A Guide to Accounts Payable Automation Software for Agencies

Discover how accounts payable automation software transforms agency workflows. Streamline invoices, cut costs, and improve accuracy with our complete guide.

Payly Team

February 1, 2026

At its heart, accounts payable automation software is a tool designed to take the manual grind out of paying your bills. It handles everything from the moment an invoice lands in your inbox to the final payment, helping Aussie businesses save time, sidestep costly mistakes, and get a much better grip on their finances.

What Is Accounts Payable Automation and Why Does It Matter?

Think of your current, manual AP process as trying to navigate Sydney traffic during peak hour. It’s slow, incredibly frustrating, and one wrong move can bring everything to a grinding halt. You’re constantly chasing approvals, painstakingly keying in invoice details, and shuffling paper, all while your valuable time gets eaten up by admin. This old-school approach isn't just inefficient; it's a genuine drain on your business's resources.

This is where accounts payable automation software comes in, acting like your personal express lane. It completely transforms your workflow into a seamless, digital journey. Instead of being buried under a mountain of paperwork, the software instantly captures, sorts, and sends every bill where it needs to go. It’s a fundamental change from being reactive and manual to proactive and automated.

The Problem with Manual AP Processes

For many small service businesses in Australia, the manual AP process is a minefield of hidden costs and operational headaches. It’s built on a delicate sequence of human steps, and a single slip-up can cause a cascade of problems.

Here are a few of the most common pain points:

- Time-Sucking Data Entry: Manually punching invoice details into your accounting software is not just boring; it’s a recipe for mistakes. A simple typo can easily lead to an overpayment or a missed due date.

- Costly Human Errors: From paying the same invoice twice to miscalculating GST, these manual mistakes add up fast. The real cost to process one invoice by hand is often much higher than you'd think once you account for staff time and potential errors.

- Approval Bottlenecks: We’ve all been there, chasing someone down the hallway or sending endless follow-up emails just to get a bill approved. These delays can strain your relationships with suppliers and mean you miss out on handy early payment discounts.

- Zero Financial Visibility: When invoices are scattered across desks and buried in inboxes, you have no real-time view of your cash flow. It turns financial forecasting and budgeting into a complete guessing game.

A manual AP process creates constant friction in your business. It pulls your team away from the important, client-focused work that actually grows your business, tying them up with low-value admin.

The Solution Automation Provides

Accounts payable automation software tackles these issues head-on by smoothing out every single step. It digitises invoices the moment they arrive, uses smart technology to pull out the key information, sends them for approval based on rules you set, and then lines up the payments.

For small businesses keen to tighten up their financial operations, getting a handle on the bigger picture of automation is a great first step. A good starting point is this practical guide on automation for small business, which helps you spot the right tasks and tools for the job.

By cutting out the manual touchpoints, you instantly get back countless hours and build a crystal-clear, efficient system for managing your expenses. This simple shift frees you up to focus on what you do best: growing your business and looking after your clients.

The Must-Have Features of Great AP Automation Software

When you start looking at AP automation software, the sheer number of options can be dizzying. But it gets a lot simpler once you know what to look for. Think of this as your practical checklist, the non-negotiable features that solve real-world business headaches and give you your time back.

Not all platforms are created equal, particularly when you factor in the specific needs of Australian businesses. The best software goes way beyond being a simple digital filing cabinet for invoices. It offers a set of smart, interconnected tools that build a genuinely smooth AP process, from the moment an invoice lands to its final payment.

Intelligent Invoice Capture (OCR)

The engine of any solid AP automation system is Optical Character Recognition (OCR). This is the magic that reads invoices for you, whether they’re PDFs in an email or scanned paper documents. It automatically spots and pulls out all the crucial details: the supplier’s name, ABN, invoice number, due date, and even the line items with GST.

This one feature gets rid of the most mind-numbing and error-prone part of the old-school process: manual data entry. Knowing how to automate data entry with AI is fundamental to making any accounts payable system truly efficient.

