freelance invoice template australia - Free Word/PDF

freelance invoice template australia: Download a ready-to-use Word/PDF template with ABN, GST setup, and clear payment terms to get paid faster.

Payly Team

November 28, 2025

Getting paid on time really boils down to sending a clear, professional invoice. For freelancers here in Australia, that means using a freelance invoice template for Australia that ticks all the ATO boxes, whether you prefer Word, PDF, or Google Docs. Nailing your template from the get-go is the secret to a smooth financial workflow and getting your money without any drama.

Why a Professional Invoice Is a Game-Changer in Australia

Think of your invoice as more than just a bill. It's a critical business document that screams professionalism and safeguards your cash flow. When you're a freelancer juggling everything yourself, a rock-solid invoicing system isn't just nice to have, it's essential. It keeps your records straight for tax time and makes sure you're meeting all your legal obligations.

Your invoice is also a reflection of your brand. A tidy, easy-to-understand document tells your clients you’re organised and take your work seriously. This builds trust, encourages them to hire you again, and cuts out any confusion by clearly listing what you did, what your payment terms are, and giving their accounts team everything they need.

Staying on the Right Side of the ATO

Let's be clear: following the Australian Taxation Office (ATO) rules is non-negotiable. The ATO has very specific requirements for what makes a tax invoice valid, which is crucial for both you and your client when it comes to GST claims and tax records. If you get it wrong, you’re looking at delayed payments and potential compliance headaches.

Australia's freelance scene is massive, with over 4 million people making a living this way. For this huge chunk of the workforce, getting invoicing right is a core skill. The big one to watch? Under ATO rules, you must register for Goods and Services Tax (GST) if your yearly turnover hits $75,000. That makes compliant invoicing an absolute necessity. If you want to dive deeper, you can find out more about freelancer invoicing rules and best practices.

The Real Perks of Using a Template

Grabbing a ready-made freelance invoice template for Australia offers some fantastic, practical benefits that will immediately sharpen up your business operations.

- Saves a Ton of Time: No more building an invoice from scratch every single time you finish a job.

- Keeps Things Consistent: Every client gets a document with the same professional, polished look.

- Cuts Down on Mistakes: Templates have all the necessary fields laid out, so you're less likely to forget something critical like your ABN or the due date.

- Helps Your Cash Flow: When an invoice is clear, professional, and has explicit payment terms, clients are far more likely to pay it on time.

A great template is like a personal checklist, making sure you never overlook the details needed for fast payment and ATO compliance. It turns invoicing from a dreaded task into a quick, repeatable part of your process.

What Every Australian Freelance Invoice Must Include

Getting your invoice right isn't just about looking professional; it's about making sure it's legally compliant and gets you paid without any fuss. For Australian freelancers, a solid invoice is your best friend come tax time and keeps your relationship with the Australian Taxation Office (ATO) squeaky clean.

Let's walk through the absolute must-haves for every invoice you send. Think of these as the essential ingredients; miss one, and you risk delayed payments or a headache down the track.

Your Details and ABN

Right at the top, your client needs to see who they're paying. Make sure your business name (or your own name if you're a sole trader), logo, address, and contact details are clear and prominent. This is standard business practice, but it's also a legal must.

The most critical piece of information here is your Australian Business Number (ABN). It has to be on there, plain as day. If it's missing, your clients are legally obligated to withhold tax from your payment at the highest rate. That’s a massive hit to your cash flow you really want to avoid. I always recommend putting it right next to your business name so nobody can miss it.

Your Client’s Details (and Their ABN)

Equally important are your client's details. You'll need their full business name and address on the invoice. This simple step ensures it lands on the right desk and doesn't get lost in the shuffle, especially in a large company.

The ATO also has specific rules for bigger jobs. If your invoice totals $1,000 or more (including GST), you must include the client’s full name, business name, or their ABN. This is a non-negotiable tax invoice requirement that helps with clear identification and prevents any payment disputes. For a deeper dive, check out this complete guide to Australian freelancer invoicing.

