A Guide to the Agreement of Purchase and Sale of Business

Master the agreement of purchase and sale of business in Australia with our guide on key clauses, due diligence, and avoiding common pitfalls.

Payly Team

February 12, 2026

When you're ready to sell your business, the agreement of purchase and sale of business is the single most important document you'll handle. It’s the master blueprint for the entire deal, a legally binding contract that lays out every term, condition, and responsibility for both you and the buyer. This ensures the whole process is clear, transparent, and enforceable.

What a Business Sale Agreement Really Is

Think of this agreement as the comprehensive playbook for one of the biggest moments in a business owner’s life. It goes way beyond a simple handshake, creating a rock-solid document that protects everyone involved by leaving absolutely no room for misinterpretation down the track.

For Australian freelancers, agency owners, and service-based businesses, getting this document right is non-negotiable. A vague or poorly drafted agreement can open the door to serious financial loss or messy legal fights long after you’ve handed over the keys. It’s what sets the ground rules for everything, from the final price to what happens if an unexpected problem pops up.

The Foundation of a Smooth Transfer

At its core, the primary job of a business sale agreement is to manage risk and set clear expectations. It provides a structured framework that guides the entire transaction, from the moment an offer is accepted right through to the final handover.

Here's what this agreement really pins down:

- Clarity on Terms: It spells out precisely what is being sold, the exact purchase price, and the terms of payment.

- Legal Protection: It includes crucial warranties and indemnities that shield the buyer from any nasty surprises or undisclosed liabilities.

- A Clear Timeline: It establishes firm dates for key milestones like due diligence, the closing date, and the operational transfer.

- Dispute Resolution: It outlines a pre-agreed process for sorting out any disagreements that might crop up.

If the sale involves transferring ownership through company shares, a key document you'll come across is the Stock Purchase Agreement. This is a specific type of sale agreement that deals with the company’s equity itself, rather than just its individual assets.

Ultimately, this agreement is far more than just paperwork; it’s a strategic tool. It ensures that the value you've poured your life into is transferred fairly and securely, giving peace of mind to both the person selling their legacy and the one excited to start a new chapter.

The Core Anatomy of the Agreement

To get your head around an agreement of purchase and sale of business, you first need to understand its building blocks. At its heart, this legal document is all about transferring ownership from a seller to a buyer, making sure every single detail of the deal is crystal clear. Getting this structure right is the key to a smooth, headache-free transaction.

Right out of the gate, you'll hit a major fork in the road: should this be an asset sale or a share sale? This isn't just a minor detail; it's a fundamental decision that changes everything for both the vendor (seller) and the purchaser (buyer), from tax bills to future liabilities.

Honestly, this is the most critical choice you’ll make in the entire process. It sets the stage for every other clause in the agreement and fundamentally shapes the risk each party is taking on.

Asset Sale vs Share Sale: The First Big Decision

Think about it like buying a second-hand car.

In an asset sale, you’re just buying the car itself: the engine, the wheels, the stereo system. You aren’t taking on the previous owner's driving history, their old parking fines, or the loan they took out to buy it.

That’s an asset sale in a nutshell. The buyer cherry-picks the specific assets they want, like customer lists, equipment, brand names, and goodwill. Just as importantly, they can decide which liabilities, if any, they’re willing to take on, leaving the rest behind with the seller's original company.

A share sale is a completely different beast. Sticking with our car analogy, a share sale is like buying the entire company that owns the car. You get the car, sure, but you also inherit the company’s entire history: its debts, past legal troubles, and any skeletons hiding in the closet. The buyer takes over the whole legal entity, warts and all.

For a buyer, an asset sale often feels safer because it allows them to leave behind unwanted historical baggage. For a seller, a share sale can be simpler and may offer tax advantages, as they are selling a single capital asset: their shares in the company.

No matter which path you take, knowing how to draft a contract that properly protects your interests is vital. This is especially true when making a foundational choice between these two sale structures.

Comparing the Two Structures

So, how do you choose? It really comes down to a careful look at the legal, financial, and day-to-day operational realities. The right decision hinges entirely on the specific business and what both the buyer and seller want to achieve.

To make it clearer, let's break down the key differences.

