Ultimate Guide: how to improve cash flow for Australian agencies

Discover how to improve cash flow with practical steps for Australian agencies and freelancers. Master invoicing, expenses, and forecasting to boost stability.

Payly Team

January 4, 2026

To get a handle on your cash flow, you need a two-pronged attack: speed up the money coming in and get smarter about the money going out. This means tightening up your invoicing, keeping a firm grip on spending, and building a solid financial forecast so you can make decisions with confidence, not just react to nasty surprises.

The Cash Flow Crunch for Aussie Creatives

For anyone running a freelance gig, an agency, or a service-based business in Australia, cash flow isn't just accounting jargon. It's the fuel in your engine. It's what lets you pay your team, invest in better software, and actually grow the business. When cash is flowing well, you can confidently chase bigger clients and think about the future.

But when it's tight, every decision feels like it’s made under pressure. You might find yourself putting off supplier payments, scrambling to pay super on time, or leaning on the overdraft just to make payroll. This isn't just some worst-case scenario; it’s a daily reality for a lot of great businesses.

The Aussie Market Can Be Tough Going

This problem is particularly sharp in creative and professional services. Our work is often project-based, which can create a lumpy, unpredictable income stream. One month you're celebrating a huge payment, the next you're wondering where the next dollar is coming from. This feast-or-famine cycle makes it incredibly hard to plan ahead.

And you're definitely not alone. A recent CommBank survey revealed that nearly 80% of Australian small to medium businesses hit cash flow bumps last year. For 35% of them, falling revenue was the main issue, but low cash reserves and seasonal lulls were also major headaches.

These stats tell a clear story: this is a shared struggle. Knowing what the common pressure points are is the first step to building a business that can weather the storms.

The root of most cash flow problems isn't a lack of profit. It's the timing gap, the painful delay between when you earn the money and when it finally lands in your bank account.

Spotting the Red Flags in Your Own Business

Before you start fixing things, you need to know what’s broken. A good diagnosis will show you exactly where the cash is leaking out.

What are the tell-tale signs of a cash flow problem? They often look like this:

- Living on credit: Are you constantly reaching for the business credit card or using the overdraft to cover normal expenses like rent or software subscriptions?

- Paying others late: Finding yourself consistently stretching payment terms with your own suppliers, contractors, or even the ATO?

- Missing growth opportunities: Have you had to say no to hiring someone great or buying that piece of equipment you desperately need because the funds just aren't there?

- Dreading payroll day: That sinking feeling when payroll is looming, just hoping enough invoices clear in time to cover everyone's wages.

Seeing these signs isn't a mark of failure. Think of it as an early warning system. It's your chance to get strategic and take back control of the money moving through your business. Let’s dive into how you can do just that.

Streamline Your Invoicing to Get Paid Faster

Let’s be honest: the biggest handbrake on your cash flow is almost always the time it takes to get paid. Waiting 30, 60, or even 90 days for a client payment can feel like running a marathon where the finish line keeps moving further away. This isn't just an annoyance; it’s a direct threat to your ability to pay your team, cover overheads, and actually grow the business.

The fix is to stop treating invoicing as a painful admin task and start seeing it as a critical part of your cash flow strategy. A smarter system doesn't just chase late payments; it stops them from happening in the first place. It’s all about being proactive, clear, and making it ridiculously easy for your clients to pay you.

Set Clear Expectations from Day One

The best way to guarantee prompt payment is to establish the rules before any work even begins. Ambiguity is the enemy of healthy cash flow. If your payment terms are fuzzy or buried deep in a long contract, you’re just setting yourself up for delays and awkward conversations later on.

Your proposals and service agreements need to be absolutely watertight on the financial side. This means spelling out:

- Payment Due Dates: Forget vague terms like "Net 30." Be specific. Use clear language like "Payment due within 14 days of invoice date."

- Upfront Deposits: For any significant project, requiring a 30-50% deposit before you start is standard practice. It’s not just about cash flow; it’s a powerful way to secure client commitment and protect your initial investment of time and resources.