Why a Unique Invoice Number Matters

A small detail that makes a huge difference is the unique invoice number. It’s more than just a random code; it's your primary tool for staying organised. A good numbering system helps you track who has paid, chase up late payments, and keep your books in perfect order. If the ATO ever audits you, a logical sequence of invoices shows you run a tight ship.

A simple sequential system works best.

- Start with a prefix that means something to you (like your initials or a business acronym).

- Add the year.

- Finish with a number that goes up with each invoice and resets at the start of the year.

For example, my first invoice of the year might be CW2024-001, then CW2024-002, and so on. It’s easy to manage, instantly tells you when the invoice was from, and looks professional.

The Two Dates Every Invoice Needs

To be valid, your invoice needs two key dates. These aren't just for show; they remove any confusion and set clear payment expectations from the get-go.

- Issue Date: This is simply the date you send the invoice. It officially starts the clock on the payment term.

- Due Date: This is the deadline for payment, based on the terms you've agreed on (e.g., Net 7, Net 14, Net 30).

Having both dates displayed clearly means there’s no guesswork for your client. It gives them a concrete deadline to work with, which is one of the simplest and most effective ways to encourage prompt payment and keep your cash flow healthy.

How to Correctly Handle GST on Your Invoices

Let’s be honest, tax is rarely the most exciting part of being a freelancer in Australia. Getting your head around the Goods and Services Tax (GST) can feel like a chore, but it’s absolutely essential for keeping your business compliant and your cash flow healthy. Nailing it on your invoices from the get-go saves a world of confusion for your clients and keeps the ATO happy.

The magic number you need to remember is the $75,000 turnover threshold. If your freelance business hits this figure (or you expect it to) within any 12-month period, the law says you must register for GST. Once you're registered, you'll need to start adding GST to your taxable services.