Asset Sale vs Share Sale: Key Differences for Your Business

This table lays out the practical implications of each approach, helping you see which structure might be a better fit for your situation.

| Aspect | Asset Sale | Share Sale |

|---|---|---|

| What is Sold | Specific, chosen assets (e.g., equipment, client contracts, brand) and sometimes liabilities. | The entire company, including all its assets, liabilities, and history, through the sale of shares. |

| Liability Transfer | The buyer generally avoids unknown or historical liabilities. They only take on liabilities explicitly listed in the agreement. | The buyer inherits all liabilities of the company, both known and unknown. The company's legal identity remains intact. |

| Employee Contracts | Employees are typically terminated by the seller and may be offered new employment by the buyer. | Employee contracts continue uninterrupted, as their employer (the company) remains the same, just under new ownership. |

| Tax Implications | Can be complex. The seller may face different tax treatments for various assets, and GST often applies unless it's a "going concern". | Often simpler for the seller, potentially leading to Capital Gains Tax (CGT) concessions. The company's tax history transfers to the buyer. |

| Contract Transfers | Key contracts (leases, supplier agreements) may need to be renegotiated or assigned to the buyer, which requires third-party consent. | Contracts generally remain with the company, requiring no change unless specific "change of control" clauses are triggered. |

Ultimately, this choice between an asset or share sale shapes the entire framework of the agreement. For a deeper dive into what makes any agreement legally binding, you can learn more about the essential elements of a contract in our related guide.

Once this crucial decision is locked in, you can move on to negotiating the specific clauses that will bring your deal to life.

Key Clauses You Cannot Ignore

While the big decision between an asset or share sale sets the overall direction, the real grunt work happens in the specific clauses of the agreement of purchase and sale of business. These are the nuts and bolts of the deal, spelling out the rights, responsibilities, and crucial protections for everyone involved. Getting these details wrong can quickly turn a great deal sour.

Think of these clauses as the detailed rules of the game. They cover everything from how the final price is calculated to what happens if a skeleton pops out of the closet after the handover. For any Australian business owner, getting a handle on these is non-negotiable if you want to protect your financial interests.

Each clause has a specific job to do, building a legal framework that tries to head off problems before they start. Let's walk through the ones you absolutely have to get right.

Purchase Price and Adjustments

You’d think the purchase price is a simple, fixed number. In reality, the figure you shake hands on is often just the starting point. The final amount the buyer actually pays can shift depending on the business’s performance between signing the contract and the official completion day.

This is where purchase price adjustments come in. They’re a mechanism to make sure the buyer gets the financial position they thought they were paying for. The most common adjustment by far is based on working capital.

Working capital is really just the cash flow lifeline of a business: the difference between its current assets (like cash and what customers owe) and its current liabilities (like bills to suppliers). You’ll agree on a target amount of working capital that should be in the business at handover.

- If the actual working capital is higher than the target when the keys change hands, the buyer usually tops up the purchase price to pay for that extra value.

- If the actual working capital is lower, the seller typically has to cover the gap, which means the final price they receive is reduced.

This stops a seller from, say, chasing all their debtors for cash while putting off paying their own bills, which would hand the buyer a business that looks cash-rich but is actually hiding a pile of urgent debts.

Conditions Precedent

Just because an agreement is signed doesn't mean the sale is guaranteed to happen. Most contracts include conditions precedent, a list of things that absolutely must happen before the deal becomes legally binding. Think of them as a final checklist of green lights. If any of them stay red, the deal can be called off.

These conditions are a critical safety valve. They give either party a clean exit if a crucial piece of the puzzle doesn't fall into place, preventing them from being locked into a deal that’s no longer viable.

In a typical Australian business sale, you'll see conditions like:

- Buyer securing finance: The buyer needs to show they’ve actually got the money lined up.

- Landlord consent: If there’s a lease, the landlord must formally agree to transfer it to the new owner.

- Regulatory approvals: Some industries need a nod from a government body before a sale is official.

- No material adverse change: This protects the buyer in case the business takes a major nosedive between signing and completion.

These aren't just legal formalities. They are fundamental risk management tools, ensuring all the external approvals and internal stabilities are locked in before you pop the champagne.

Representations and Warranties

This section is almost always the most heavily negotiated part of the entire agreement, and for good reason. Representations and warranties are a long list of promises the seller makes about the business. They’re legally binding statements of fact, assuring the buyer that everything is as it seems.

