influences your financial stability and shapes the professional expectations you set with your clients.

Finding the Right Fit: A Strategic Comparison

There's no one-size-fits-all answer here; the best term is all about context. Often, a Net 14 term hits the sweet spot. It’s more flexible than a tight seven-day window but gets you paid twice as fast as Net 30.

You can also get strategic and vary your terms. A loyal, long-term client might get more generous terms as a sign of trust, while you might keep a new relationship on a shorter leash.

To help you map it out, here’s a quick look at how the common terms stack up in the Australian market.

A Comparison of Common Payment Terms

This table breaks down the most common Australian invoice payment terms, giving you a clearer picture of the ideal use case, cash flow impact, and typical client expectations for each.

| Payment Term | Best For | Cash Flow Impact | Client Perception |

|---|---|---|---|

| Net 7 | New clients, small jobs, high-volume businesses | Excellent. Money arrives quickly, minimising financial gaps. | Can be seen as demanding by larger organisations. |

| Net 14 | Regular clients, professional services | Good. A balanced approach for steady cash flow. | Generally viewed as fair and reasonable. |

| Net 30 | Large companies, government contracts, established clients | Fair. Can create cash flow gaps for small businesses. | Widely accepted as the professional standard. |

At the end of the day, your goal is to find a payment window that keeps your business financially healthy without pushing away your clients. Don't be afraid to mix and match your terms to create a system that truly works for you and your business.

How to Write Clear and Enforceable Payment Clauses

When it comes to getting paid, ambiguity is your worst enemy. A fuzzy payment clause is an open invitation for interpretation, and that almost always leads to delays. Writing clear, enforceable payment clauses isn't just about being strict; it's about clear communication, setting professional boundaries, and making it dead simple for your client to pay you correctly and on time.

Think of your payment clause as the instruction manual for getting you paid. It needs to answer three questions without any fluff: How much? By when? And how? Every detail should be spelled out so there’s absolutely no room for confusion. This clarity is what turns a simple request for money into a legally solid part of your agreement.

Key Components of a Strong Payment Clause

To make your payment terms bulletproof, you need to include a few non-negotiable elements. These components work together to build a clause that’s both easy for your client to follow and simple for you to enforce if needed.

Here’s what every payment clause should cover:

- Due Date: Don’t just state the payment window; give the exact date. Instead of a vague "Net 30," be explicit: "Due Date: 25 November 2024 (30 days from invoice date)."

- Accepted Payment Methods: Spell out exactly how you want to be paid. If you prefer a bank transfer, list your BSB and account number. If you take cards, include a direct link to your payment gateway like Stripe or Square.

- Late Payment Consequences: Clearly state what happens if a payment is late. This is where you outline any late fees or interest charges that will apply.

Covering these points creates a clause that not only guides your client but also protects your business if things don't go to plan. For a better understanding of how these terms fit into a larger agreement, it's worth learning about the essential elements of a contract and why each one is so important.

Handling Late Fees and Interest in Australia

Adding a late fee clause is a standard and sensible practice in Australia, but you have to get it right. The goal isn’t to punish a client; it's to recover the genuine admin costs you bear while chasing up the overdue payment. It also sends a clear signal that you expect to be paid on time.

A late fee must be a genuine pre-estimate of your costs for recovering the debt. It cannot be an excessive penalty, or a court could rule it unenforceable under Australian law.

So, what does that look like in practice? You could specify a reasonable fixed fee or a small percentage of the overdue amount. A common and legally sound approach is to charge interest based on the cash rate target set by the Reserve Bank of Australia, plus a small margin on top.

Here’s a practical example you can adapt for your own invoices:

Sample Late Payment Clause:

"Payment is due on the date specified on this invoice. For overdue accounts, a late fee of 2% of the outstanding amount will be charged for every 30-day period the invoice remains unpaid. This fee is intended to cover our administrative and recovery costs."

This kind of straightforward, upfront communication means there are no nasty surprises for your client. It establishes that you run a professional operation and encourages them to treat paying your invoices with the respect they deserve.

What to Do When Australian Invoices Go Unpaid

Even with rock-solid payment terms, late payments are an unfortunate reality of doing business in Australia. It’s a frustrating situation, to be sure, but having a clear, professional plan of action can make all the difference. The goal is to get paid without burning bridges, and that means starting gently and escalating your approach in a measured way.

Let’s be honest, late payments aren’t just a minor headache; they’re a huge problem. In fact, only 37% of B2B invoices in Australia are actually paid on time. That leaves a staggering 52% of invoices overdue, and a worrying 11% are eventually written off as bad debt.

For a small business, this can be a cash flow killer. The average business owner wastes 12 days a year just chasing money they’ve already earned. You can dive deeper into these figures in this detailed report from Dynamic Business.

