The 12 Best Practice Management Software Australia for 2026

Discover the best practice management software Australia has to offer. Compare top tools for agencies, legal, and health to streamline your operations.

Payly Team

February 13, 2026

Running a service-based business in Australia means constantly juggling clients, projects, billing, and compliance obligations. The right software can transform this operational chaos into a streamlined, organised, and profitable engine. Finding that perfect fit, however, can be a significant challenge. Many popular platforms are built for overseas markets, lacking essential Australian features like correct GST handling, seamless integrations with local banks, and state-specific compliance tools.

This guide is designed to cut through the marketing noise and simplify your decision. We have meticulously analysed the 12 best practice management software Australia has to offer, focusing on real-world applications for a range of local businesses. Whether you are a freelancer, a growing digital agency, a professional services firm, or an allied health clinic, this resource will help you find the ideal solution for your specific needs.

Many practice management solutions integrate deeply with core financial platforms. To understand the options for these foundational tools, see our guide to the best accounting software for small business Australia.

We dive deep into crucial features, transparent pricing (in AUD, of course), and the practical considerations that matter most to Australian operators. Each review includes screenshots, direct links, and an honest assessment of both strengths and limitations. Our goal is simple: to provide a clear, actionable comparison that helps you select the platform that will save you time, eliminate administrative headaches, and ultimately help you get paid faster.

1. Payly

Best for Australian freelancers, agencies, and SMBs seeking an all-in-one, cost-effective operations platform.

Payly distinguishes itself in the Australian market by consolidating essential business functions into a single, cohesive platform. It's purpose-built for service-based businesses that need to replace a disjointed stack of specialised tools for time tracking, invoicing, document management, and e-signatures. This integrated approach is designed to eliminate the common pain points of data silos, duplicate entry, and the administrative burden of managing multiple software subscriptions.

Key Features and Australian Focus

Payly’s standout feature is its account-based pricing model, which charges a flat monthly fee per account rather than per user. This offers predictable billing and significant cost savings for growing teams, a stark contrast to the escalating per-seat fees common with competitors. For example, the Professional plan covers up to 10 users for just $49 per month.

The platform's deep integration with the Australian business landscape makes it a strong contender for the best practice management software Australia has to offer. Key AU-centric features include:

- Built-in Compliance Tools: GST and fuel tax credit calculators simplify tax obligations.

- Localised Calendars: Australian working-day calendars and state-specific public holiday schedules are pre-loaded, ensuring accurate project planning and timesheet management.

- Local Integrations: Seamless connections with Xero, MYOB, and QuickBooks ensure your financial data stays synchronised with local accounting standards.

Beyond specific services like Payly, many practice management platforms integrate with various payment gateways. A comprehensive understanding of your options can help streamline your billing process. Discover key factors for choosing a payment gateway in Australia.

Security and Practical Use Cases

Security is a cornerstone of the platform, featuring bank-level encryption and legally binding PDF e-signatures complete with cryptographic audit trails. This makes it particularly suitable for professional services like legal and accounting firms that handle sensitive client information. For digital agencies and consultancies, the workflow is seamless: track billable hours, convert them into branded invoices, and send them for client approval in one unified system.

Website: https://www.payly.com.au

| Feature | Details |

|---|---|

| Pricing Model | Account-based (not per-user). Free tier available. Paid plans from $49/month for 10 users. |

| Core Functions | Time Tracking, Invoicing, E-Signatures, Document Management, Onboarding. |

| Key Integrations | Xero, MYOB, QuickBooks, Stripe, Zapier, Google Drive. |

| Australian Features | GST tools, state public holidays, AUD support. |

Pros:

- All-in-one platform reduces tool switching and subscription costs.

- Account-based pricing is highly scalable and budget-friendly for teams.

- Strong focus on Australian compliance and business needs.

- Secure, legally binding e-signatures with robust audit trails.

Cons:

- The mobile experience is currently limited to iOS and web, with an Android app still in development.

- Lower-tier plans have caps on monthly signatures and features, with advanced tools reserved for higher plans.

2. Xero Practice Manager (XPM)

For Australian accounting and bookkeeping firms already embedded in the Xero ecosystem, Xero Practice Manager (XPM) is the logical and most powerful choice. It’s designed specifically as the central hub for practices, seamlessly connecting client work, job tracking, time billing, and staff management directly with Xero HQ and Xero Tax. This deep, native integration is its defining feature, creating a unified workflow that other platforms struggle to replicate for Xero-centric firms.

Unlike generalist project management tools, every feature in XPM is tailored for the accounting profession. You can track time and costs against specific jobs, manage work-in-progress (WIP), and generate invoices that sync directly to your firm's Xero ledger. The platform excels at providing clarity on firm performance with built-in reporting on key metrics like productivity, write-offs, and client recoverability. For a comprehensive overview of accounting software options that integrate well with tools like XPM, see our guide to the best small business accounting software in Australia.