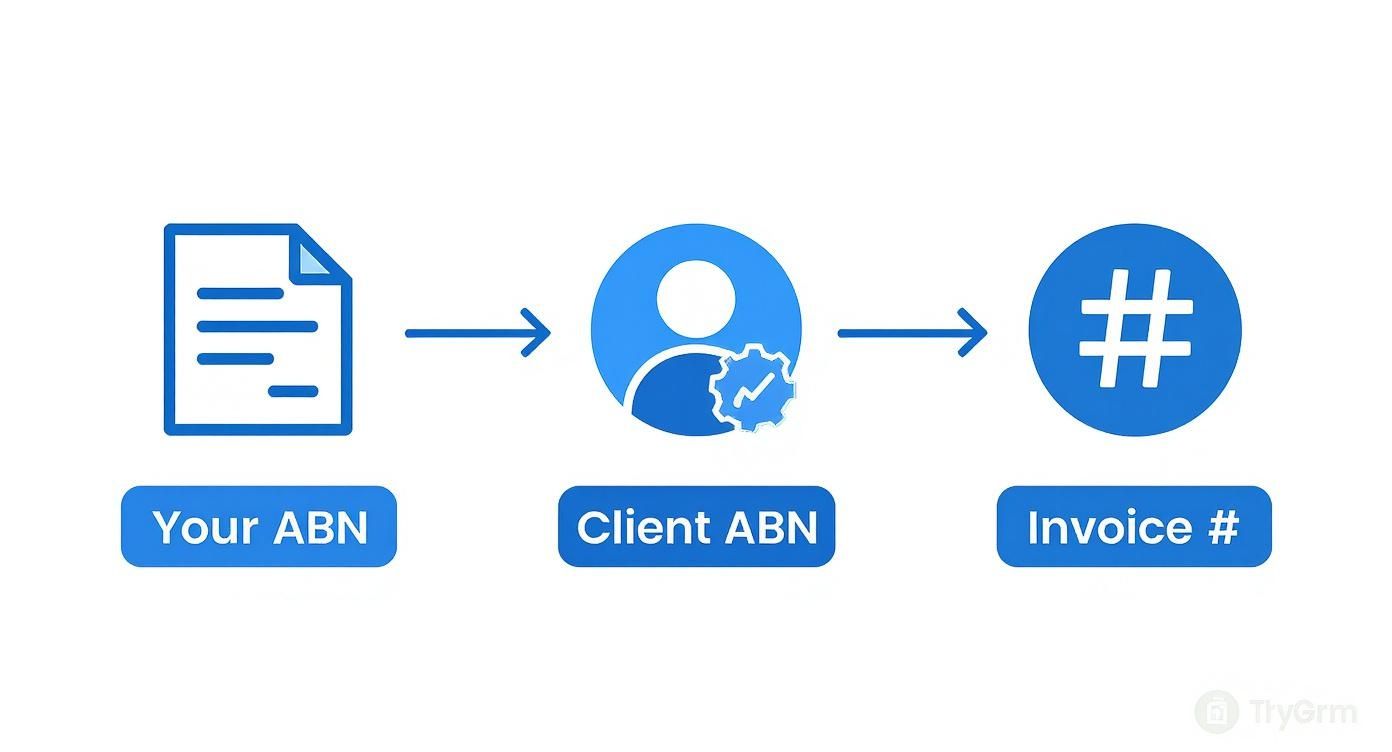

This quick diagram shows how the whole process fits together, starting with your ABN.

As you can see, having your ABN and your client’s ABN on the invoice, along with a unique invoice number, is the bedrock of a professional, trackable document.

Calculating and Adding GST to Your Invoice

Okay, so you're registered for GST. Now what? You need to add 10% to your total fee. The crucial part is making this crystal clear on the invoice itself. A single, vague total figure is a recipe for questions and payment delays.

Your invoice must explicitly show the GST amount. You've got a couple of common options here:

- List it per line item: Useful if you've provided several different services and want to show the GST for each one.

- Show a single total: This is the most common approach. Just add up the subtotal for all your work, then add a separate line for the total GST before showing the final grand total.

Let's say you finished a project and your fee is $2,000. The GST is simply $200 (10% of $2,000), which brings the total amount payable to $2,200. For your invoice to be considered a valid tax invoice, you have to show this breakdown. For a deeper dive into the specifics, check out our guide on the Australian GST invoice template.

Pro Tip: To be ATO-compliant, your document must clearly state the words "Tax Invoice", show your ABN, and list the GST amount. You can show it as a separate line item or simply state "Total price includes GST".

Invoicing When You Are Not Registered for GST

But what if you're just starting out and your turnover is well below the $75,000 threshold? Many freelancers are in this boat, and in this case, you must not charge GST. It shouldn't even be mentioned on your invoice as a charge.

The problem is, just leaving it off can sometimes cause confusion. A larger company's accounts department might see the omission and assume GST is included, which can lead to unnecessary back-and-forth emails.

A simple note at the bottom of your invoice is the best way to avoid this. It’s a tiny detail that can prevent a lot of headaches.

Wording to Use If You're Not GST-Registered:

- "No GST has been charged on this invoice."

- "Price does not include GST."

- "GST is not applicable."

This little clarification looks professional and gives the client's finance team everything they need. It shows you know your tax obligations and are invoicing correctly, which helps build trust and gets you paid faster.

Getting Your Payment Terms Right to Avoid Delays

Sending an invoice should feel like crossing the finish line of a project. But for far too many Australian freelancers, it’s just the start of a long, frustrating wait. Your best line of defence isn't chasing clients; it's setting crystal-clear, professional payment terms from the very beginning.

Think of these terms as the rules of engagement for your business. They aren’t just polite suggestions; they’re what protect your cash flow and keep your business healthy.

Getting paid on time is, without a doubt, a huge challenge. Late payments are a chronic issue for freelancers and small businesses right across Australia. Just how bad is it? In some sectors, over 95% of small business invoices are paid after 60 days or more, well beyond typical terms. The average invoice for a freelancer often isn't settled for 37 days, with many stretching out to 56 days. You can dig into the data yourself in these Australian payment time reports.

