How Many Working Weeks in a Year An Australian Guide

Calculate the actual working weeks in a year for Australian businesses. Our guide covers formulas, public holidays, and turning billable hours into revenue.

Payly Team

February 5, 2026

It’s a simple question: how many weeks are in a year? The calendar says 52, but if you're planning your work schedule or finances around that number, you're setting yourself up for a nasty surprise.

The reality is that your actual number of working weeks is quite a bit lower. Why? Because that 52-week block doesn't account for your well-deserved time off, like annual leave and all those lovely public holidays.

Calculating Your True Number of Working Weeks

Getting a grip on the difference between a calendar year and your actual working year is the cornerstone of solid project planning and financial forecasting. For Australian freelancers and agencies, this isn't just academic; it directly impacts your quotes, deadlines, and bottom line. Getting this number wrong is a classic rookie mistake that leads to over-promising, under-delivering, and missing your income goals.

To figure out your true number of working weeks, you first need to accept that the 52-week year is a myth in the working world. It's crucial to understand how many work weeks in a year you can realistically bill for.

For a typical full-time Australian employee, the year isn't 52 working weeks. Once you subtract the standard four weeks of annual leave and about two weeks for public holidays, you're left with approximately 46 working weeks.

Why This Calculation Matters

Ignoring your non-working weeks creates a huge gap between your plans and what you can actually achieve. Think of it like planning a road trip based purely on the total kilometres, without factoring in stops for petrol, food, or a decent night's sleep. You’d never make it on time.

Nailing this calculation is vital for:

- Accurate Quoting: You can base your project fees on the real time you have available, ensuring you don't undercharge.

- Realistic Timelines: Set deadlines for clients that you can confidently meet because they account for your planned time off.

- Better Financial Planning: Forecast your annual income with much greater accuracy and avoid cash flow surprises.

For a more granular look at your own schedule, check out this handy working days calculator to see how the numbers stack up for you.

To give you a clear picture, here's a quick comparison of the standard calendar year versus a more realistic Australian working year.

Standard Year vs Your Actual Working Year

This table breaks down how the standard 52 weeks in a year get whittled down to what you actually have available for work.

| Metric | Standard Calculation | Realistic Australian Calculation |

|---|---|---|

| Total Weeks in a Year | 52 weeks | 52 weeks |

| Annual Leave (Standard) | 0 weeks (not considered) | - 4 weeks |

| Public Holidays (Approx.) | 0 weeks (not considered) | - 2 weeks |

| Effective Working Weeks | 52 Weeks | Approx. 46 Weeks |

As you can see, the difference is significant. Starting your planning with 46 weeks instead of 52 provides a much more grounded and achievable foundation for the year ahead.

The Simple Formula for Nailing Your Numbers

So, how do you actually figure out the number of working weeks in a year? It's not as simple as just saying "52". To get an accurate number for your business planning, you need a reliable formula. Think of it as your recipe for financial clarity.