Key Features and Considerations

| Feature | Details & Use Case |

|---|---|

| Pricing & Access | XPM is included at no extra cost for Xero Partners on Silver, Gold, or Platinum status. This makes it exceptionally valuable for firms committed to the Xero platform, as access is tied to partner program tiers rather than a direct subscription fee. |

| Best For | Accounting and bookkeeping practices in Australia that use Xero as their primary ledger and client accounting platform. |

| Limitations | The user interface and functionality are highly specialised for accounting workflows. It is not designed as a general-purpose professional services automation (PSA) tool, making it a poor fit for creative agencies, IT consultants, or other professional services outside of finance. |

| Website | Xero Practice Manager |

3. MYOB Practice (Practice Management)

For Australian accounting firms deeply integrated into the MYOB ecosystem, MYOB Practice stands as the central command centre. It’s purpose-built to unify client data, job scheduling, timesheets, and billing within the broader MYOB suite of tools for accountants, including MYOB AE/AO. This tight, native integration provides a cohesive workflow for firms that rely on MYOB for compliance, tax, and ledger management, making it a powerful contender for practices committed to their platform.

As one of the best practice management software Australia has to offer for MYOB users, every feature is geared towards accounting operations. The platform offers a centralised view of clients, jobs, WIP, and debtors, along with performance reporting to track firm health. Key functionalities like resource planning and mobile timesheet capture are designed to streamline daily tasks. Firms can also extend its capabilities with optional add-ons for CRM, secure document management, and even fee funding, allowing the system to scale with the practice's needs.

Key Features and Considerations

| Feature | Details & Use Case |

|---|---|

| Pricing & Access | Pricing for MYOB Practice is not publicly available and requires a direct sales quote. This approach allows for a tailored package based on firm size, required modules (like CRM or document management), and existing MYOB products. |

| Best For | Accounting and bookkeeping practices in Australia that are standardised on the MYOB ecosystem, particularly users of MYOB AE/AO for compliance and client work. |

| Limitations | Its primary strength is also its main limitation: it delivers maximum value when used with other MYOB accountant tools. Firms using a mix of software (e.g., Xero for clients) will not experience the same level of seamless integration. |

| Website | MYOB Practice |

4. Karbon

Australian-founded Karbon is a premium practice management platform built around communication and collaboration. It uniquely treats your email inbox as the central to-do list, allowing teams to manage jobs, tasks, clients, and internal communication from a unified space. This email-centric approach sets it apart, designed for modern, often distributed, accounting practices that need absolute clarity on who is doing what and when, without leaving their primary communication tool.

Karbon excels at workflow automation, allowing firms to create sophisticated, templated checklists and automate client reminders to ensure nothing falls through the cracks. It provides a single source of truth for all client activity, with timelines that show every email, note, and task. This makes it one of the most powerful options when evaluating the broader landscape of professional services automation software specifically tailored for client-heavy industries. Its strong focus on team collaboration makes it ideal for firms aiming to standardise processes and increase efficiency.

Key Features and Considerations

| Feature | Details & Use Case |

|---|---|

| Pricing & Access | Karbon operates on a per-user, per-month subscription model with annual billing required. It has three tiers: Team, Business, and Enterprise. While powerful, the per-user pricing can become a significant investment for larger teams, so firms must evaluate the ROI based on efficiency gains. |

| Best For | Modern accounting and bookkeeping firms focused on deep collaboration, workflow automation, and managing high volumes of client communication. It is particularly well-suited for practices with remote or distributed teams. |

| Limitations | The per-user pricing model can be a barrier for smaller firms or sole practitioners. Its comprehensive feature set also comes with a steeper learning curve compared to simpler tools, requiring a firm-wide commitment to adoption for maximum benefit. |

| Website | Karbon |

5. Ignition (formerly Practice Ignition)

Ignition is an Australian-born platform focused squarely on the client engagement and payment collection process. While not a traditional practice management tool for task tracking, it excels at the crucial starting point of any client relationship: the proposal and agreement. It streamlines creating professional digital proposals, securing engagement letters, and crucially, automating the entire billing and collections cycle from day one. This proactive approach to getting paid is its defining advantage for service-based businesses.

The platform is designed to eliminate scope creep and debtor days by connecting your proposal directly to automated invoicing and payment collection. It integrates seamlessly with Xero and QuickBooks Online, pushing invoices and reconciling payments automatically. For Australian firms, its built-in payment system handles both credit card and direct debit, providing clear guidance on fees and allowing you to automatically pass on surcharges where appropriate. This makes Ignition a powerful tool for improving cash flow, forming a key part of the best practice management software in Australia for firms prioritising financial hygiene.