- Late Payment Fees: A simple clause outlining interest on overdue accounts isn't aggressive; it’s professional. It sets a clear boundary and gives clients a compelling reason to pay on time.

Using tools with e-signatures for proposals is a genuine game-changer here. It lets clients approve the work and agree to your terms with a single click, cutting out the old-school delays of printing, signing, and scanning. This one change can shave days, sometimes weeks, off the project start, which means you get to the invoicing stage that much faster.

Make Paying You Effortless

Think about your own online shopping habits. You’re far more likely to buy something if the checkout is simple and offers your preferred payment method. The exact same logic applies to your business invoices. The easier you make it for clients to pay, the faster that money will hit your account.

Every bit of research on this shows that businesses offering modern, online payment options get paid substantially faster, sometimes on the very same day the invoice is sent. Your mission is to remove every single piece of friction standing between your client receiving your invoice and you receiving their money.

Offering multiple, convenient payment methods isn't just a "nice-to-have" for clients. It's a core cash flow strategy. By accepting credit cards, direct debit, or using payment gateways like Stripe, you can shrink the payment cycle from weeks to days, or even hours.

Automate Your Follow-Up Process

Chasing late invoices is, without a doubt, one of the most soul-destroying tasks for any agency owner or freelancer. It's awkward, it’s a time-suck, and it pulls you away from doing the high-value work you actually enjoy. This is where automation becomes your best friend.

Modern invoicing software can send out polite, professional payment reminders on your behalf, completely automatically. You can set up a simple schedule that does the heavy lifting for you, something like:

- A friendly heads-up 3 days before the due date.

- A firm reminder on the day the invoice is due.

- A more direct follow-up 7 days after the due date.

This systematic approach means no invoice ever slips through the cracks. It professionalises your collections, takes the emotion out of it, and ensures follow-ups happen consistently, even when you're swamped. If you need to brush up on the fundamentals, a solid guide on how to send an invoice can help you structure these communications effectively.

Connect Time Tracking Directly to Invoicing

One of the sneakiest ways service businesses lose money is through "revenue leakage." This is the money that simply vanishes when billable hours aren’t captured properly and, as a result, never make it onto an invoice. All those "quick" 15-minute phone calls and small revisions add up, easily costing you thousands of dollars in lost income every year.

Integrating your time tracking software directly with your invoicing platform plugs these leaks for good.

When every minute your team spends on a project is automatically logged against the right client, you can generate a perfectly detailed and accurate invoice in just a couple of clicks. This doesn't just guarantee you get paid for all your work; it gives clients a transparent breakdown of the costs, which reduces questions and payment disputes. It turns time from an abstract concept into a tangible, billable asset that directly boosts your bottom line.

Master Your Spending and Plug Financial Leaks

Getting more cash in the door is only half the battle. To really get a grip on your cash flow, you need to be just as strategic about what’s going out. This isn’t about a painful, slash-and-burn cost-cutting mission; it's about making sure every dollar you spend is pulling its weight, not just disappearing into a black hole of inefficiency.

So, let's skip the generic "cut costs" advice. A much smarter way forward is to systematically audit your spending to find real, sustainable savings without kneecapping your growth. When you know exactly where your money is going, you can make sharp decisions that give your bottom line a healthy boost.

Conduct a Ruthless Expense Audit

First things first: you need a brutally honest picture of where your cash is flowing. This means digging into your bank statements and accounting software, line by line. Go through and categorise everything, from the big-ticket items like rent and payroll down to that forgotten software subscription.

As you comb through it all, ask two simple but powerful questions for each expense:

- Is this essential? Does this cost directly help us make money or keep the lights on?

- Is there a better way? Can we get the same (or better) value for less, or from a different supplier?

You’ll be amazed at what this exercise uncovers. It’s often the small, forgotten costs, like services you no longer use or auto-renewing subscriptions, that add up to a significant drain.