For a buyer, warranties are your shield against the unknown. They give you a legal comeback if you later discover the seller's claims about the business weren't true.

A seller will be asked to give warranties on things like:

- Financial Records: Promising the books are accurate and give a true picture of the company's health.

- Legal Compliance: Stating the business has followed all the relevant laws and regulations.

- Contracts and Leases: Assuring all key agreements are valid and nobody is in breach.

- Employees: Confirming details about staff entitlements, contracts, and any ongoing disputes.

- Assets: Warranting that the company truly owns all its assets, and they aren't secretly promised to a lender.

Breaking one of these promises is a big deal and can lead to a hefty claim for damages long after the sale is done.

Indemnities and Limitations

Following on from warranties, the indemnities clause spells out exactly what happens if a warranty is breached or a specific, known risk comes to pass. An indemnity is essentially a promise from one person to cover the financial losses of another in a specific scenario. It's like a custom-built insurance policy for risks identified during the deal.

For instance, if the seller knows about a looming lawsuit, they might indemnify the buyer against any costs that come from it. This means the seller agrees to foot the bill for that specific problem, so the buyer doesn't have to worry about it.

Of course, sellers will want to cap their potential exposure. The agreement will almost always include limitations on liability, such as:

- Time Limits: A buyer might only have 12-24 months to make a warranty claim.

- Financial Caps: The seller’s total liability could be capped at a percentage of the purchase price.

- Thresholds (Baskets): A seller might not have to pay for anything until the total value of all claims exceeds a certain minimum amount.

Getting the balance right here is a classic tug-of-war. The buyer wants an iron-clad safety net, while the seller wants to walk away and sleep soundly at night.

Restraints of Trade

No one wants to buy a business only to find the old owner has set up a new, competing shop right across the road. A restraint of trade clause, often called a non-compete, is designed to stop that exact thing from happening.

This clause legally restricts the seller from starting or working in a similar business within a set geographical area for a certain amount of time. It's all about protecting the goodwill: the customer relationships and reputation that the buyer just paid a premium for.

For a restraint to hold up in an Australian court, it has to be reasonable. A judge will look at:

- The Geographic Area: Does the restricted zone make sense for where the business actually operates?

- The Time Period: Is the length of the ban (say, 2-3 years) fair and necessary to protect the new owner?

- The Scope of Activities: Does it only restrict activities that are genuinely in competition?

If a restraint is too broad, a court can throw it out completely. It's vital to draft this clause carefully so it’s fair, enforceable, and properly protects the value of the agreement of purchase and sale of business.

The Journey From Due Diligence to Settlement Day

Buying or selling a business isn't just about signing a contract. It's a journey with a clear roadmap, guiding both sides from the initial handshake right through to the final handover. Think of it as a carefully choreographed process designed to make sure everyone is on the same page, risks are uncovered, and the deal moves forward without any nasty surprises.

This whole process is built on a foundation of trust and verification. It starts with the buyer doing their homework and ends on settlement day, when the keys are finally handed over. Getting these steps right is absolutely crucial for a smooth, stress-free sale.

Each stage logically builds on the one before it, ensuring a transparent and orderly transfer. If you try to skip a step or rush through it, you're just asking for trouble later on.

Kicking Things Off: The Due Diligence Deep Dive

Before any buyer puts their money on the line, they need to have a proper look under the bonnet. This is the due diligence phase – a full-scale investigation into the business to make sure everything the seller has claimed is true and to sniff out any potential red flags. For sellers, this is your cue to get your house in order and have all your paperwork ready to go.

The buyer and their team of accountants and lawyers will want to get their hands on a few key things:

- Financial Records: They'll pore over your profit and loss statements, balance sheets, and tax returns for the last three to five years to get a true picture of the business's financial health.

- Legal Compliance: This is about checking that all your licences, permits, and registrations are up-to-date and that the business is ticking all the right regulatory boxes here in Australia.

- Key Contracts: Expect them to scrutinise your agreements with major customers and suppliers, not to mention employee contracts and, of course, the property lease.

- Assets and Liabilities: A full audit of what the business owns (and its condition) and what it owes.