Key Features and Considerations

| Feature | Details & Use Case |

|---|---|

| Pricing & Access | Ignition uses a tiered subscription model, with pricing based on the number of active clients you have. Plans start from a monthly fee, with add-ons like Deals Pipeline and Price Insights available for an additional cost. |

| Best For | Accounting firms, bookkeepers, and professional service businesses in Australia looking to automate client onboarding, proposals, and payment collection to significantly reduce administrative overhead and improve cash flow. |

| Limitations | Its core strength is in client engagement and billing, not in-depth job or task management. It is designed to be used alongside a dedicated project management tool (like XPM or Karbon) for managing the actual delivery of work. |

| Website | Ignition |

6. WorkflowMax by BlueRock

For professional services firms, creative agencies, and consultants in Australia, WorkflowMax by BlueRock represents a significant evolution of a familiar platform. After Xero divested the original WorkflowMax, Melbourne-based BlueRock revitalised it, focusing on the core job management needs of service-based businesses like architects, engineers, and marketing agencies. It’s a powerful, all-in-one solution for managing the entire project lifecycle, from quoting and lead management through to time tracking, job costing, and invoicing.

Unlike specialised accounting practice software, WorkflowMax is built for a broader range of professional services that bill by time and project. Its strength lies in providing detailed visibility over job profitability. You can create detailed quotes, track staff time against specific tasks, manage purchase orders, and issue invoices that sync seamlessly with Xero. This comprehensive feature set makes it one of the most robust options for any Australian business needing to convert time into revenue efficiently. For many legacy users, the transition to the BlueRock version offers a familiar yet enhanced experience.

Key Features and Considerations

| Feature | Details & Use Case |

|---|---|

| Pricing & Access | Pricing is tiered based on the number of users, starting with a Standard plan for up to 5 users and scaling to a Premium plan for larger teams. This user-based model allows businesses to choose a plan that fits their current size and operational needs. An optional Lead Manager add-on is available for integrated sales tracking. |

| Best For | Creative agencies, architects, engineers, IT consultants, and other professional services firms in Australia that require end-to-end job and project management, from quoting to final invoice. It’s also the natural upgrade path for businesses familiar with the original WorkflowMax. |

| Limitations | While it integrates deeply with Xero, it is not an accounting ledger itself. The platform's breadth can present a learning curve for very small teams or freelancers who may not need its full suite of features. The transition from the legacy Xero version requires careful data migration and planning. |

| Website | WorkflowMax by BlueRock |

7. LEAP (Legal Practice Management)

For Australian law firms, LEAP offers one of the most specialised and compliance-focused practice management solutions available. Unlike generic platforms, it is built from the ground up for legal workflows, combining matter management, document automation, trust accounting, and legal billing into a single, integrated system. Its standout feature is the vast library of over 50,000 automated legal forms and templates, which are regularly updated to align with current Australian federal and state legislation, significantly reducing administrative overhead and compliance risk.

LEAP deeply embeds legal-specific tools that other systems lack, such as built-in calculators for court fees, professional costs, and stamp duty. This focus on the nuances of legal practice ensures that every function, from client intake to final billing, is optimised for efficiency and accuracy within a legal context. While it's a powerful tool, its specialisation is also its main limitation, making it less suitable for professional services outside the legal sector. For a deeper dive into tools for this industry, explore our complete guide to legal practice management software in Australia.

Key Features and Considerations

| Feature | Details & Use Case |

|---|---|

| Pricing & Access | Pricing is available by requesting a quote directly from their sales team and is not published publicly. Access is typically provided on a per-user, per-month subscription basis. |

| Best For | Small to medium-sized Australian law firms that require a comprehensive, all-in-one system for matter management, document automation, and compliant trust accounting. |

| Limitations | The platform is highly specialised for the legal industry. Its workflows, terminology, and feature set are not easily adapted for accounting firms, creative agencies, or other professional services. |