Tame the Subscription Bloat

For most modern agencies and freelancers, "subscription bloat" is a real and constant cash leak. It happens almost without you noticing. You sign up for a collection of different apps for different jobs, and before you know it, you’re bleeding cash on a dozen small monthly fees.

Sound familiar? It’s common to find yourself paying separately for tools that handle:

- Time Tracking: A must for capturing every billable minute.

- E-Signatures: For getting proposals and contracts signed off fast.

- Invoicing: The crucial last step to actually getting paid.

- Cloud Storage: To share project files with clients and the team.

Consolidating multiple single-purpose tools into an all-in-one platform is one of the fastest ways to slash your monthly software spend. Look for predictable, account-based pricing that doesn't penalise you with per-user fees as your team grows. It's a clear financial win.

When you bring functions like invoicing and time tracking together, you also get a massive efficiency boost. Imagine automatically turning tracked hours into a ready-to-send invoice without touching a spreadsheet. Getting this right is critical, and you can learn more about its importance in our guide on tracking employee time.

Negotiate Better Terms with Suppliers

Your relationships with suppliers and vendors are another goldmine for cash flow improvements. Don't be shy about starting a conversation to negotiate better terms. This doesn't always have to be about a lower price, though it’s always worth asking.

Consider negotiating longer payment terms. For instance, shifting from a 14-day to a 30-day payment cycle on a recurring expense instantly gives you an extra 16 days to hold onto your cash. That simple change can make a huge difference in your day-to-day liquidity, and it often costs your supplier nothing.

Even tiny improvements to your income-to-expense ratio add up. The Westpac Business Cashflow Gauge, which tracks these ratios for Australian businesses, recently climbed 0.4% in a single quarter, showing just how resilient local firms are. This small jump proves why every freelancer and agency needs to use every tool in their arsenal to manage outflows. You can read more about these Australian business cash flow trends on Westpac.com.au.

Ultimately, optimising what goes out is fundamental to preventing those frustrating cash leaks. For more ideas, you can explore strategies to reduce your business tax bill as well. By plugging these holes, whether from too many subscriptions or less-than-ideal supplier terms, you free up capital to reinvest in growth, build a cash buffer, or simply take home as profit.

Building a Reliable Cash Flow Forecast

Constantly putting out financial fires is exhausting. It leaves you feeling stressed, makes your business feel unstable, and stops you from making the bold, forward-thinking decisions needed to grow. The best way to break this reactive cycle is to start anticipating what’s coming with a cash flow forecast you can actually trust.

A forecast isn't about gazing into a crystal ball. It’s a practical tool that uses your own business data to map out your likely income and expenses over the next three to six months. This visibility is the secret sauce to better cash flow management because it flags potential problems while you still have plenty of time to do something about them.

Start with What You Already Know

You're sitting on a goldmine of data. Your time tracking and invoicing software aren't just for admin; they hold the keys to building an accurate forecast. You don’t need complex financial models to get started, just the basics.

Pull together your financial data from the past six to twelve months. The goal is to map out a few key things:

- Recurring Income: List all your retainer clients and any other guaranteed monthly income. This is your financial bedrock, the predictable cash you can count on.

- Projected Project Income: Look at your pipeline. What's been signed off? What’s a near certainty? Give each project a realistic value and an expected payment date.

- Fixed Expenses: These are the easy ones. Think rent, software subscriptions, insurance, and salaries for your permanent staff. These costs rarely change month-to-month.

- Variable Expenses: These are the costs that move around, like contractor payments, project-specific software licences, or ad spend. Look at past averages to make an educated guess for the months ahead.

Just by plotting this on a simple spreadsheet or using forecasting software like Float or Cash Flow Frog, you’ll get a baseline view of your future cash position. This simple act alone can instantly highlight a looming shortfall or a period where you'll have extra cash on hand.

Plan for Different Scenarios

This is where your forecast goes from being a report to a strategic weapon. Business is never a straight line, so running a few "what-if" scenarios helps you prepare for the bumps and opportunities along the way.