Automated Three-Way Matching

If your business relies on purchase orders (POs), then three-way matching is a game-changer. It’s like having a digital gatekeeper that automatically checks if a payment is legitimate before a single dollar leaves your account.

The software cross-references three documents in a flash:

- The Purchase Order: What your business agreed to buy in the first place.

- The Goods Received Note: The proof of what actually showed up at your door.

- The Supplier Invoice: What the supplier is asking you to pay for.

When all three documents match up, the invoice is green-lit for payment. But if there’s a discrepancy, a difference in quantity or price, the system flags it for a human to look at. This simple check is brilliant at preventing costly overpayments and catching potential fraud.

Customisable Approval Workflows

Let’s be honest, chasing people for invoice approvals is a massive time-waster. Good AP automation software puts an end to this with customisable approval workflows. You can set up simple, logical rules that automatically send invoices to the right person for the sign-off.

For instance, you could create rules like:

- Any bill from our marketing supplier under $500 goes straight to the marketing manager.

- All IT invoices over $1,000 need a tick from both the department head and the finance director.

This stops bills from getting lost in someone’s inbox, speeds up the entire process, and gives you a clear line of sight over company spending. It also creates a perfect digital audit trail, which is incredibly useful for compliance and end-of-year reviews. Of course, a strong audit trail needs a solid foundation, which is where choosing the right document management software for your Australian business comes in.

Seamless Accounting Integrations

Finally, any software worth considering must connect perfectly with the accounting system you already use. For small businesses in Australia, that means rock-solid, native integrations with platforms like Xero, MYOB, and QuickBooks.

A seamless link means that as soon as an invoice is approved, all the relevant data, including vendor info, expense codes, and GST amounts, is pushed directly to your general ledger. This completely removes the need for double data entry, keeps your books accurate in real-time, and makes tedious tasks like BAS reporting much, much easier.

What Are the Real-World Benefits of Automating Accounts Payable?

Moving past a simple feature list, the real power of accounts payable automation software is the direct, measurable impact it has on your business. For a busy Australian service business, these aren't just abstract ideas; they're tangible returns that boost your financial health and sharpen your competitive edge. The jump from manual processing to an automated system brings massive improvements right across the board.

