A Guide to Accounting Software for Freelancers in Australia

Discover the best accounting software for freelancers in Australia. This guide covers key features, choosing the right tool, and streamlining your finances.

Payly Team

January 29, 2026

The best accounting software for a freelancer is one that handles the tedious stuff for you: invoicing, tracking expenses, and keeping the tax office happy. For us Aussies, that means having built-in support for GST and BAS reporting is an absolute must-have. It’s what turns hours of admin dread into a quick, straightforward task.

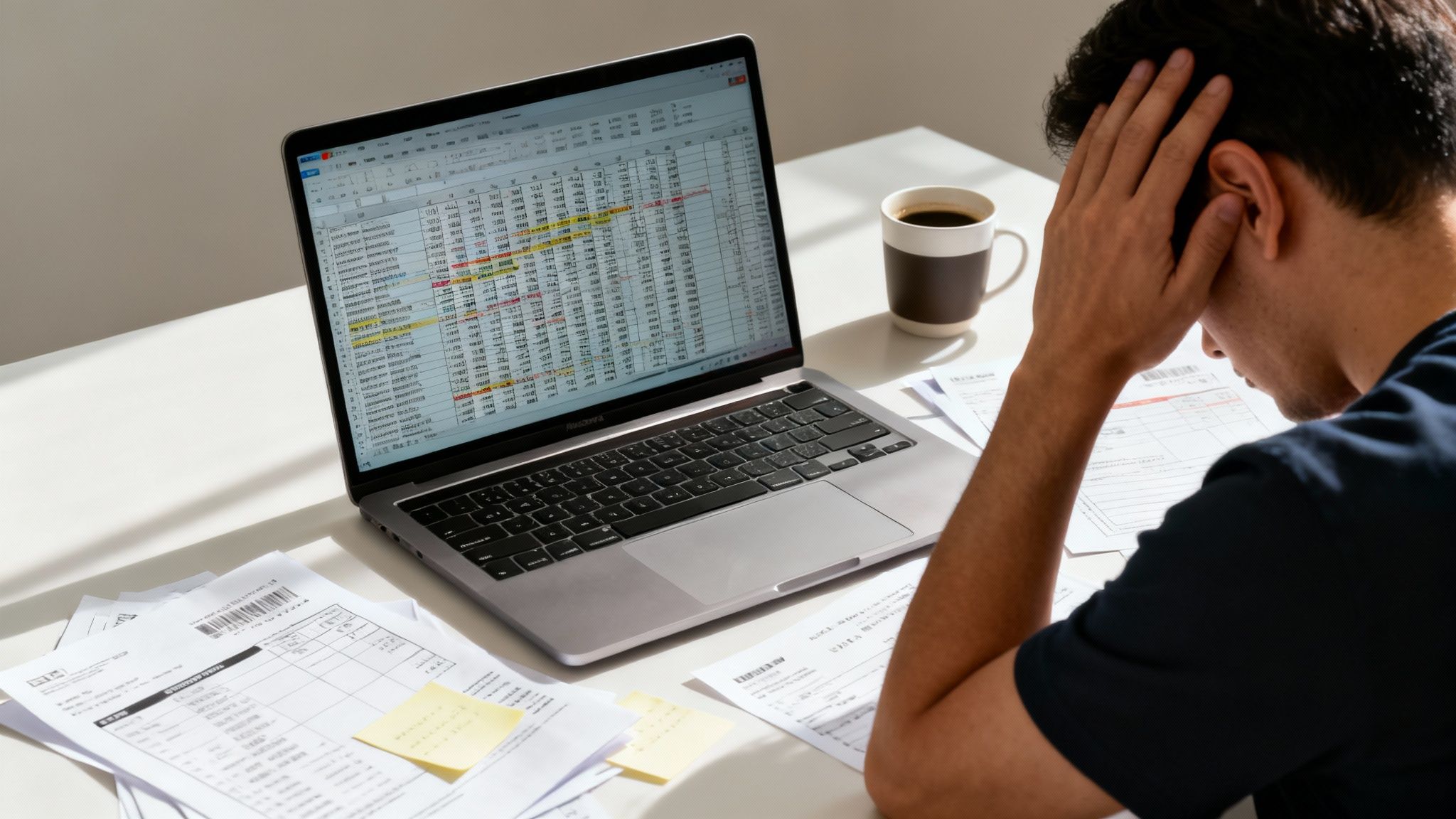

Why Spreadsheets Are Holding Your Freelance Business Back

If you’re still wrangling your freelance finances in a spreadsheet, you know the feeling. The endless copy-pasting, the tangled formulas, the manual data entry for every coffee receipt, and that nagging worry that your GST calculations are off. It feels like you’re in control at first, but it quickly becomes a massive time-sink.