This is exactly why your invoice terms, backed up by a solid contract, are non-negotiable. They establish a firm, professional expectation right out of the gate.

Choosing Your Freelance Payment Terms

Deciding whether to state "Net 7" or "Net 30" on your invoice isn't a random choice. It’s a strategic decision that depends on the project size, your relationship with the client, and, most importantly, your own cash flow needs. Shorter terms get money into your bank account faster, which is great for new clients. Longer terms might be a necessary evil for bigger corporate clients who are stuck in rigid payment cycles.

To help you decide what’s right for each situation, here’s a look at the most common options.

Choosing Your Freelance Payment Terms

A comparison of common payment terms, outlining the pros and cons of each to help freelancers choose the best option for their business.

| Payment Term | Best For | Potential Risks |

|---|---|---|

| Net 7 (Due in 7 days) | Quick projects, new clients where trust is still being built, or when you need to improve immediate cash flow. | Can feel a bit aggressive for large corporate clients who have slower, fixed payment schedules. |

| Net 14 (Due in 14 days) | A great middle-ground. It feels professional and is reasonable for most small-to-medium businesses. | Might still be a touch too quick for large organisations that only run accounts payable once a month. |

| Net 30 (Due in 30 days) | The standard for bigger companies, long-term clients, and ongoing retainer agreements. | Puts a real strain on your cash flow. You're effectively financing their business for a full month. |

| Due on Receipt | Perfect for small, one-off jobs or the final payment on a project that’s been delivered and signed off. | Can be impractical for clients who need a few days for internal processing and approvals. |

The most important takeaway here is to discuss and agree on these terms before you start any work. That bit of transparency upfront saves a world of awkward conversations down the line.

Your payment terms are not just a line on an invoice; they are a fundamental part of your business agreement. Make them clear, fair, and non-negotiable from the start to build respectful client relationships.

Your Invoice Is a Request; Your Contract Is an Agreement

While your invoice clearly states your terms, it’s your contract that makes them legally binding. Before a project kicks off, make sure your client agreement explicitly details the payment schedule, due dates, and any consequences for late payments. That document is your safety net if a dispute ever arises.

By including a simple line like "Payment due Net 14 from invoice date" in the signed contract, you’ve turned a polite request into a binding obligation.

Practical Steps to Get Paid Faster

Beyond setting clear terms, you can be proactive in encouraging prompt payments. Honestly, one of the most effective strategies is to simply make it easy for them to pay you.

Offer multiple payment options right on your invoice:

- Bank Transfer: Always include your BSB and Account Number.

- Credit Card: Use a payment gateway like Stripe to let them pay online instantly.

- PayPal: A familiar and easy option for many clients.

The more convenient you make it, the fewer excuses clients have for delays. Another crucial step is to have a system for follow-ups. Don't be shy about sending a polite reminder the day an invoice is due. Our guide on how to send an invoice has some great templates and tips for these messages.

Often, a gentle nudge is all it takes to get an overdue invoice paid. A simple, friendly message maintains a good client relationship while reminding them of their obligation, ensuring you get paid for your hard work without the stress.

Invoice Examples for Common Freelance Scenarios

It's one thing to talk about what goes on an invoice, but seeing how it plays out in the real world makes all the difference. Staring at a blank freelance invoice template for Australia can be intimidating, so let's walk through a few practical examples to show you how to structure things.