| Website | LEAP Legal Software |

8. Smokeball (Australia)

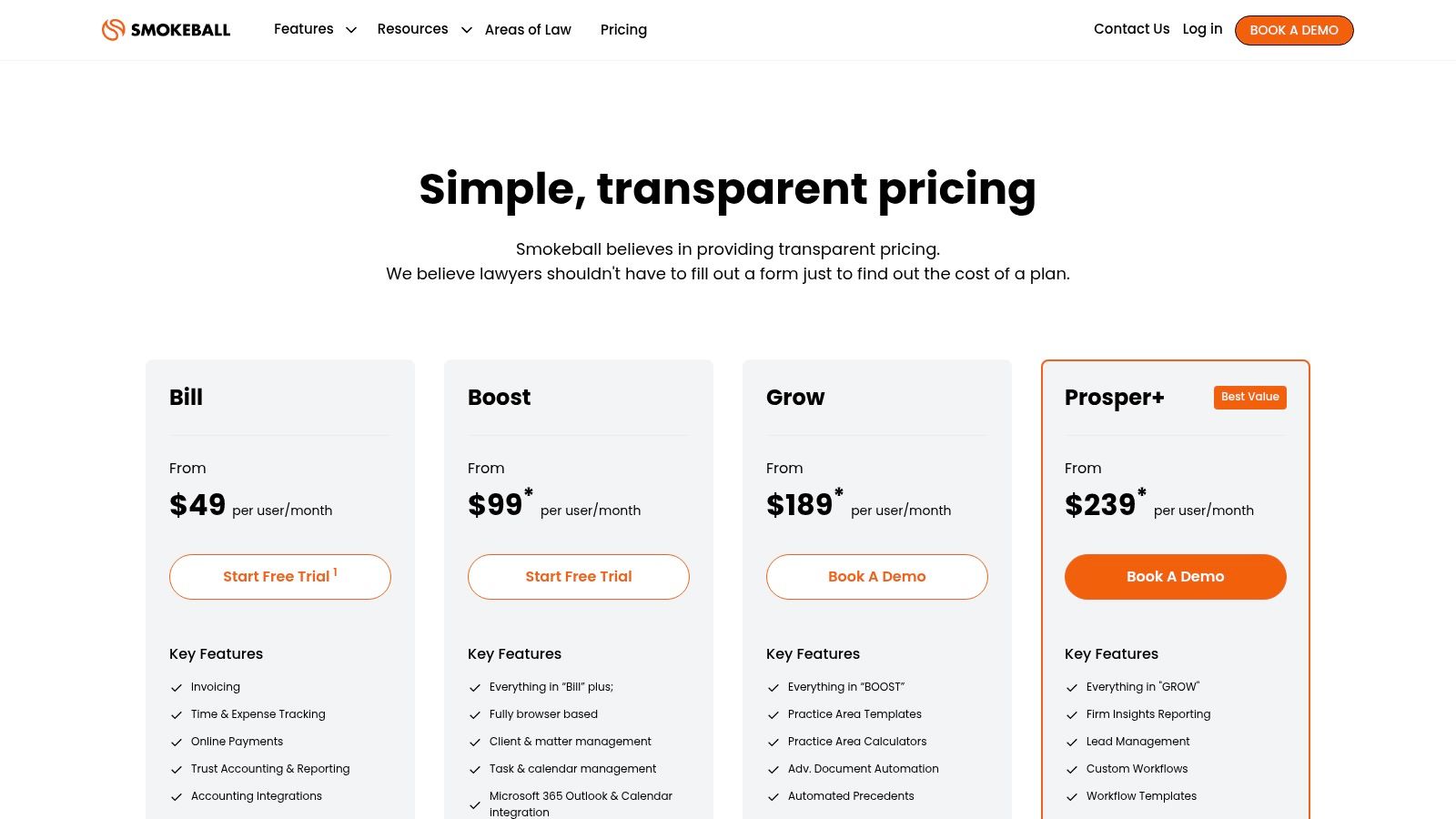

Smokeball is a cloud-based legal practice management software specifically engineered for small to mid-sized Australian law firms. Its key differentiator is the deep integration of matter management, document automation, and billing with a unique automatic time tracking feature called AutoTime. This tool runs in the background, capturing all billable activity within Microsoft Word and Outlook, which helps firms to accurately bill for time that might otherwise be missed.

The platform is built around the day-to-day realities of legal work, offering thousands of practice-area-specific legal forms and precedents. Smokeball centralises client communication, documents, and critical dates, ensuring all information related to a matter is organised and accessible. It includes robust trust accounting and billing functionalities compliant with Australian legal standards, making it a comprehensive solution for firms looking to enhance both efficiency and profitability.

Key Features and Considerations

| Feature | Details & Use Case |

|---|---|

| Pricing & Access | Smokeball offers tiered, per-user per-month pricing in AUD. While transparent, the most advertised prices often require a 36-month contract, and the most powerful features like AutoTime are reserved for higher-tier plans. A free trial is available for evaluation. |

| Best For | Small to medium-sized law firms in Australia that require a comprehensive solution combining matter management, document automation, and sophisticated, automatic time capture to maximise billable hours. |

| Limitations | Its specialisation in the legal sector makes it unsuitable for other professional services like accounting, marketing, or consulting. The reliance on long-term contracts for the best pricing may not suit firms seeking more flexibility. |

| Website | Smokeball (Australia) |

9. Actionstep

Actionstep is a cloud-based practice management platform specifically engineered for midsize law firms that require deep customisation. Its core strength lies in its highly configurable workflows, allowing legal practices to automate processes across different areas like family law, conveyancing, or commercial litigation. This focus on tailored automation sets it apart from more generic software, enabling firms to build a system that mirrors their unique operational procedures from client intake through to matter resolution.

The platform combines matter and case management, time capture, billing, and accounting into a single, integrated hub. A key benefit for Australian firms is its partner-led implementation model, where certified local consultants guide the setup and onboarding process. This hands-on approach is designed to improve user adoption and ensure the software is configured correctly from day one. Integrations with Microsoft 365 and a dedicated client portal further centralise communication and document management, making it a comprehensive choice among the best practice management software in Australia for legal professionals.

Key Features and Considerations

| Feature | Details & Use Case |

|---|---|

| Pricing & Access | Pricing is provided by request only and is typically structured on a per-user, per-month basis. Firms should also budget for the one-off implementation and onboarding fees, which are delivered by certified Australian partners. |

| Best For | Midsize Australian law firms that need highly configurable workflows for different legal practice areas and value a structured, partner-led implementation process. |

| Limitations | The requirement for a custom quote and separate implementation fees can make it a more significant upfront investment. While it has accounting features, the availability of its full legal trust accounting module can vary by region and should be confirmed for Australian compliance. |

| Website | Actionstep |

10. Clio (Australia)

Clio is a global leader in legal practice management software, and its Australian-specific offering is tailored for local law firms needing a comprehensive, cloud-based solution. It combines client relationship management (CRM), case management, billing, and trust accounting into a single, cohesive platform. Its key differentiator is the depth of its legal-specific features, moving beyond generic project management to address the unique compliance and workflow needs of Australian legal professionals.