Start with your baseline forecast, what you think is most likely to happen. Then, create two more versions:

- A "Worst-Case" Scenario: What happens if that big client pays 30 days late? Or if that new project you were banking on gets delayed? This isn't about being negative; it's about stress-testing your finances to find the breaking points.

- A "Best-Case" Scenario: What if you land that massive project you just pitched? What if a client decides to pay for the whole year upfront? This helps you plan for growth, showing you exactly when you might have the cash to hire someone new or invest in that big software upgrade.

Running these scenarios transforms your forecast from a static document into a dynamic decision-making tool. It gives you the clarity to know whether you need to build a bigger cash buffer or if you’ve got the green light to invest.

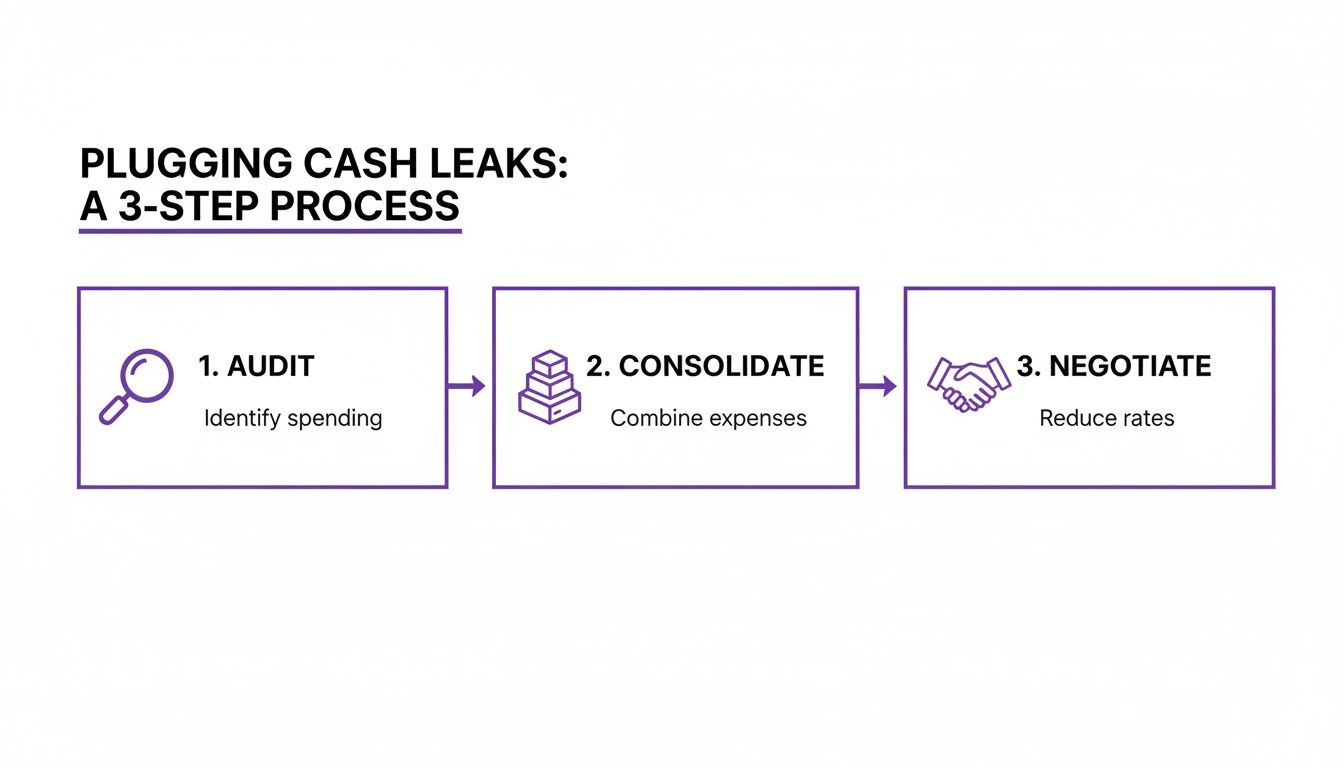

Once you have a handle on forecasting, you can focus on plugging any leaks you find.