Because you're sharing sensitive commercial information, this whole process is usually wrapped in a confidentiality agreement. To see how this works in practice, it’s worth understanding the role of a non-disclosure agreement in Australia to protect your information.

From Negotiation to the Final Agreement

Once the buyer has finished their due diligence and is happy with what they've found, the real negotiations begin. This is where the initial offer, often sketched out in a non-binding Heads of Agreement or Term Sheet, gets fleshed out into the final, legally binding sale contract.

Lawyers for both sides will go back and forth, hammering out the finer details of every clause, from purchase price adjustments and warranties to the conditions that must be met before the deal can close. This can be the most intense part of the process, a real tug-of-war to find a middle ground that works for everyone. The end goal is a single, solid document that both parties are ready to sign.

The negotiation phase is where the deal is truly made or broken. It’s the point where high-level terms become legally binding promises, forcing every last detail out into the open before anyone commits.

The Final Stretch to Settlement Day

Signing the agreement feels like a huge milestone, but you're not quite over the finish line. The period between signing and settlement is all about ticking off the conditions precedent, the last few hurdles that need to be cleared for the sale to go ahead. This could be anything from getting the landlord's official consent to transfer the lease to securing a critical third-party approval.

Finally, you arrive at the big day: settlement day (sometimes called the closing day). This is the moment it all becomes real.

- The buyer transfers the final, adjusted purchase price to the seller.

- The seller signs over all the documents needed to legally transfer the assets or shares.

- Control of the business, from the bank accounts to the front door keys, officially passes to the new owner.

Reaching settlement day is the culmination of what can be months of hard work. A well-managed process ensures that when the day comes, everything falls into place smoothly, making for a clean and decisive handover.

Navigating Australian Tax and Regulatory Hurdles

Finalising an agreement of purchase and sale of business goes far beyond just what the buyer and seller decide between themselves. Here in Australia, our legal and tax systems add a few extra layers you absolutely must get right. Fail to manage these, and you could be looking at some very costly penalties.

It’s a classic mistake to overlook these local rules, but it's one that can have serious financial blowback. From Goods and Services Tax (GST) to competition laws, getting your head around this landscape is non-negotiable for a smooth, financially sound deal.

GST and the Going Concern Exemption

One of the first tax hurdles you'll encounter in an asset sale is GST. By default, selling business assets is a taxable supply. This means the seller would normally have to slap an extra 10% GST on top of the price, which can really sting the buyer’s upfront cash flow.

Thankfully, there's a critical exemption. If your sale ticks the right boxes, it can be treated as a "GST-free supply of a going concern." In plain English, no GST is payable on the deal. This is a huge win for the buyer, freeing up a substantial amount of cash at settlement.

So, what does it take to qualify?

- Both parties must be registered for GST.

- The agreement has to state in writing that the sale is a 'going concern'.

- The seller has to hand over everything necessary for the new owner to keep the business running.

- Of course, payment has to be made for the business.

This isn’t some minor tax loophole; it's a fundamental part of structuring a business sale in Australia. Making sure your agreement is drafted to meet these conditions can be the difference between a deal that works and one that falls over.

Capital Gains Tax for the Seller

While the buyer is thinking about GST, the seller’s mind is usually on Capital Gains Tax (CGT). If you sell your business or its assets for more than what they cost you, that profit is a capital gain, and you can be sure the Australian Taxation Office (ATO) will want its share.

Working out your CGT can get tricky, as it depends on things like the original cost of the assets and how long you've owned them. The good news? Small business owners might be able to access some very generous CGT concessions, which can slash the taxable gain by 50% or even wipe it out completely. It's essential to sit down with a tax professional early on to make sure you're taking full advantage of these.

Broader Regulatory Oversight

If you're dealing with a larger transaction, you'll need to factor in some oversight from key government bodies. These regulators are there to make sure big deals don't harm market competition or go against the national interest.

The main players to be aware of are:

- The Australian Competition and Consumer Commission (ACCC): The ACCC gets involved when a sale could significantly reduce competition in a particular market.

- The Foreign Investment Review Board (FIRB): If your buyer is from overseas, FIRB approval might be needed to confirm the sale is in Australia's best interests.