This manual method isn't just clunky; it's downright risky. A single misplaced decimal point or a forgotten expense can throw your financial reporting completely out of whack, creating a nightmare come tax time. Every hour you spend trying to match bank statements to invoices is a billable hour you'll never see again.

The True Cost of Manual Financial Management

The problem with spreadsheets isn't just the inconvenience. It genuinely costs you money and can even damage your professional image. Think of it like trying to build a house with a hand screwdriver instead of a power drill. Sure, you might get it done, but it’s painfully slow, exhausting, and the final product is likely to be a bit wobbly.

For Aussie freelancers, the common pain points of using spreadsheets usually include:

- Delayed Payments: Manually creating and emailing invoices is slow. Without a system to send automatic reminders, you're stuck with the awkward and time-consuming job of chasing up late payments, which can strain client relationships.

- Compliance Risks: Getting your GST calculations right and lodging your Business Activity Statement (BAS) is tricky. One small formula error could mean you overpay or underpay the Australian Taxation Office (ATO), which can lead to nasty penalties.

- No Real-Time Insights: A spreadsheet can’t give you a quick, clear picture of your business's health. You have no instant visibility on your cash flow, who owes you money, or how profitable you were last month without a whole lot of manual effort.

- Lost Billable Hours: Every minute you spend on admin is a minute you’re not earning. This admin drag directly eats into your income.

For many freelancers, the "aha!" moment hits hard when it’s time to do the BAS. That frantic scramble to find every receipt and the tedious process of reconciling income and expenses makes it painfully clear just how unsustainable manual bookkeeping really is.

The Shift to Smarter Systems

The good news is, there’s a much better way. Moving to accounting software designed for freelancers is about taking back your time and giving your business a solid financial foundation. While spreadsheets seem like a free solution, understanding some basic small business bookkeeping tips will quickly show why dedicated software is the only serious choice for a professional.

The trend speaks for itself: 73% of Australian small businesses are already using cloud-based accounting software. This shift is powering a $1.2 billion annual market because freelancers and small businesses need efficiency and peace of mind when it comes to compliance. Moving from a clunky spreadsheet to a smart cloud platform isn't a luxury anymore; it's a fundamental part of growing a successful freelance business.

The Must-Have Features in Freelancer Accounting Software

Choosing the right accounting software isn't just about picking a tool; it's more like hiring a digital business partner. You need a system that does more than just crunch numbers. You need something that actively saves you time, cuts down on the admin headache, and helps keep your business running smoothly.

The best platforms manage this by bringing several critical functions together under one roof. Think about tracking your billable hours and, with a single click, turning that timesheet straight into a professional invoice. That's the kind of smart efficiency that separates a basic tool from a real business asset.

It's not about a long list of features. It's about how those features work together to make your day-to-day financial wrangling a whole lot easier.

To help you sort through the options, it's useful to separate the absolute essentials from the features that are great to have but not strictly necessary for everyone. This depends a lot on how you work and the complexity of your freelance business.

Must-Have vs. Nice-to-Have Software Features for Aussie Freelancers

| Feature Category | Must-Have Feature | Why It's Essential | Nice-to-Have Feature |

|---|---|---|---|

| Invoicing & Time | Integrated time tracking and invoicing | Prevents double-handling and ensures you bill for every minute worked. It’s your core money-making workflow. | Project management tools |

| Expenses | Mobile receipt capture & auto-categorisation | Drastically reduces manual data entry and makes tax time a breeze by keeping expenses organised in real-time. | Supplier payment portals |

| Compliance (AU) | GST calculation & BAS reporting | Non-negotiable for staying compliant with the ATO. Automating this removes the risk of costly errors. | Superannuation tracking |

| Payments & Banking | Secure bank feeds & reconciliation | Gives you a live, accurate view of your cash flow and makes balancing your books simple and fast. | Multi-currency support |

| Contracts | Integrated e-signatures | Keeps your client onboarding process slick and professional without needing another paid subscription. | Customisable proposal templates |

Ultimately, the goal is to find a platform that covers all your "must-haves" while offering some of the "nice-to-haves" that will genuinely make your life easier.

Now, let's dig into what makes those core features so important.