This process of auditing where money is going, consolidating where you can, and negotiating better terms is fundamental to maintaining healthy cash flow.

Make Forecasting a Regular Habit

A forecast is completely useless if it’s gathering dust in a folder somewhere. For it to work, it has to be a living document that’s part of your regular financial rhythm.

Set aside a bit of time each month to update it with your actual income and expenses. This monthly check-in is crucial for two reasons. First, it keeps your forecast accurate and relevant. Second, it lets you compare your predictions to reality, which makes your future forecasts even sharper.

Did that project take way longer than you thought? Were contractor costs higher than you budgeted for? Every review is a chance to learn and get better. Over time, this habit will give you a powerful, intuitive feel for the financial pulse of your business, making it one of the most effective tools you have for building a more resilient and stable agency.

Your Australian Cash Flow Toolkit

Theory is one thing, but cash in the bank is what keeps the lights on. Let's pull all these strategies together into a practical toolkit specifically for Australian service businesses. We'll focus on the tools and processes that genuinely move the needle on your bottom line.

The hardest part of improving any part of your business is just getting started. The secret is to begin with small, manageable tweaks that give you an immediate win. That momentum is what builds a truly resilient financial system over time.

Why Local Tools Are a Game-Changer

For Aussie businesses, using tools that understand how we work isn't just a nice-to-have, it's essential. This goes beyond supporting local tech; it's about making compliance and accuracy effortless, saving you from a world of administrative pain down the track.

The right platform just gets the uniquely Australian parts of doing business, so you don't have to think twice.

What should you look for?

- Seamless Xero and MYOB Integrations: This is non-negotiable. Your core operational software must sync perfectly with your accounting system. It keeps your financial data bang up-to-date and makes reconciliation a walk in the park.

- Automatic GST Calculation: Manually adding GST to every single invoice is asking for trouble. Look for tools that automatically apply the correct 10% GST, keeping you on the right side of the ATO without any extra effort.

- AUD as the Default: You shouldn't have to select Australian dollars every time you create an invoice. This simple feature prevents silly currency conversion mistakes and provides total clarity for your local clients.

Choosing the right software is one of the most important first steps. A platform that combines several functions into one doesn't just save you money on subscriptions; it saves you a massive amount of time. If you’re weighing up your options, our deep dive into the best invoicing software in Australia is a great place to start.

Your Action Checklist: What to Do This Week

Want to make a real impact on your cash flow, right now? Here’s a short-and-sharp list of high-impact actions you can take this week. Just pick one or two to focus on and watch what happens.

1. Switch on Your First Automated Invoice Reminder

If you're still chasing payments manually, stop. This is your number one priority. Jump into your invoicing software and set up a polite, simple reminder that automatically pings your client three days before an invoice is due. This one change can slash your late payments.

2. Run a 15-Minute Subscription Audit

Grab your latest bank statement and a highlighter. Go through and mark every recurring software subscription. Ask the simple question: "Have I actually used this in the last month?" If the answer's no, cancel it. You'll be amazed at how much you can save. It's often a few hundred dollars hiding in plain sight.

3. Tweak Your Payment Terms

Open your standard proposal or contract template and make one tiny change. If your terms are "Net 30," change them to "Net 14." It’s a simple adjustment that completely resets client expectations from day one and can literally halve your average payment time.

4. Add an Online Payment Option

If you only offer bank transfers, you’re creating friction. You're making it harder for people to give you their money. Integrate a payment gateway like Stripe so clients can pay by credit card straight from the invoice. The small transaction fee is a tiny price to pay for getting your cash in the door weeks earlier.

When to Think About Short-Term Financing

Even with the best systems, cash gaps can still pop up. It happens. A major client pays late, or an exciting new project lands that needs a big upfront investment in people or tools.