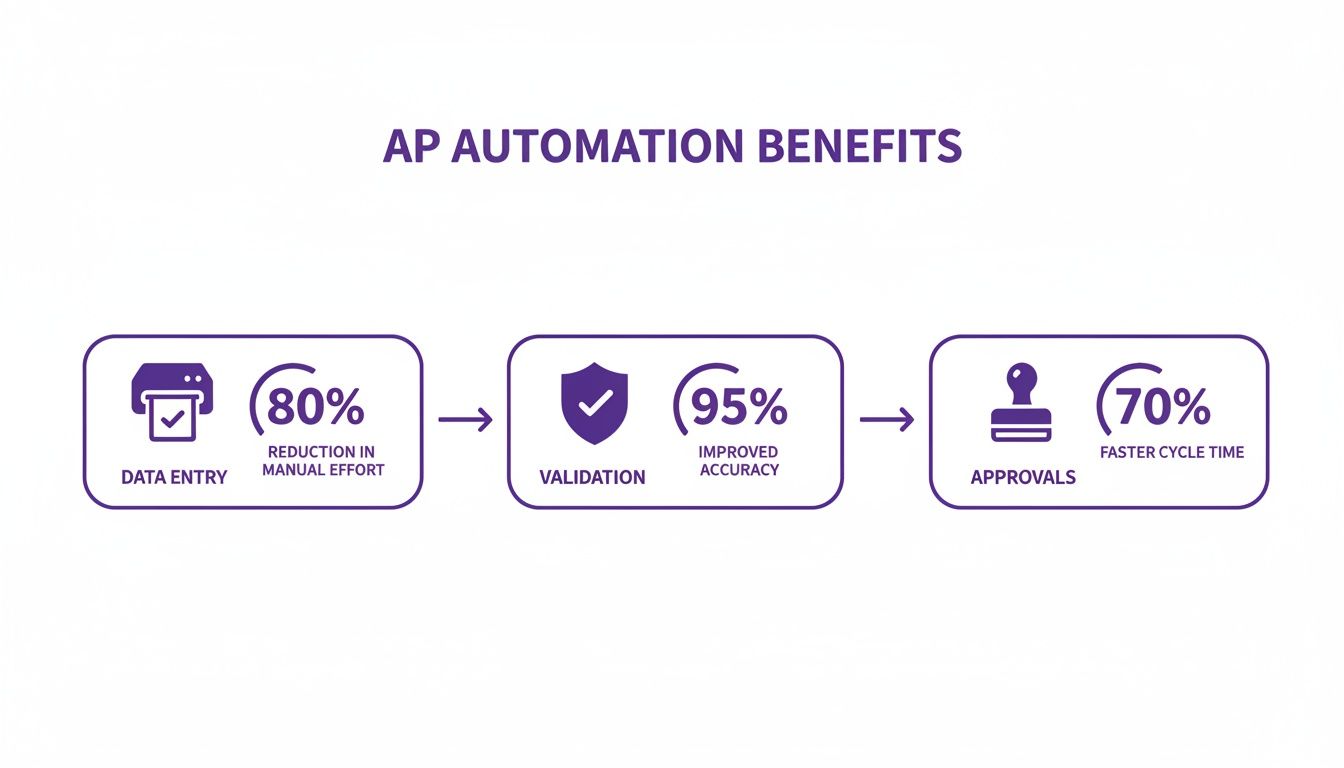

These gains come from core automated functions like smart data capture, validation, and approval workflows that just work.

This shows just how much automation slashes manual work, ramps up accuracy, and speeds up the entire approval process from start to finish.

Drive Down Your Operational Costs

One of the first things you'll notice is a serious drop in your costs. Manual invoice processing is surprisingly expensive when you add up staff hours, paper, postage, and the unavoidable cost of human error. In fact, studies show manual processing can cost upwards of $15 for every single invoice.

AP automation software tackles this expense head-on. By taking over data entry, validation, and approvals, it drastically cuts the labour cost tied to each bill. It also helps you sidestep late payment penalties by making sure invoices are approved and paid on time, protecting both your cash flow and your supplier relationships.

Let’s look at a simple comparison for a typical small business processing around 100 invoices a month.

Manual AP vs Automated AP: A Cost and Time Comparison

| Metric | Manual Accounts Payable Process | Automated Accounts Payable Process |

|---|---|---|

| Average Cost Per Invoice | $15.00 | $3.50 |

| Time Per Invoice | 15 minutes | 3 minutes |

| Monthly Cost (100 invoices) | $1,500 | $350 |

| Monthly Time (100 invoices) | 25 hours | 5 hours |

| Annual Cost Savings | - | $13,800 |

| Annual Time Saved | - | 240 hours |

As you can see, the savings aren't trivial. An automated system puts real money and, just as importantly, significant time back into your business.

Boost Team Efficiency and Focus

Your team's time is your most valuable asset. Every hour spent manually punching in data, chasing down approvals, or fixing payment mistakes is an hour not spent on billable client work or growing the business. This administrative quicksand is a huge drag on productivity.

By bringing in AP automation, businesses often report a staggering 50% reduction in invoice processing time. This allows your team to shift their focus from mind-numbing admin to the work that actually matters. For example, modern platforms handle Australian GST down to the cent, reducing compliance headaches with the ATO. Research shows that Australian and New Zealand firms using these tools see invoice matching improve so much that it cuts payment errors by 39%. You can find more insights on AP automation benefits at OFX.com.au.

Automation gives your team back its most precious resource: time. It frees them from low-value administrative tasks, empowering them to concentrate on the high-impact work that truly drives your agency forward.

Gain Real-Time Financial Visibility

When your AP process is manual, getting a clear, up-to-the-minute picture of your finances is almost impossible. Invoices get stuck in email inboxes or sit on desks, leaving you with a fuzzy, incomplete view of your cash flow commitments. This lack of clarity makes accurate financial forecasting a guessing game.

Automated systems give you a central dashboard where you can see the status of every single invoice in real time. No more digging.