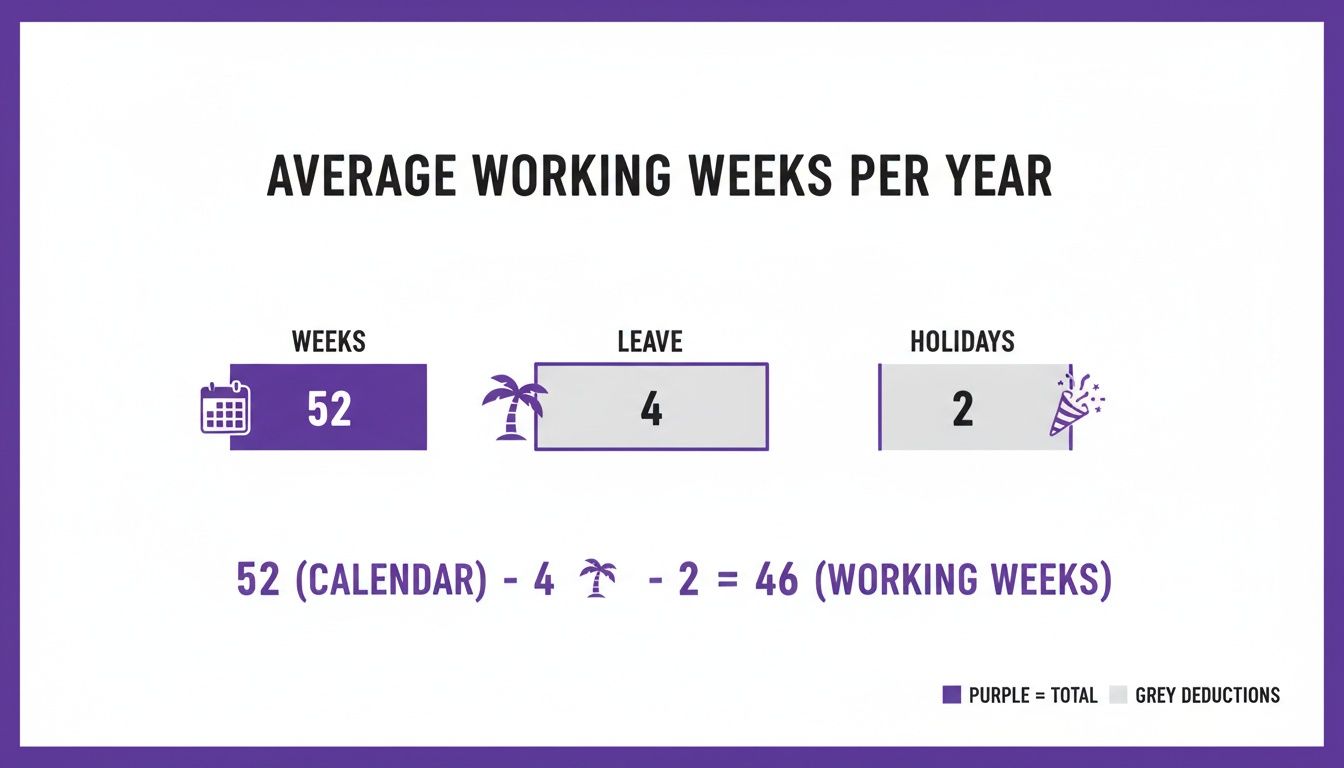

At its heart, the calculation is pretty straightforward. It’s your starting point for everything else.

(Total Weeks in a Year) – (Weeks of Annual Leave) – (Weeks of Public Holidays) = Your Total Working Weeks

Let's pull apart each piece of that puzzle. Once you get the hang of it, you'll be able to transform that generic 52-week calendar into a powerful, precise tool for your business.

Deconstructing the Core Elements

First up, the easy one: there are 52 weeks in a calendar year. This is our baseline, the total pie we’re about to start slicing into.

Next, we need to account for time off. In Australia, the standard for full-time employees is four weeks of paid annual leave. This is the biggest and most predictable chunk you'll take out of the calendar.

Finally, we have public holidays. This is where it gets a little trickier, as they’re scattered throughout the year. On average, Aussies get between 10 to 12 public holidays. To make them fit our weekly formula, we just need to convert them. Assuming a standard five-day work week, 10 public holidays works out to be exactly two full work weeks.

Putting the Formula into Practice

Alright, let's plug in the numbers and see how it works in the real world. This will give us a baseline for a typical full-time professional in Australia.

Here’s the calculation, step-by-step:

- Start with Total Weeks: 52

- Subtract Annual Leave: 52 - 4 = 48 weeks

- Subtract Public Holidays: 48 - 2 = 46 weeks

And there you have it. This simple maths shows you have around 46 weeks of actual working time, not the 52 you might have guessed. This 46-week figure is a much more realistic number to use for annual planning and financial forecasting.

Of course, this changes for part-time workers. While a full-time week is capped at 38 hours, part-timers, who make up a huge 31% of the workforce, have much lower totals, which alters their annual working weeks significantly. You can discover more insights about Australian working conditions and see how your hours compare.

For even more accuracy, many businesses prefer to calculate using working days instead of weeks. This method is great for dealing with holidays that fall on a weekend and gives you a much more granular view of your available time, a must-have for precise project scoping and invoicing.

How to Adjust Your Calculations for Each Australian State

Figuring out your working weeks isn't a simple, nationwide formula here in Australia. Because each state and territory has its own unique set of public holidays, a business in Victoria will have a slightly different working calendar from one in Western Australia.