H3: Time Tracking and Invoicing Integration

If you’re a service-based freelancer, your time is quite literally your money. The old way of logging hours in a spreadsheet and then manually creating an invoice somewhere else is a recipe for mistakes and wasted effort. Good accounting software for freelancers merges these two jobs seamlessly.

This means every billable minute you track is instantly ready to be invoiced. Imagine you're a freelance copywriter: you start a timer for a client’s blog post, and when you’re done, the software has already lined up an invoice with the correct hours and your set rate. No more guesswork or forgotten time.

Even better, a great platform can chase payments for you. Instead of you having to remember who’s late, the system can send out polite, automated reminders once an invoice is past its due date. It helps you get paid faster without damaging your client relationships.

Expense Management and Receipt Capture

Let's be honest, the shoebox full of crumpled receipts is a classic freelancer cliché for a reason. But it’s a chaotic and stressful way to manage your finances. Modern software sorts this out with mobile receipt capture.

You just snap a photo of a receipt on your phone. The app scans it, pulls out the key info like the vendor and amount, and categorises the expense for you. This gives you a clear, real-time picture of where your money is going.

The real magic of this happens at tax time. Instead of that frantic end-of-year scramble, all your deductible expenses are already digitised, sorted, and ready for your accountant or your BAS lodgement.

This level of organisation not only helps you claim everything you're entitled to but also creates a clean audit trail, which is a huge weight off your shoulders.

Australia-Specific Compliance Tools

For any freelancer in Australia, local tax compliance is non-negotiable. Your accounting software must be built for the Australian system. Just having AUD as a currency option doesn't cut it.

There are two features that are absolutely crucial for Aussie freelancers:

- Built-in GST Calculation: The software needs to automatically calculate and add GST to your invoices. This saves you from having to do fiddly maths and worrying about getting it wrong.

- BAS Reporting: A platform that generates the figures you need for your Business Activity Statement (BAS) is a massive time-saver. It gathers all the GST you've collected and paid into one simple report, making it much easier to lodge with the ATO.

Having these tools built-in means you can spend less time stressing about your tax obligations and more time doing the actual work you love.

Secure Bank Feeds and E-Signatures

Finally, a truly powerful platform connects all the dots between your proposals, invoices, and payments. Secure bank feeds automatically pull in your transaction data from your bank account, which turns bank reconciliation into a quick matching game instead of a painstaking manual task. It's the best way to know your books are always accurate.

On top of that, integrated e-signatures streamline your client onboarding. You can send contracts or project quotes directly from the platform and get a legally binding digital signature back. This means you don't have to pay for a separate e-signature service and all your important client documents stay organised in one central place.