The platform is divided into two core products: Clio Manage for case and practice management, and Clio Grow for client intake and CRM. Together, they create an end-to-end solution from initial client contact to final invoice. For Australian firms, Clio’s robust integration with Xero is a major advantage, ensuring seamless trust accounting and financial reporting that aligns with local regulations. This focus makes it one of the best practice management software Australia has available for the legal sector.

Key Features and Considerations

| Feature | Details & Use Case |

|---|---|

| Pricing & Access | Clio offers transparent per-user, per-month pricing in AUD, with tiers like 'Easy', 'Advanced', and 'Complete'. They often include free training and support for data migration, which is a significant value-add for firms switching systems. |

| Best For | Small to medium-sized Australian law firms seeking an all-in-one, cloud-based platform with strong client intake, case management, and trust accounting capabilities. |

| Limitations | The most advanced features are locked behind higher-priced tiers, which can become expensive for larger teams. The system's power comes from using its integrated suite (Manage and Grow); using only one part may feel less complete. |

| Website | Clio Australia |

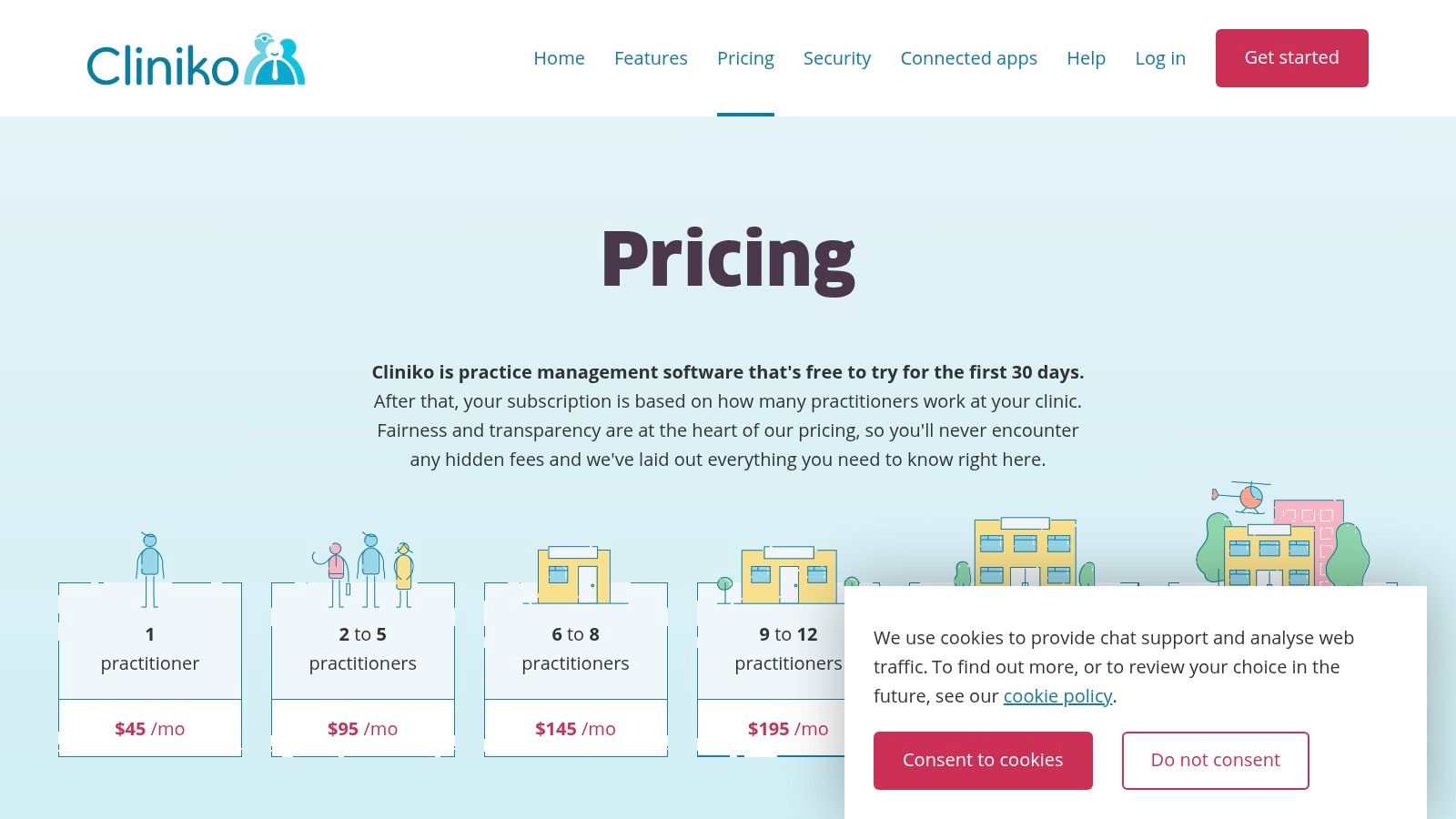

11. Cliniko (Allied Health)

For Australian allied health clinics, Cliniko is a standout practice management solution founded right here in Australia. It’s purpose-built for practitioners like physiotherapists, psychologists, and chiropractors, covering everything from appointment scheduling and online bookings to clinical treatment notes and invoicing. Its comprehensive, health-centric feature set is what makes it a top choice for solo practitioners and multi-location clinics alike.

Unlike generic scheduling tools, Cliniko deeply integrates clinical and administrative workflows. It handles patient records, telehealth appointments, recall reminders, and secure letter generation within a single, user-friendly interface. This unified approach simplifies daily operations, reduces administrative burden, and helps clinics deliver better patient care. The platform is highly regarded as one of the best practice management software options in Australia for the allied health sector due to its dedicated focus and robust functionality.

Key Features and Considerations

| Feature | Details & Use Case |

|---|---|

| Pricing & Access | Cliniko offers a 30-day free trial with straightforward tiered pricing based on the number of practitioners. A key benefit is the inclusion of unlimited support staff (reception/admin) and multi-location support at no extra charge on all plans. Note that pricing is in USD, and SMS credits are an additional cost. |

| Best For | Allied health professionals in Australia, including physiotherapists, chiropractors, psychologists, and podiatrists. It scales well from solo practitioners to large, multi-clinic practices needing a centralised management system. |

| Limitations | Its specialisation in allied health means it is not suitable for other professional services like accounting, legal, or creative agencies. The USD pricing may be a minor inconvenience for Australian businesses managing their budgets in AUD. |