This instant visibility allows you to:

- Forecast Cash Flow Accurately: Know exactly what you owe and when, so you can manage your cash with confidence.

- Make Smarter Decisions: Use real-time data to inform your budgeting, spending, and strategic plans.

- Improve Financial Control: Maintain a clean audit trail of every transaction, from the moment an invoice arrives to the final payment.

Strengthen Supplier Relationships

Your suppliers are critical partners. Paying them on time, every time, builds trust and strengthens those vital relationships. But manual processes are notorious for causing delays, lost invoices, and payment mix-ups that can quickly sour even the best partnerships.

Accounts payable automation ensures your suppliers are paid accurately and promptly. This reliability not only keeps them happy but can also open the door to better payment terms or even early payment discounts. In a competitive market, being known as a dependable client is a powerful advantage that helps your business run that much more smoothly.

Choosing the Right AP Software for the Australian Market

Picking the right accounts payable automation software isn’t about chasing the longest feature list. For Australian businesses, it's about finding a platform that genuinely gets our unique financial landscape. A tool built for another country can easily create more problems than it solves, leaving you tangled in compliance headaches and clunky workarounds.

To make a smart decision, you need a clear checklist of what actually matters for your business. This means looking past the slick marketing and measuring each option against the day-to-day realities of running a service business in Australia. From local tax rules to the accounting tools you already live in, the right software should feel like it was built just for you.

Let's walk through an actionable checklist to help you cut through the noise and find a platform that’s a perfect fit.

Australian-Specific Compliance and Features

First things first: any accounts payable automation software worth your time has to be fluent in Australian tax law. These aren't just "nice-to-haves"; they are absolute non-negotiables for staying on the right side of the Australian Taxation Office (ATO) without drowning in manual checks.

When you're evaluating your options, make sure they tick these boxes:

- Robust GST Handling: Does the software automatically spot, calculate, and code the Goods and Services Tax on every invoice? This is a huge time-saver and critical for getting your Business Activity Statement (BAS) right.

- ABN Validation: Can the platform instantly check Australian Business Numbers (ABNs)? This simple feature ensures you're paying legitimate suppliers and keeps your records clean.

- Local Data Hosting: Where is your financial data being stored? For peace of mind and compliance with Australian privacy principles, choosing a provider with local data centres is a massive advantage.

Choosing a platform that is purpose-built for the Australian market isn't just a convenience; it's a critical step in mitigating compliance risks. Features like automated GST calculations and local data security are essential for operating confidently.

Seamless Integration with Your Existing Tools

Your AP software doesn't exist in a bubble. It needs to talk to the accounting platform that serves as your business's financial brain. For most Aussie businesses, that means seamless, reliable integrations with a few key players.

Look for native, one-click integrations with the tools you already use:

- Xero: The go-to accounting software for most small businesses in Australia.

- MYOB: A long-standing favourite with a huge, loyal user base.

- QuickBooks: Another popular choice, especially for agencies and service-based businesses.

A solid sync means that once an invoice is approved, all the important data flows straight into your general ledger. This completely eliminates double-handling, keeps your financial records accurate, and makes bank reconciliation a walk in the park. For a refresher on why this accuracy is so important, check out our guide on how to send an invoice correctly.

Scalability and Pricing Model

Your business is growing, and your software should be ready to grow with you, not hold you back. As you bring on more staff or land bigger clients, your AP workload will naturally increase. The right solution should scale effortlessly without the price tag becoming eye-watering.

Pay close attention to how platforms structure their pricing:

- Per-User Fees: This is a common model where you're charged for every person who needs access. It can get very expensive, very fast as your team expands.

- Account-Based Pricing: This model offers a flat fee for the whole company, which makes your costs predictable and easy to manage as you grow. It's often the most cost-effective option for ambitious businesses.

Never commit without asking for a free trial. It's the only real way to see if the software gels with your workflow and actually delivers value. Remember, businesses that successfully automate AP often claw back 8-10 hours per week of manual work, so the right tool pays for itself.