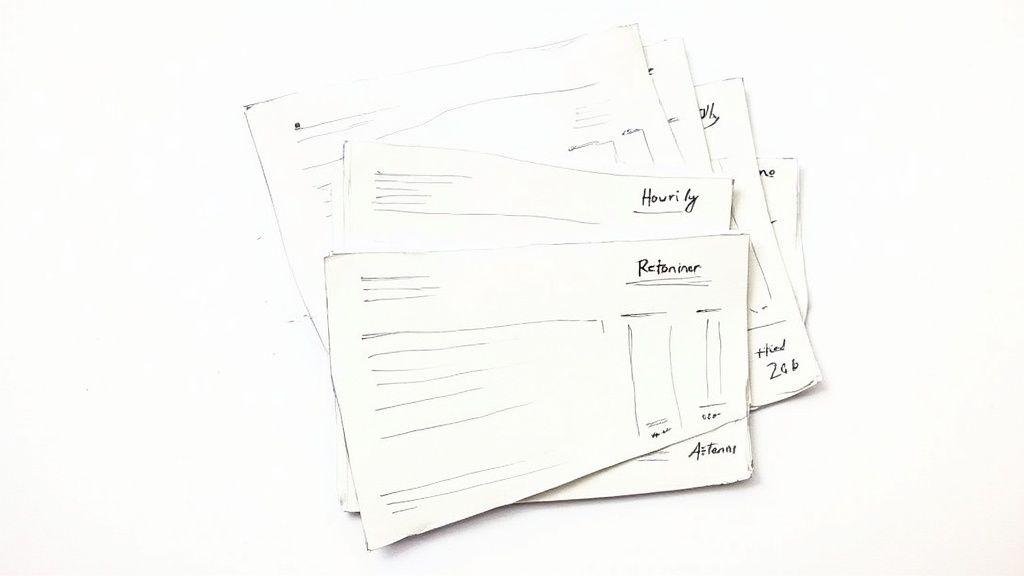

We'll look at the three most common ways freelancers charge: by the hour, a fixed project fee, and a monthly retainer. Each one needs a slightly different approach to keep things crystal clear for your client and get you paid without any back-and-forth.

The Hourly Rate Invoice

This is classic territory for consultants, developers, and many creative professionals. When you’re billing for your time, transparency is your best friend. Your client wants, and deserves, to see a clear breakdown of where their money is going.

A single, vague line item like "Design Work" is a red flag for clients and a sure-fire way to delay payment. You need to itemise your time against specific tasks. It’s not about justifying your work; it’s about demonstrating the value you delivered.

For instance, a graphic designer’s invoice might break down the hours like this:

- Initial Client Consultation & Briefing: 1.5 hours @ $120/hr

- Logo Concept Development (3 options): 6 hours @ $120/hr

- Client Feedback & Revisions (Round 1): 2 hours @ $120/hr

- Final Logo Asset Delivery: 0.5 hours @ $120/hr

See how much clearer that is? It gives the client a complete picture of the process, making them feel confident about hitting 'approve' on the payment.

The Fixed Fee Project Invoice

When a project has a well-defined scope, like a website build or a copywriting package, a fixed fee makes sense for everyone. You agree on the price upfront, and the invoice simply reflects that amount.

Even though you aren't itemising hours, you still need to spell out exactly what you delivered. This is your chance to remind the client of the total value they received for the agreed-upon price.

A copywriter invoicing for a three-article package could frame it this way:

- Service: SEO Blog Post Package (3 x 1,500-word articles)

- Description: As per our agreement, this includes topic research, keyword analysis, writing, two rounds of revisions, and sourcing royalty-free images for each article.

- Total Project Fee: $1,800.00

This keeps the invoice tidy while reinforcing the full scope of work you knocked out of the park.

The Monthly Retainer Invoice

Retainers are fantastic for predictable income, especially if you offer ongoing services like social media management or SEO. You’re typically invoicing a set fee at the beginning of the month for a specific block of work.

The most important detail here is to clearly state the service period the invoice covers. It seems obvious, but forgetting this can cause confusion about which month's work is actually being paid for.

Here’s what a social media manager’s retainer invoice might include:

- Service: Social Media Management Retainer

- Description: Services for the period of 1 July 2024 - 31 July 2024. Includes content calendar creation, daily posting on Instagram and Facebook, community management, and a monthly performance report.