| Website | Cliniko |

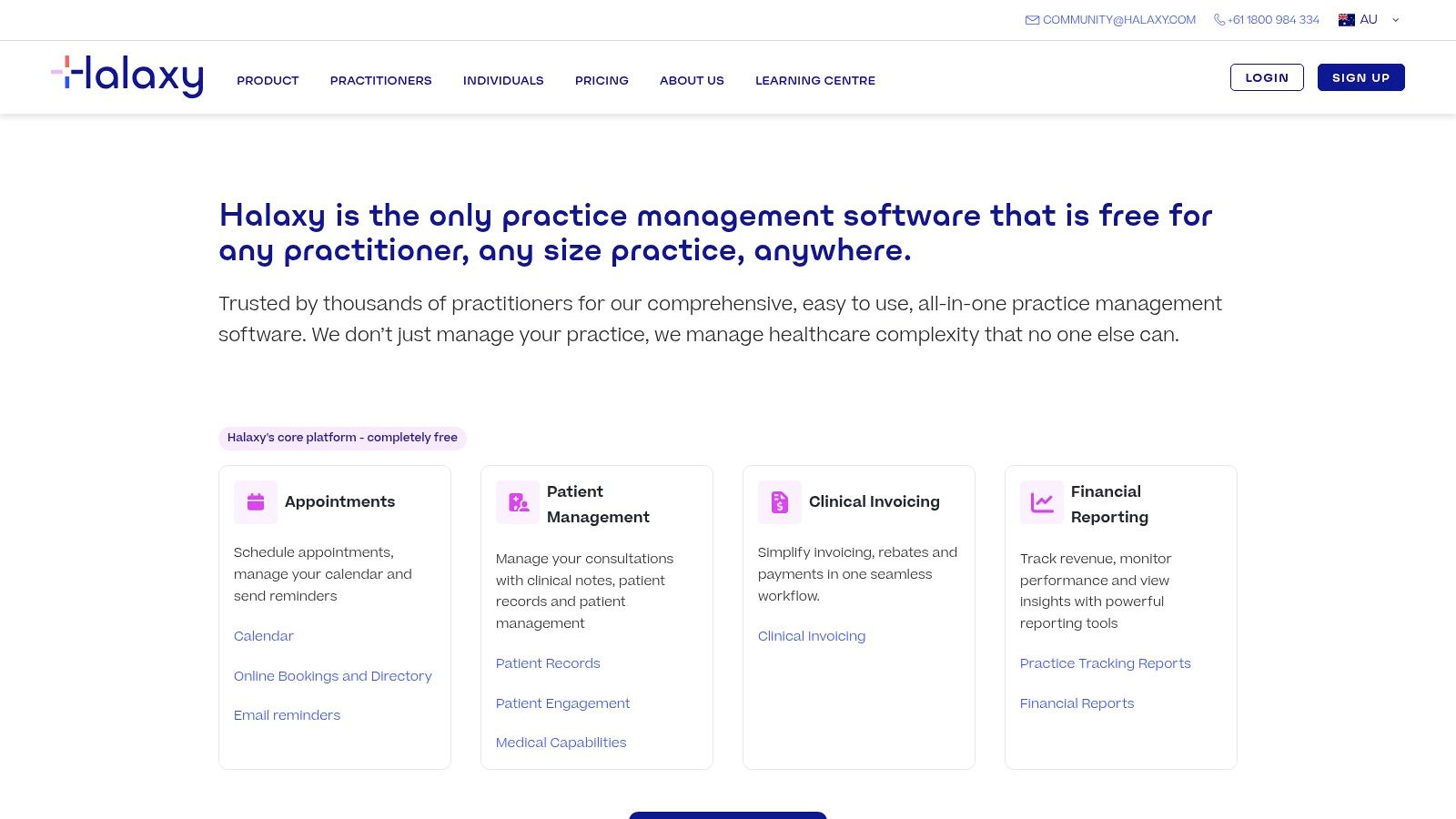

12. Halaxy (Healthcare)

For Australian allied health, medical, and therapy practices, Halaxy offers a specialised and uniquely cost-effective practice management solution. Its core strength lies in its "freemium" model combined with deep integrations into the Australian healthcare system. The platform provides a free base version covering essentials like appointments and clinical notes, with advanced features like SMS reminders, online payment processing, and Medicare/DVA/NDIS claims managed through a pay-as-you-go credit system. This makes it an accessible starting point for solo practitioners and small clinics managing costs.

Unlike generalist software, Halaxy is built from the ground up for clinical workflows. It handles patient records, invoicing, and complex funding body requirements with tailored functionality that generic project tools lack. This focus on Australian healthcare intricacies, from private health funds to government rebate schemes, solidifies its position as a leading choice in the medical and allied health sectors. For those needing a powerful, industry-specific solution, Halaxy provides a compelling alternative to broader professional services software.

Key Features and Considerations

| Feature | Details & Use Case |

|---|---|

| Pricing & Access | The core software is free, with no subscription fees. Costs are incurred by purchasing credits for add-on services like SMS reminders, telehealth video sessions, or processing claims (e.g., Medicare, DVA, NDIS). This model minimises upfront investment for new or small practices. |

| Best For | Solo practitioners and small to medium-sized allied health and medical clinics in Australia, including psychologists, physiotherapists, chiropractors, and GPs who need robust clinical and administrative tools. |

| Limitations | Its primary focus is on healthcare, making it unsuitable for other professional services like accounting, legal, or creative agencies. The pay-as-you-go credit model, while flexible, can make monthly cost forecasting less predictable compared to a fixed subscription. |

| Website | Halaxy |

Top 12 Australian Practice Management Software Comparison

| Product | Key features | Target audience | Pricing / Value | Integrations & Compliance | Unique selling points |

|---|---|---|---|---|---|