Your Professional Escalation Plan

When an invoice slips past its due date, the last thing you want to do is panic or fire off an angry email. A calm, structured approach is always more effective. The best practice is to start with automated reminders before moving to more direct, personal communication.

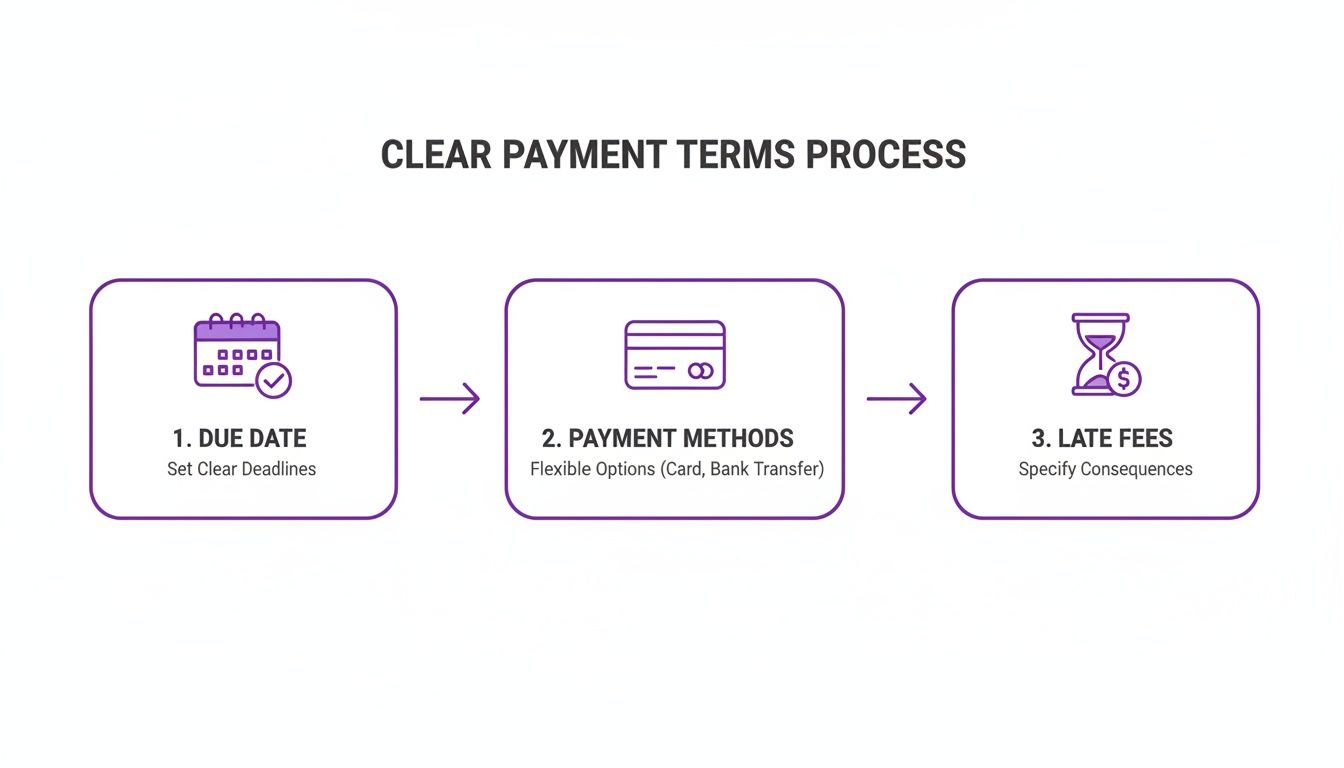

This infographic breaks down the key elements you should have in place from the start to prevent invoices from going unpaid. Clear due dates, simple payment methods, and defined late fees.

When these three areas are crystal clear on every invoice, you create a straightforward process that minimises confusion and makes it easy for your clients to pay on time.

Here’s a step-by-step process we recommend following:

- Automated Reminder (1-3 Days Overdue): A gentle, automated email is the perfect first step. Think of it as a polite nudge that gives the client the benefit of the doubt. They’ve probably just forgotten.

- Follow-Up Email (7 Days Overdue): If the invoice is still sitting there, it’s time for a friendly but more direct personal email. Politely check that they received the invoice and ask if there are any issues holding things up.

- Phone Call (14 Days Overdue): A phone call is much harder to ignore. It gets you a direct line to your contact so you can understand the reason for the delay and, ideally, agree on a specific date for payment.

- Formal Communication (30 Days Overdue): At the one-month mark, things get more serious. Send a formal email that restates the overdue amount, references your payment terms, and clearly mentions any late fees that are now in effect.

Throughout these early stages, keep your tone professional and helpful. Most late payments are due to a simple oversight, not malice. A good relationship is your most powerful tool for getting paid.