In these moments, short-term financing can be a strategic lever to pull, not a sign of failure.

For businesses that need a quick injection of funds to cover payroll or jump on a growth opportunity, options like cash flow lending can be incredibly effective. Unlike traditional bank loans, these products often look at your consistent revenue, not just your assets. This guide on Cash Flow Lending for Businesses provides a great overview of what's out there.

By combining smarter internal processes with the right tools and resources, you create a financial foundation that can weather any storm. This toolkit isn’t about achieving perfection overnight. It’s about making small, consistent improvements that put you back in control of your financial destiny.

Your Top Cash Flow Questions, Answered

We’ve walked through the nuts and bolts of improving your cash flow, from overhauling your invoicing to getting a firm grip on your expenses. Now, it's time to tackle the questions I hear most often from agency owners, freelancers, and consultants across Australia. These are the real-world sticking points that pop up when you start putting theory into practice.

Getting these right can be the difference between spinning your wheels and confidently moving your business forward.

How Often Should I Really Be Checking My Cash Flow?

For most service businesses, a quick weekly check-in is the perfect rhythm. This doesn't have to be some epic, two-hour session in a spreadsheet. Honestly, a focused 15-20 minutes is all it takes to review your bank balance, see what bills are due, and check which invoices should be landing soon. This simple habit helps you catch small issues before they snowball.

Then, once a month, you'll want to do a more thorough review. This is where you sit down, update your cash flow forecast, see how your actual numbers stacked up, and make those bigger-picture decisions for the coming quarter. It’s about staying on top of the day-to-day while still planning for the future.

I always tell my clients to think of it this way: your weekly check is like a quick glance at the ship's wheel to stay on course. The monthly review is when you pull out the charts to make sure you’re still heading for the right island.

What's the Best Way to Deal with a Client Who Always Pays Late?

Ah, the million-dollar question. It's a frustratingly common scenario, but you’ve got more leverage here than you might think. The trick is to have a clear, pre-defined process that protects your bottom line without having to go nuclear straight away.

First, let your systems do the heavy lifting:

- Automated Reminders: This is your first line of defence. Let your software send the polite-but-firm follow-ups. It’s professional, consistent, and takes the emotion out of it.

- A Personal Call: If the automated nudges are ignored, it's time for a direct phone call. It’s amazing how often a simple, "Just checking you received the invoice and everything is okay?" can solve the problem.

If the lateness becomes a pattern, you need to escalate. That means enforcing the terms in your contract. Don't be afraid to pause all work until the account is settled. And for any future projects with that client? Make a 50% upfront deposit your new, non-negotiable standard. It’s a simple way to protect yourself.

Is It Better to Have More Clients, or Fewer, Higher-Paying Ones?

This is the classic "all your eggs in one basket" dilemma. While there's no single right answer for every business, for rock-solid cash flow, a balanced, hybrid approach usually wins out.

Putting all your faith in one or two huge clients is a massive risk. If one of them suddenly pulls their project or goes through a tough patch, you’ve got a catastrophic hole in your revenue. On the flip side, trying to manage dozens and dozens of tiny clients can become a huge administrative headache, spreading you too thin.

The sweet spot for most agencies I've worked with is a diversified client mix. This usually looks like having a couple of key "anchor" clients on retainers who provide that predictable, recurring income. This is then supplemented with a healthy mix of smaller, project-based clients. This setup gives you stability without making you vulnerable if any single client walks away.

Ready to stop juggling multiple apps and start managing your business operations in one place? Payly combines time tracking, smart invoicing, and e-signatures into a single, powerful platform built for Australian businesses. See how you can get paid faster and simplify your workflow. Start your free 14-day trial today at Payly.

Payly Team

Sharing insights and strategies to help service businesses thrive. Follow Payly for more tips on time tracking, invoicing, and business operations.

Related Articles

Ready to streamline your business?

Join thousands of freelancers and agencies who use Payly to track time, send invoices, and get paid faster.