| Payly (recommended) | Time tracking, smart timesheets, branded invoicing, PDF e-signatures, docs, POs, onboarding (web + iOS) | Australian freelancers, agencies, consultancies, service businesses | Account-based pricing (no per-user fees). Personal free; Professional $49/mo (≤10), Business $99, Business Plus $199; 14-day trial | Xero, MYOB, QuickBooks, Stripe, Zapier, Google Drive, Dropbox; bank-level encryption; AU GST/fuel tax tools, state holidays | All-in-one AU-centric platform, predictable account pricing, cryptographic e-signatures, proven traction |

| Xero Practice Manager (XPM) | Jobs, task/time tracking, WIP, billing, productivity reporting | Accountants & bookkeepers using Xero | Best value for Xero partners/subscribers; pricing tied to Xero ecosystem | Native Xero integrations (Tax, Workpapers, HQ) | Seamless Xero workflow and built-in practice tools |

| MYOB Practice | Client/jobs, scheduling, mobile timesheets, billing, reporting | Accounting firms using MYOB stack | Sales-quoted pricing; better value when paired with MYOB products | Integrates with MYOB AE/AO and compliance apps | Deep MYOB ecosystem linkage and flexible add-ons |

| Karbon | Shared email/tasks, client timelines, workflow automation, time & billing | Modern/distributed accounting teams | Per-user pricing (can scale costs); tiered feature limits | AUD billing support; integrations for accounting apps | Strong collaboration, automation and clear roadmap |

| Ignition | Digital proposals/engagements, automated invoicing, integrated payments (AU direct debit) | Firms needing proposal-to-billing automation | Reduces debtor days; some add-ons cost extra | Integrates with Xero/QuickBooks; AU payment fee guidance | Best for automated client engagements and AU payments |

| WorkflowMax by BlueRock | Quotes, job costing, timesheets, POs, invoicing, reporting | Agencies, architects, engineers, professional services | Pricing varies by user count; legacy WorkflowMax migration path | Xero integration for accounting sync | Comprehensive PSA tailored for service businesses |

| LEAP (Legal) | 50,000+ legal templates, calculators, matter mgmt, trust accounting | Law firms requiring legal compliance workflows | Sales-quoted pricing | Regular legal compliance updates, jurisdictional calculators | Extensive Australia-specific legal content and automation |