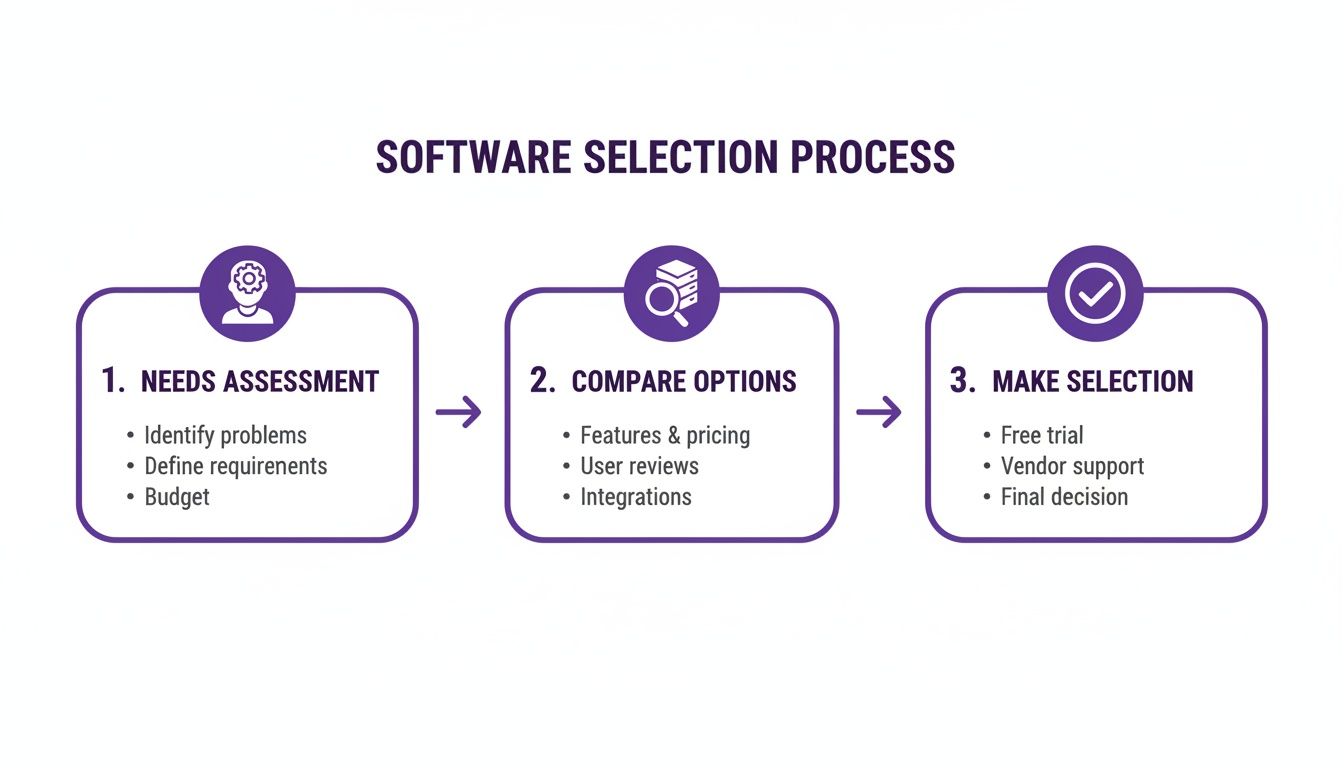

Choosing the Right Software for Your Business

Picking the right accounting software can feel a bit like wandering through a maze. There are so many options out there, all shouting about how they're the best. It's easy to feel swamped. But here’s the secret: the best choice isn’t about marketing hype. It starts with a really honest look at what your freelance business actually needs.

The trick is to think about where your business is right now and where it’s headed. Are you a solo creative sending out five invoices a month? Or are you a growing consultancy juggling a bunch of clients and complex projects? Your answer to that question will completely change what you should be looking for.

Evaluating Your Unique Business Needs

Before you even glance at a pricing page, take a minute to audit how you work. This simple step gives you a personalised checklist to measure every option against. It's the best way to avoid paying for flashy features you'll never touch or, worse, picking a tool you’ll outgrow in six months.

Start by asking yourself a few practical questions:

- How many clients do you have? Some platforms have sneaky limits on lower-tier plans or charge you per client.

- Do you bill by the hour or by the project? If you’re an hourly-rate freelancer, built-in time tracking is an absolute must-have.

- Do you bring in contractors? If you do, you might need a system that can handle payments to others or allow for multiple user logins.

- What other tools are essential to your workflow? Make sure the software plays nicely with your payment gateway (like Stripe), your bank, and any other apps you can’t live without.

This self-assessment gives you a solid foundation to build on, making sure the accounting software for freelancers you land on is a true fit.

Understanding Pricing Models and Scalability

Pricing can be tricky. That super-low monthly fee might catch your eye, but hidden costs, transaction fees, or per-user charges can make your bill balloon unexpectedly. Most platforms follow one of two paths: a tiered system where you pay more to unlock more features, or a straightforward flat-rate price.

A tiered model might seem cheaper at first, but it can get pricey fast as you grow. Imagine needing to add just one team member, only to find you have to jump to a much more expensive plan. On the flip side, an all-in-one platform with predictable pricing gives you stability. You know exactly what you’re paying, letting you grow without any nasty surprises.

The goal is to find a solution that scales with you. Switching accounting software is a massive headache. It’s disruptive and costs time and money, so choosing a platform that can support your journey from a one-person show to a small agency is one of the smartest moves you can make early on.

The Importance of Compliance and Support

Let’s be honest, financial compliance in Australia is a big deal. The local accounting services market, which recently hit USD 11.4 billion, is expected to double by 2033. Why? Because freelancers and small businesses are desperate for help navigating the ATO’s complex rules. With regulations getting tighter, getting it wrong can lead to hefty fines, which makes software with solid, built-in support for GST and BAS absolutely critical.

Just as important is the quality of customer support. When you're stuck on a payment issue or staring at a confusing tax report at 10 PM, you need help, and you need it fast. Look for platforms that offer real support from real people, so you’re never left stranded when you’re dealing with your finances. When you're weighing your options, getting a sense of what major players like Sage, Xero, and QuickBooks offer can provide a useful benchmark.

Ultimately, the right tool should feel less like software and more like a partner in your business. For a deeper dive into specific options, check out our guide on small business accounting software in Australia. It should take the pain out of your finances, keep you on the right side of the ATO, and give you back the time to focus on what you actually love doing: serving your clients.