When to Call in the Experts

If your own efforts aren't getting you anywhere, it's time to explore the more formal avenues available in Australia. These options add legal weight to your request and signal to the client that you’re serious about collecting what you’re owed.

For those deeply overdue invoices, consider these next steps:

- Letter of Demand: This is a formal letter, often sent by a solicitor or a debt collection agency. It clearly states the amount owed, provides a final deadline for payment, and outlines the legal action you’ll take if the debt remains unpaid.

- ASBFEO Assistance: The Australian Small Business and Family Enterprise Ombudsman (ASBFEO) offers mediation services. This is a fantastic resource for resolving payment disputes without getting tangled up in costly and time-consuming legal battles.

- State Tribunals: For smaller claims, you can take your case to your state's Civil and Administrative Tribunal (like NCAT in NSW or VCAT in Victoria). It's a much more accessible and less formal alternative to going to court.

Getting Paid Faster: It’s All About a Smarter Workflow

Nailing your payment terms is a massive step, but it’s only half the battle. If you really want to get a handle on your cash flow, you need a slick invoicing workflow that ties those clear terms to modern, clever tech. The right tools can put the whole process on autopilot, wiping out the manual mistakes and frustrating delays that so often leave you waiting for your money.

This is where you can make a real difference. When your invoicing process talks to the other parts of your business, you create a system that’s working for you, not against you. Think about it: tracking your hours, creating a perfect tax invoice, and sending it out with automatic follow-ups, all in a matter of minutes.

Put Your Invoicing on Autopilot

Automating your invoicing isn’t just a time-saver; it’s about being consistently professional and accurate. A good system makes sure every single invoice has the right ABN, GST, and payment terms, while automatic reminders do the awkward chasing for you.

This kind of setup pays off in a few key ways:

- Fewer Human Errors: Automation slashes the chance of typos or missing info that can give clients an excuse to delay payment.

- Consistent Chasing: Automatic reminders mean no overdue invoice ever gets forgotten, which is a game-changer for getting paid on time.

- Look Like a Pro: A smooth, automated process shows clients you’re organised and you mean business.

The real aim here is to build a system where getting paid is just the natural, easy result of doing great work. It frees you up to focus on what you're good at, growing your business, instead of chasing payments.

If you want to seriously speed up how you collect payments, digging into the many accounts receivable automation benefits is a great place to start. And if you're looking for a refresh on the basics, you can walk through the entire process of how to send an invoice from beginning to end.

Got Questions About Australian Payment Terms? We’ve Got Answers.

When you're running a business in Australia, getting the hang of invoice payment terms can feel like navigating a maze. A few common questions always seem to pop up. Let's tackle them head-on so you can invoice with confidence and keep your cash flow in good shape.

What Should I Do If a Client Disputes a Term?

First off, don't panic. If a client pushes back on a payment term, the best first step is always a simple, open conversation. Politely ask them to explain their concern. It could just be a misunderstanding about the due date or how they're meant to pay.

Gently refer them back to the original contract or agreement where the terms were laid out. If they’re still not on board, you might need to find a middle ground. The key is to be flexible but firm, and make sure you get any changes in writing to protect yourself later.

Are Late Fees Actually Enforceable in Australia?

Absolutely, but you have to do it right. You can legally charge a fee for a late payment, but it can't be a random penalty you've plucked out of thin air. The amount you charge has to be a genuine pre-estimate of the loss you've suffered because of the delay. Think of it as covering the cost of your admin time chasing them up or any interest you've had to pay.

Be careful not to charge an excessive amount. If a fee looks more like a punishment than a recovery of costs, a court could rule it an unenforceable "penalty." Always spell out your late fee policy clearly on your invoices and in your client agreements from day one.

Is There a Standard "One-Size-Fits-All" Payment Term for My Industry?

While Net 30 is a pretty common starting point across many Australian industries, it’s definitely not a universal rule. The reality on the ground can be quite different.

For example:

- Creative freelancers, consultants, and tradies often use shorter terms like Net 7 or Net 14. It just makes sense for smaller businesses that need to keep cash moving.

- Big corporations and government departments, on the other hand, often have more complex payment systems and typically operate on Net 30 or even Net 60 schedules.

The smartest approach? Do a little homework to see what’s standard in your field, then find a balance between what your clients expect and what your own business needs to thrive.

Juggling everything from tracking time and sending out compliant invoices to chasing up payments can be a real headache. Payly is designed to pull it all together in one place, helping you run a tighter ship and get your money faster. Stop switching between a dozen different apps and start managing your business the smart way. See how Payly can make your life easier.

Payly Team

Sharing insights and strategies to help service businesses thrive. Follow Payly for more tips on time tracking, invoicing, and business operations.

Related Articles

Ready to streamline your business?

Join thousands of freelancers and agencies who use Payly to track time, send invoices, and get paid faster.