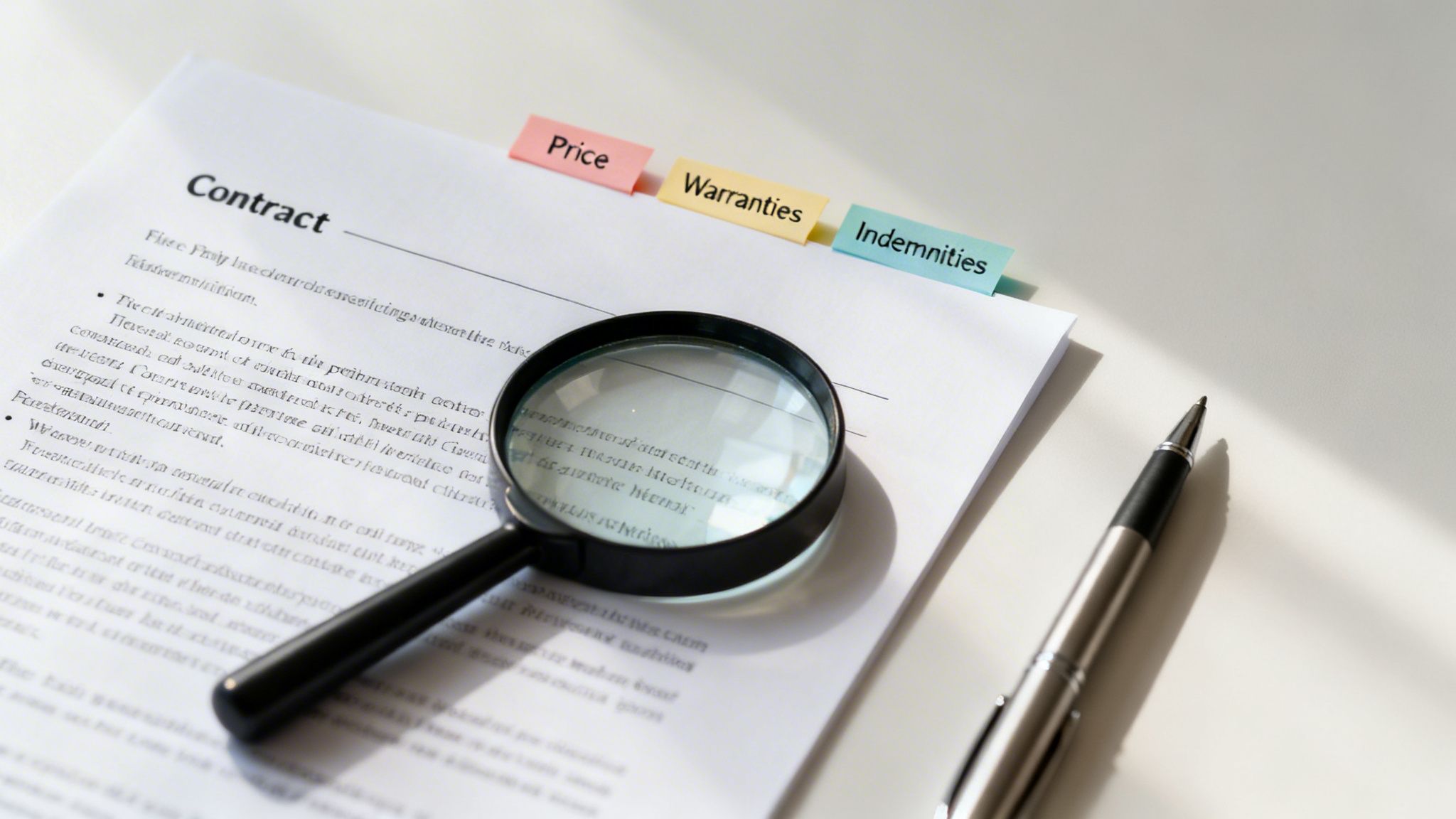

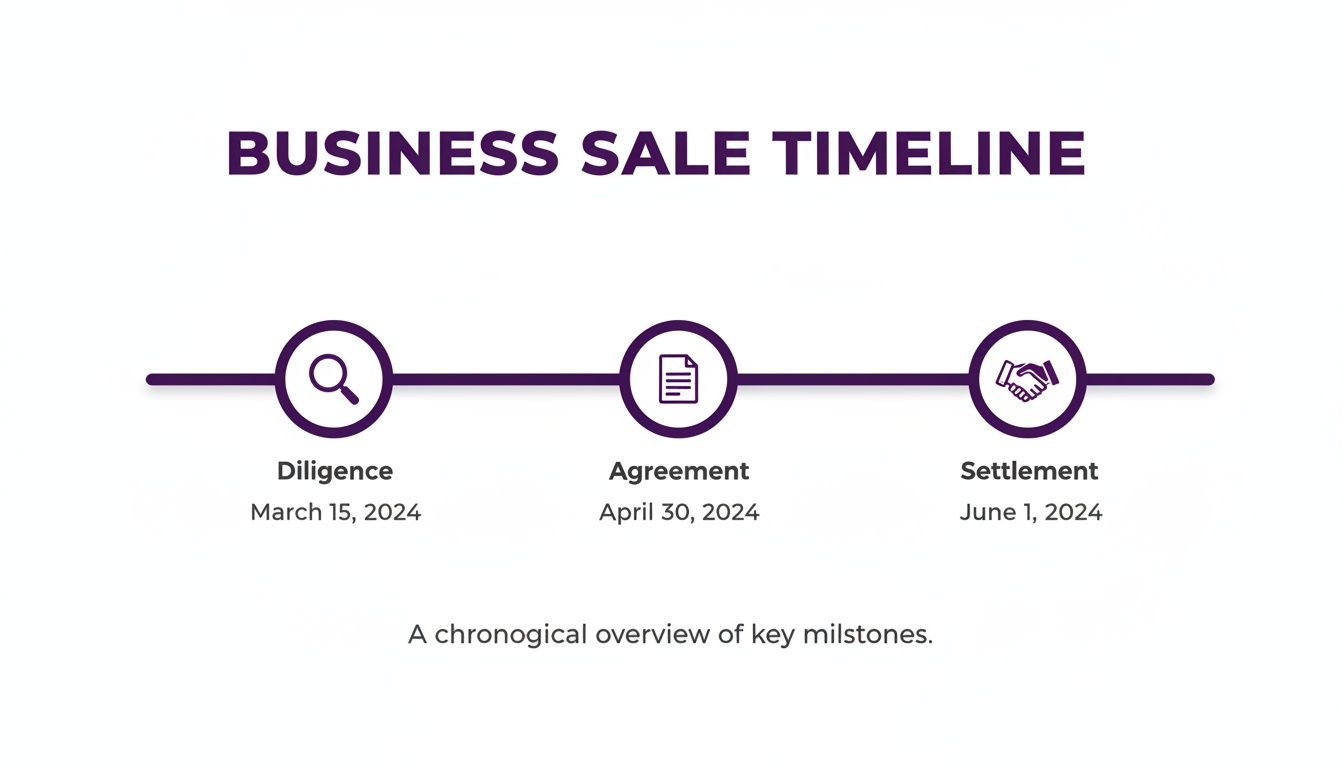

This visual timeline shows you how all these pieces typically fit together, from the initial due diligence right through to the final settlement.

As you can see, regulatory approvals and tax planning aren't last-minute details. They need to be woven into the process from the very beginning. This proactive approach is a hallmark of Australia's dynamic M&A market. To give you an idea, recent data shows Australia saw 186 transactions worth a massive US$11.2 billion in just one quarter. It’s a market that sees fluctuating deal numbers but consistently high values, driven by both local and international investors. You can find more detailed analysis of Australian M&A trends on S&P Global Market Intelligence.

Successfully Signing and Managing Your Agreement

It’s easy to think that signing the agreement of purchase and sale of business is the final step. In reality, it’s the starting pistol for the last, and arguably most critical, phase of the deal. Getting the post-signature management right is what turns a solid contract into a successful real-world transition.

This stage is less about legal drafting and more about practical execution. It's about a clean handover and making sure every promise made on paper is delivered in practice. How you navigate this final leg is what ultimately protects you from future headaches and truly locks in the value of the transaction.

Best Practices for Signing and Execution

The act of signing itself needs to be handled with precision. Thankfully, in Australia, electronic signatures are legally recognised for most commercial contracts. This offers a highly secure and efficient way to finalise the deal without the back-and-forth of couriering physical documents. Using a platform that creates a cryptographic audit trail gives you an even stronger layer of security.