Security and Support

Last but not least, you’re trusting this software with incredibly sensitive financial information. Security can't be an afterthought. Make sure any provider you consider meets high standards for data protection, including things like bank-level encryption and regular security audits.

Just as important is the quality of their customer support. When you hit a snag, you need fast, helpful advice from a team that understands your business context. Always prioritise providers with an Australian-based support team available during your business hours. That local expertise can be the difference between a quick fix and a day of lost productivity.

How Payly Brings It All Together for Australian Agencies

While the idea of automation sounds great, the reality for many Australian agencies is a messy patchwork of different software. You end up juggling multiple subscriptions, which isn't just expensive, it's inefficient. One tool for timesheets, another for documents, and a third for invoices. It’s a constant app-switching headache that creates disconnected workflows.

We built Payly to fix that exact problem. It’s a single platform for your business operations, designed to replace that clumsy tech stack with one unified system. It pulls everything from purchase orders to payments into one logical workflow.

A Single Source of Truth for Your Agency

The real power of Payly is having everything in one place. Instead of your team digging through different platforms to find what they need, they have one central hub for all things financial. This gives you a crystal-clear view from the initial purchase request all the way to the final payment. That kind of visibility is vital for staying in control.

A unified system also puts an end to mind-numbing double entry. For example, once a purchase order is approved in Payly, it automatically lines up with the invoice when it arrives. No more re-typing details into another program. That saves a heap of time and drastically cuts down on human error.

Built for Australian Businesses

Payly isn’t just another piece of generic accounts payable automation software. It was designed from the ground up specifically for the Australian market, and you can see it in the details.

Here’s what makes it truly local:

- Built-in GST Handling: The system automatically spots and calculates GST, keeping your numbers accurate and making BAS time much less of a chore.

- Local Payment Scheduling: Payly gets the Aussie business calendar. It helps you schedule payments around public holidays and works with local banking timelines.

- AUD as Standard: Everything is in Australian dollars, right out of the box. No confusion, no conversion hassles.

This focus on local requirements means you can stop worrying about compliance and manual checks and get back to focusing on your clients.

For an Australian agency, using a tool that understands local tax and business practices isn’t just a nice-to-have, it’s essential. Payly’s design ensures you’re always aligned with ATO standards.

Predictable Pricing That Grows With You

One of the biggest frustrations for growing agencies is software pricing that punishes you for hiring. Those per-user models mean your costs can spiral every time you expand the team. Payly does away with that with a simple, account-based pricing model.

You pay one flat fee for your entire team. It doesn't matter if you have three people or thirty. This lets you scale your business without the dread of ballooning software bills. It's a fairer approach that actually supports your growth.

By combining the right features under one roof with a transparent price, Payly offers a genuinely practical solution. If you're keen to see how this unified approach could work for your business, you can find out more about Payly for agencies and simplify your operations.

Sidestepping the Common Stumbles When You Automate Accounts Payable

Bringing new software into your business is always a big move. But getting it right is less about the tech itself and more about good old-fashioned planning and people skills. A smooth rollout for your accounts payable automation software is entirely possible when you know what to look out for.

Think of it like this: a clear plan is your roadmap. It helps you navigate around the usual bumps in the road, like team confusion or technical hiccups. By mapping out your current processes, getting your team on board early, and maybe even running a small test run, you can turn a potentially tricky transition into a simple, effective upgrade for your business.

Stumble #1: Poor Change Management

Honestly, the biggest hurdle you'll face isn't the software, it's human nature. We're creatures of habit. If you just drop a new tool in your team's lap without explaining the why behind it, you’ll be met with resistance, or worse, they just won't use it.

The secret? Communication. It’s all about framing the change around how it makes their lives easier. We're talking less tedious data entry, no more chasing people for approvals, and getting suppliers paid on time, every time.

Here’s a simple game plan:

- Get Your Team Involved Early: Before you even choose a tool, ask them what drives them crazy about the current process. When they help identify the problem, they'll be much more invested in the solution.

- Find a "Champion": Pick someone on the team who’s generally good with tech and gets what you’re trying to do. They can be the go-to person for questions and help build a bit of positive buzz.