Your New Workflow From Tracking Time to Getting Paid

Picture a typical project, but without all the usual admin headaches. What if your financial workflow felt less like juggling a bunch of clunky apps and more like one smooth journey, from the first minute of work to the final payment? With the right accounting software, this isn't just wishful thinking; it's completely achievable.

Let’s walk through what your day-to-day could actually look like. This shows how an all-in-one system can turn a jumble of separate tasks into a single, clean process that saves you time and gets you paid faster.

From Billable Minutes to Polished Invoices

It all starts the moment you begin working. Instead of fumbling with a separate timer app or scribbling notes in a pad, you click ‘start’ on a timer built right into your accounting platform. Every single billable minute is captured and automatically assigned to the right client and project.

Once the job is done, the real magic happens. With a couple of clicks, you can convert all those tracked hours into a professional, branded invoice. No more manual calculations, no copy-pasting details from one app to another, and zero risk of forgetting to bill for that extra half-hour of work.

This direct link between time tracking and invoicing cuts out the tedious admin that so often slips through the cracks. It ensures every second of your hard work gets accounted for. If you want to really nail this part of your process, check out these time tracking best practices for freelancers.

Automated Follow-Ups and Effortless Payments

You’ve created the invoice and now you can send it to your client straight from the software. But your job doesn’t end there. Instead, the system takes over the most awkward part of freelancing: chasing up late payments.

You can set up polite, automated email reminders that go out if an invoice becomes overdue. These professional nudges work on your behalf, helping you maintain a great client relationship while still making sure you get paid on time. This one feature can make a huge difference to your cash flow, and you never have to play the "bad guy."

A good, integrated system basically acts as your own personal accounts department. It handles the persistent follow-ups so you can focus on your next project instead of worrying about outstanding invoices.

When your client is ready to pay, they just click a link on the invoice and can pay instantly using gateways like Stripe. The whole process is designed to be as easy as possible for them, which naturally helps you get paid a whole lot faster.

Closing the Loop with Automatic Reconciliation

The final step is where a truly integrated system really proves its worth. Once the payment lands in your bank account, the journey is complete. Because your software is connected to your bank via a secure feed, it spots the incoming payment right away.

The platform then automatically matches that payment to the right invoice, marks it as paid, and reconciles the transaction in your books. This closes the loop without you having to lift a finger for manual data entry, giving you a crystal-clear, real-time view of your business’s financial health.

By figuring out your needs, comparing your options, and choosing an all-in-one platform, you can build a workflow that is efficient, professional, and almost entirely automated. You stop being just a freelancer and start operating like a smart, savvy business owner.

How Payly Solves Freelancer Challenges in Australia

It's one thing to know the common headaches for Aussie freelancers, but finding a single platform that actually fixes them? That’s the real prize. Too many of us get stuck patching together a Frankenstein’s monster of different apps. You’ve got one tool for tracking your time, another for sending invoices, and a separate, pricey subscription just to get contracts signed. It’s not just messy; it’s a quiet drain on your profits.

This is exactly where an all-in-one platform like Payly comes in. It was built to replace that expensive collection of subscriptions with one streamlined system. Instead of juggling Harvest, DocuSign, and QuickBooks, you get a single tool that handles everything from logging billable hours to getting contracts legally signed.

Unifying Your Workflow with Integrated Tools

The biggest problem with using a bunch of separate apps is the endless manual work it creates. You’re constantly exporting, importing, and copying data from one place to another. Payly gets rid of all that by weaving the essential freelancer tools into a single, logical workflow.

- Time Tracking That Flows into Invoicing: Every minute you track in Payly is ready to be added to an invoice instantly. Forget exporting timesheets or punching in numbers by hand. This simple connection cuts down on admin time and, more importantly, makes sure you bill for every single second of your hard work.

- Legally Binding E-Signatures: Instead of forking out for a dedicated e-signature service, you can create and send proposals and contracts straight from Payly. Clients can sign PDFs digitally on any device, and you get a legally binding document complete with a full cryptographic audit trail.

- Centralised Document Management: All your client documents, from the first signed agreement to the final paid invoice, are kept in one tidy, organised place. No more hunting through folders and email chains.

This integration is more than just a nice-to-have. It creates a smooth, professional journey from the moment you onboard a client to the moment you get paid.

Built for Australian Freelancers

Generic, overseas software often misses the mark for Australian freelancers because it completely ignores our local compliance rules. Payly was built from the ground up for the Australian market, and that native support makes a huge difference.