- Monthly Retainer Fee: $2,500.00

A great invoice is more than just a bill. It’s a professional summary of the value you delivered and often the final touchpoint for a project, leaving a lasting positive impression.

These examples should give you a solid starting point for adapting your freelance invoice template in Australia to just about any job. If you want to dive deeper, our complete guide on invoicing for freelancers is packed with more tips to help you perfect your entire process.

Got Questions About Freelance Invoicing? We’ve Got Answers

Even with the best invoice template in hand, freelancing in Australia throws up some curly questions. What happens if you forget your ABN? Do you need to charge GST to a client in London? Let's clear up some of the most common invoicing headaches you might run into.

What Happens If I Forget My ABN on an Invoice?

Leaving your Australian Business Number (ABN) off an invoice is one of those small mistakes that can have a huge impact on your cash flow. It's a surprisingly common slip-up, but the consequences are serious.

Under the ATO’s 'No ABN withholding' rule, if your client receives an invoice from you without an ABN, they are legally required to withhold tax from your payment at the highest possible rate - a whopping 47%.

You can eventually claim that money back when you lodge your tax return, but that could be months away. In the meantime, getting paid less than half of what you’re owed can put a massive, often crippling, dent in your business's finances. Make it a habit to check for your ABN every single time before you hit send.

My advice? Put your ABN right at the top of your invoice, next to your business name. Make it impossible for you or your client to miss. This simple check protects your income and keeps your cash flow healthy.

Do I Charge GST for International Clients?

This is a big one for freelancers with clients based overseas. The short answer is: usually, no.

For the most part, services provided to a client who isn't in Australia are considered a 'GST-free' export. So, even if you’re registered for GST, you won't add the standard 10% to invoices for your international clients.

To keep the ATO happy, your invoice should clearly state the client's international address. This acts as proof that the service was 'exported'. But remember, international tax rules can get complicated depending on the type of service you provide and the client's country.

When in doubt, have a quick chat with your accountant. A five-minute conversation can save you a lot of stress and potential tax issues down the line.

How Long Should I Keep My Freelance Invoices?

Solid record-keeping is non-negotiable when you're running a business. The Australian Taxation Office (ATO) is very clear on this: you need to hang onto all your business records, including copies of invoices you've sent and bills you've paid, for a minimum of five years.

That five-year clock starts ticking from the date you lodge your tax return for that financial year, not the date on the invoice itself. Storing them digitally is the easiest way to stay organised.

- Go Digital: Save PDF copies of every invoice in a dedicated folder on a cloud service like Google Drive or Dropbox.

- Always Back Up: Make sure you have a backup of your digital files. A hard drive failure shouldn't mean losing all your financial records.

- Be Audit-Ready: Having these records neatly organised makes life much easier if the ATO ever comes knocking for an audit.

Can I Charge a Late Fee on an Overdue Invoice?

Yes, you absolutely can charge a late fee on an invoice in Australia, but there’s a catch. You can only do it if the client agreed to it upfront.

This means your policy on late fees must be clearly outlined in the contract, service agreement, or proposal they signed before you started the work. You can’t just decide to add a fee later on because a payment is overdue.

If you have this clause in your agreement and a client pays late, you'll need to issue a new, updated invoice. This should clearly itemise the original amount and the added late payment fee. Keep the fee reasonable - it’s meant to cover the admin time you spend chasing them, not to be a massive penalty.

Ready to stop wrestling with templates and manual follow-ups? Payly brings smart invoicing, time tracking, and e-signatures together in one place, built specifically for Australian freelancers and small businesses. It can turn your tracked hours into a professional invoice automatically, helping you get paid faster. Start your free trial at https://www.payly.com.au and see how simple your business admin can be.

Payly Team

Sharing insights and strategies to help service businesses thrive. Follow Payly for more tips on time tracking, invoicing, and business operations.

Related Articles

Ready to streamline your business?

Join thousands of freelancers and agencies who use Payly to track time, send invoices, and get paid faster.