Whether you're using a pen or a screen, the golden rule is to ensure all parties sign the exact same version of the final agreement. If any last-minute amendments are made, everyone must initial those changes to show they've seen and approved them. It’s a simple step that prevents enormous confusion down the track. You can dive deeper into this modern signing method by checking out our guide on what a digital signature is.

Your Post-Settlement Checklist

Once the ink is dry and the keys are handed over, organisation is everything. A post-settlement checklist is your best friend, ensuring no crucial obligations are forgotten during the busy transition period.

Here’s a look at the essential tasks that need your attention:

- Finalise Price Adjustments: Get those final figures for working capital or other purchase price adjustments calculated and settled as quickly as possible.

- Monitor Warranty Periods: Both buyer and seller need to keep a close eye on the calendar. Track the expiry dates for making any claims under the agreement’s representations and warranties.

- Transition Key Accounts: Work together to smoothly transfer control of bank accounts, supplier relationships, essential software subscriptions, and utilities.

- Secure Document Storage: Keep a complete, fully signed copy of the agreement and all related documents (like due diligence reports and closing statements) in a secure place where you can easily find them later.

Diligent post-closing management is your final line of defence. It ensures every term agreed upon is fulfilled and protects both the buyer and seller from costly oversights long after the handover is complete.

This kind of careful management is crucial, especially in the current climate of high confidence across the Australian market. A recent Deloitte survey found 75% of M&A leaders believe conditions support strong deal activity, with 54% prioritising acquisitions for growth. This optimism signals a market driven by strategic moves, which makes meticulous post-deal follow-through more important than ever. You can explore more on these M&A trends and insights from Deloitte's report.

Common Questions About Business Sale Agreements

Selling your business is a huge step, and it's completely normal to have a lot of questions pop up along the way. Let's tackle some of the most common queries that come up when you're working through an agreement of purchase and sale of business.

Do I Always Need a Lawyer for a Business Sale Agreement?

In a word, yes. Trying to handle a business sale agreement without a lawyer is like trying to do your own major surgery; it’s incredibly risky. These documents are packed with legal complexities that have serious, long-term financial consequences.

A good commercial lawyer does more than just fill in a template. They’re there to protect your interests, spot hidden risks you’d never see, and make sure the whole deal is rock-solid and enforceable under Australian law. Think of the legal fees not as a cost, but as an essential investment to safeguard you from a bad deal that could cost you far more down the track.

How Long Does the Business Sale Process Usually Take?

This is a classic "how long is a piece of string?" question, as every sale is different. The timeline really depends on the complexity of your business, how ready the buyer is, and just how smoothly negotiations go.

That said, for a typical small to medium-sized Aussie business, you're usually looking at a timeframe of six to twelve months from the moment you list it to the day you hand over the keys. The best way to speed things up? Get your house in order early. Having all your financial records and key documents organised and ready for due diligence can shave weeks, or even months, off the process.

It's easy to think signing the agreement is the finish line, but it’s not. The big day is the 'closing date' or 'settlement date', which is when the ownership officially changes hands. This often happens weeks or even months after signing.

What Is the Difference Between the Signing Date and Closing Date?

This is a really important distinction that often catches people out. They sound similar, but they mark two very different milestones in the sale process.

- The Signing Date: This is the day everyone puts pen to paper (or clicks 'sign' electronically). The moment it's signed, the agreement becomes a legally binding contract.

- The Closing Date: This is the future date set out in the contract when everything is finalised. It’s when the buyer makes the final payment, and you officially transfer ownership of the business.

The gap between signing and closing gives both sides time to tick off any final conditions, like getting the landlord’s official consent to transfer the lease or securing finance.

Streamline your operations from timesheets to e-signatures with Payly. Our all-in-one platform helps Australian service businesses get organised and paid faster, replacing five subscriptions with one simple tool. Start your free 14-day trial today.

Payly Team

Sharing insights and strategies to help service businesses thrive. Follow Payly for more tips on time tracking, invoicing, and business operations.

Related Articles

Ready to streamline your business?

Join thousands of freelancers and agencies who use Payly to track time, send invoices, and get paid faster.