It handles Australian Dollars (AUD) and calculates GST automatically on all your invoices. This takes the guesswork and risk of manual errors out of the equation, helping you stay on the right side of the ATO. That focus on local needs saves you the major headache of trying to bend international software to fit Australian tax laws. You can see for yourself how Payly is structured specifically for freelancers and how its features are designed to work for you.

The real value of an all-in-one system is how much money it saves you. Stacking subscriptions for multiple tools can easily add up to hundreds of dollars every month. Payly’s simple, account-based pricing is a powerful and much more affordable alternative.

A Smart Investment for Growth

When you’re a freelancer, every dollar counts. Choosing the right accounting software for freelancers is one of the most important business decisions you’ll make. The Australian billing software market, currently valued at AUD 104.57 million, is expected to explode to AUD 525.04 million by 2035. What’s driving this? The nation's 1.5 million independent contractors are all looking for ways to automate their finances.

Automation helps you get paid faster and frees you up to focus on what you actually do best: the billable work. That’s why all-in-one solutions are such a game-changer. Learn more about the growth of the billing software market in Australia.

Ultimately, Payly isn't just about accounting; it's about streamlining your entire freelance operation. By bringing all the tools you need into one affordable platform, it helps you save money, win back your time, and run a more organised, professional, and profitable business.

Still Got Questions About Freelancer Accounting Software?

Picking the right accounting software is a pretty big deal for your freelance business, so it's totally normal to have a few last-minute questions buzzing around. To help you feel confident in your choice, let's run through some of the most common queries we hear from Aussie freelancers.

My aim here is to clear up any final uncertainties so you can pick the best tool for your gig.

Can I Actually Manage My BAS and GST with This Stuff?

Yes, you absolutely can. Any decent accounting software built for Aussies is designed from the ground up to handle GST and make lodging your Business Activity Statement (BAS) a breeze. The platform keeps a running tally of the GST you collect on your invoices and the GST you've paid on business expenses.

When BAS time rolls around, the software spits out a report with the exact numbers the ATO is looking for. This literally saves hours of painful manual calculations and dramatically cuts the risk of an expensive mistake.

Think of it like having a little tax expert built right into your workflow, keeping your GST records tidy all quarter. Instead of that last-minute panic, lodging your BAS just becomes a simple, predictable to-do item.

So, Do I Still Need to Pay for an Accountant?

Look, this software is fantastic for automating the day-to-day grind of bookkeeping, but it's not a substitute for the strategic brain of a good accountant. Your software is a champion at keeping your records organised and accurate, but an accountant gives you that high-level advice on tax planning, structuring your business, and thinking about your long-term financial health.

The massive win here is that clean, organised books make your accountant's job quicker and easier, which usually means you pay them less for their time. Most platforms also let you give your accountant secure access to your data, so working together is completely seamless.

How Painful Is It to Switch from My Old Spreadsheets?

Honestly, making the jump from spreadsheets is much easier than you probably think. Most modern accounting software for freelancers is designed to be incredibly user-friendly and comes with tools to help you get your old data across.

You can usually import things like your client list and any unpaid invoices straight from a simple CSV file. Platforms like Payly, for example, have great support articles and real people on customer service to walk you through it. The learning curve is surprisingly gentle, and you'll be up and running in no time.

What if My Business Takes Off and My Needs Change?

That’s a brilliant question, and something you should definitely be thinking about. The best software is built to grow with you. The last thing you want is a platform that holds you back just as you start landing bigger clients or offering new services.

Look for a solution that has different plans or optional add-ons. This gives you the flexibility to start with just the essentials you need today, and then switch on more powerful features as your business evolves. This could include things like:

- Multi-user access for when you hire a VA or collaborate with other contractors.

- Advanced reporting so you can see which projects are most profitable.

- More integrations with other business tools you might start using.

Choosing a scalable platform right from the start saves you the massive headache of having to migrate all your data to a new system later on.

Ready to stop juggling a dozen different subscriptions and get your freelance business organised? Payly pulls time tracking, invoicing, e-signatures, and all your Aussie compliance needs into one simple, affordable platform. Start your free 14-day trial today and feel the difference.

Payly Team

Sharing insights and strategies to help service businesses thrive. Follow Payly for more tips on time tracking, invoicing, and business operations.

Related Articles

Ready to streamline your business?

Join thousands of freelancers and agencies who use Payly to track time, send invoices, and get paid faster.