| Smokeball (AU) | Matter mgmt, AutoTime (automatic time capture), billing, trust accounting | Small-mid Australian law firms | Transparent AU pricing; free trial; some low rates require long contracts | Document automation, online payments; AU support | AutoTime capture and strong document/email management |

| Actionstep | Configurable workflows, intake/Capture, matter mgmt, billing, MS365 | Midsize law firms needing custom workflows | Pricing on request; implementation fees via partners | Partner-led onboarding; integrations vary by region | Highly configurable with certified partner implementations |

| Clio (AU) | Time, billing, trust accounting, e-signatures, Clio Grow (intake) | Law firms seeking broad integrations & cloud PM | AUD pricing with training/migration; per-user can be costly | Marketplace integrations (Xero, Zoom, etc.) | Wide integration ecosystem and extensibility |

| Cliniko (Allied Health) | Appointment calendar, online bookings, telehealth, treatment notes, invoicing | Allied-health clinics, solo practitioners to multi-location clinics | Tiers by practitioner; 30-day trial; pricing listed in USD | Payments, multi-location support, telehealth | Unlimited admin users, clinic-focused features |

| Halaxy (Healthcare) | Appointments, billing, Medicare/DVA/NDIS workflows, telehealth, credits model | Cost-sensitive solo practitioners and small clinics | Free core plan + pay-as-you-go credits for add-ons | Australian rebate/funding integrations; API, calendar sync | Free to start and strong AU healthcare funding support |

Choosing the Right Platform for Your Practice

Navigating the crowded market for practice management software in Australia can feel overwhelming, but making an informed decision is a critical investment in your firm's future. As we've explored, the landscape is diverse, with powerful solutions tailored to specific industries, from the legal-centric features of LEAP and Smokeball to the healthcare focus of Cliniko and Halaxy. The key takeaway is that there is no single "best" platform; the right choice is entirely dependent on your unique operational needs, team size, and strategic goals.

The journey to finding the best practice management software for your Australian business begins with a clear understanding of your core challenges. Are you struggling with inefficient workflows and manual data entry? Is client onboarding a disjointed and frustrating process? Or is a lack of visibility into project profitability holding you back? Your answers to these questions will illuminate which features are non-negotiable and which are merely nice to have.

Key Takeaways and Your Decision Framework

To synthesise the detailed reviews in this guide, let's recap the most important decision-making factors. When evaluating your options, consider these elements as a final checklist to ensure you're making a strategic, future-proof choice for your practice.

- Industry Specialisation: The needs of an accounting firm using Xero Practice Manager or Karbon are fundamentally different from a law firm requiring the trust accounting and compliance features found in Actionstep or Clio. Always prioritise software built with your industry's specific workflows and regulatory requirements in mind.

- Integration Ecosystem: Your practice management software doesn't operate in a vacuum. Its ability to seamlessly connect with your existing accounting software like Xero or MYOB, as well as other critical business tools, is paramount. A well-integrated system eliminates data silos and automates routine tasks, freeing up valuable time.

- Scalability and Pricing: Your business will grow, and your software must be able to grow with it. Carefully examine the pricing models. A per-user fee might be affordable for a solo practitioner but can become prohibitively expensive as you add team members. Solutions with more predictable, tiered pricing can offer better long-term value.

- Australian-Specific Compliance: From GST and BAS reporting to local data hosting and privacy laws, choosing a platform with a strong Australian presence is crucial. This ensures your software is not only compliant today but will also adapt to future changes in local regulations.

From Selection to Successful Implementation

Once you have shortlisted your top contenders, the next phase is just as critical: implementation. Don't underestimate the effort required to migrate data, configure settings, and train your team. A successful rollout hinges on a clear plan and strong internal support.

Look for a provider that offers robust onboarding assistance, comprehensive training resources, and responsive, locally-based customer support. A smooth transition will accelerate your return on investment and ensure your team embraces the new system, rather than resisting it. For many freelancers, small agencies, and consultants, the complexity of these enterprise-grade systems can be a significant barrier. This is where streamlined, all-in-one platforms offer a compelling advantage, consolidating core functions without the steep learning curve. If you're looking for a solution that combines essential tools like proposals, e-signatures, invoicing, and time tracking into one cohesive, Australian-focused platform, then a tool like Payly is designed specifically to address this need.

Ultimately, the best practice management software for your Australian business is the one that empowers you to work smarter, not harder. It should automate the mundane, provide clarity on your performance, and, most importantly, give you back the time to focus on what truly matters: delivering exceptional service to your clients and growing your practice.

Ready to simplify your operations with a single, powerful platform built for Australian businesses? Discover how Payly combines proposals, invoicing, time tracking, and client management to streamline your workflow and help you get paid faster. Start your free trial at Payly and see the difference an all-in-one solution can make.

Payly Team

Sharing insights and strategies to help service businesses thrive. Follow Payly for more tips on time tracking, invoicing, and business operations.

Related Articles

Ready to streamline your business?

Join thousands of freelancers and agencies who use Payly to track time, send invoices, and get paid faster.