- Be Straight Up: Let everyone know the plan and the timeline. Acknowledge that there will be a learning curve, and that’s perfectly normal.

Stumble #2: Skimping on Training

Even the most user-friendly software has a few quirks. Just sending out logins with a "good luck!" email is a recipe for disaster. People will get frustrated, make mistakes, or simply go back to their old spreadsheets because it feels safer.

Proper training isn't a one-off demo. It's about building confidence. Your team needs to feel like they can really master the new system and use it to its full potential.

A successful rollout all comes down to user adoption. If the team isn't trained properly, you've only bought a piece of software, you haven't actually solved a problem.

Make sure you set aside proper time for training sessions that walk through the real-world tasks they'll be doing every day. And make sure they know where to find help, whether that’s a library of how-to videos or a direct line to a friendly support person.

Stumble #3: Choosing a System That Can't Grow With You

It's easy to fall into the trap of picking software that fixes today's headaches but creates brand new ones a year from now. A classic example is a system with rigid per-user pricing that becomes incredibly expensive as you hire more people. Another is a tool that slows to a crawl once your invoice volume starts to climb.

You have to think a few steps ahead. Look for a solution with a flexible pricing model that doesn't punish you for growing your business. Make sure the accounts payable automation software you choose is built to handle more suppliers, more invoices, and more complexity without breaking a sweat. This foresight is what turns a short-term fix into a long-term investment.

And looking even further down the road, AI is becoming a game-changer in this space. While only 7% of Australian AP teams are using AI right now, a massive 40% are planning to bring it on board this year. A big driver for this is the shocking 39% error rate found in manual invoicing, a problem that costs businesses millions. For service-based businesses like yours, AI-powered tools can slash approval times and even help spot potential fraud before it happens. You can dig deeper into these ANZ accounts payable trends from Flairstech.

Your AP Automation Questions, Answered

Alright, even after seeing all the upsides, it's smart to have a few questions before you jump in. Let's tackle the common ones we hear from Australian business owners, so you can feel confident about making the move.

What's the Real Cost of AP Automation Software in Australia?

The price tag can really swing from one platform to another, but don't just get fixated on the monthly subscription fee. A lot of providers use a per-user pricing model, which can get out of hand fast as you bring on more staff. It’s a model that essentially penalises you for growing.

A better way to go is an account-based model, where you pay a single flat fee for the whole business. When you’re weighing up the costs, think about the total value you're getting. Factor in the hours saved, the expensive mistakes you’ll avoid, and the other software subscriptions you might be able to cancel. And always, always take it for a spin with a free trial to see how it actually performs in your day-to-day workflow.

Can This Software Handle Tricky Australian GST Calculations?

It absolutely has to. For any accounts payable automation software to be worth its salt in Australia, handling Goods and Services Tax properly is a must-have. It’s simply not negotiable if you want to stay compliant.

Good platforms use smart OCR technology to automatically read, pull out, and calculate the right GST amount from every single invoice. This takes a massive headache out of preparing your Business Activity Statement (BAS) and dramatically cuts the risk of getting on the wrong side of the ATO.

How Hard Is It to Connect AP Software with Xero or MYOB?

It's actually surprisingly easy. The best tools are designed from the ground up to play nicely with the accounting software Australian businesses already rely on. Look for one-click integrations with major platforms like Xero, MYOB, and QuickBooks.

This tight connection means your financial data syncs automatically, killing off the soul-destroying task of double-entry once and for all. It keeps your general ledger perfectly in sync and ensures everyone is working from the same set of numbers, without any extra effort.

Ready to stop juggling multiple subscriptions and unify your business operations? Payly brings together everything from purchase orders to payments in one simple, Australian-focussed platform with predictable pricing that grows with you. Start your free 14-day trial today.

Payly Team

Sharing insights and strategies to help service businesses thrive. Follow Payly for more tips on time tracking, invoicing, and business operations.

Related Articles

Ready to streamline your business?

Join thousands of freelancers and agencies who use Payly to track time, send invoices, and get paid faster.