This isn't just a minor detail; it's a critical piece of the puzzle for any national business, remote team, or freelancer with clients spread across the country. Getting it wrong can lead to wonky project timelines, payroll mistakes, and invoicing headaches. A holiday like the AFL Grand Final Friday in Victoria or WA Day in Western Australia directly cuts down the available workdays, meaning your true working weeks in a year will change depending on where you or your team are based.

This infographic breaks down how leave and holidays chip away at the total calendar weeks to give you your actual working time.

The main takeaway here is pretty clear: you have to subtract both your annual leave and public holidays to get an accurate picture of your billable time.

The State-by-State Holiday Impact

The number of public holidays varies enough between states to make a real difference to your final count. For example, New South Wales has 11 public holidays, which usually leaves about 252 working days after you factor in annual leave. But jump over to the ACT, and with 12 public holidays, that number drops slightly to around 251.

These small differences add up, impacting everything from project capacity to annual revenue forecasts.

To give you a clearer picture, we've put together a table that shows how each state and territory stacks up.

Working Days Per Year by Australian State & Territory

This table shows the total number of public holidays and the resulting estimated working days for each Australian state and territory, assuming a standard full-time work schedule.

| State/Territory | Total Public Holidays | Estimated Annual Working Days |

|---|---|---|

| NSW | 11 | Approx. 252 |

| VIC | 11 (+1 conditional) | Approx. 251-252 |

| QLD | 11 | Approx. 252 |

| WA | 11 | Approx. 252 |

| SA | 11 | Approx. 252 |

| TAS | 11 | Approx. 252 |

| ACT | 12 | Approx. 251 |

| NT | 11 | Approx. 252 |

Note: These estimates are based on a standard 5-day work week and 4 weeks of annual leave. The final count can shift slightly depending on which day of the week holidays fall each year.

As you can see, while most states are similar, those small variations are exactly what you need to account for to ensure your planning is spot-on.

Let Automation Handle the Headaches

Trying to manually track these regional differences can be a real nightmare, especially if you're managing staff or clients in multiple locations. A missed public holiday can easily derail project schedules and create confusing invoices, which never looks good to a client.

The smartest way to manage this complexity is to use a modern tool that does the heavy lifting for you. Platforms like Payly build state-specific public holiday calendars directly into their time tracking and invoicing systems.

This kind of automation ensures your calculations are always accurate, no matter where your business, team, or clients are located. It saves you from hours of cross-checking calendars and prevents the kinds of costly mistakes that come from manual error. It frees you up to focus on what actually matters: your billable work.

For a more detailed breakdown, check out our guide on how many working days are in a year in Australia.

Going Beyond the 9-to-5 Calculation

That standard full-time calculation gives us a great starting point, but let’s be honest, it doesn't quite fit the reality for a huge slice of the Australian workforce. If you're a part-timer, a freelancer, or running a service-based business, the one-size-fits-all model of 46 working weeks in a year starts to feel a bit flimsy.

This is where we need to shift our thinking. Instead of just looking at broad weekly estimates, we need to get down to the nitty-gritty of hours worked and, more importantly, hours billed. It’s less about subtracting leave and more about building your financial forecasts from the ground up, based on the actual time you have to generate income.

How to Calculate for Part-Time Staff

When it comes to part-time employees, thinking in terms of "working weeks" can be misleading. A more helpful approach is to focus on their total annual work capacity. The best way to do this is by figuring out their total annual hours and then translating that into what we call a "full-time equivalent".

Think of it like this: if a standard full-time week in Australia is 38 hours, a part-timer working 19 hours a week is effectively contributing 0.5 of a full-time equivalent (FTE) week.

Using this method gives you a much clearer picture of your team's total capacity for handling projects and day-to-day tasks. It lets you plan resources much more accurately because you’re looking at the total pool of available hours across your entire team, rather than getting tangled up in mismatched weekly schedules.

From Weeks to Billable Hours: A Guide for Freelancers and Agencies

For freelancers and agencies, the whole concept of working weeks in a year is tied directly to billable hours. Your goal isn't just to be "at work" for 46 weeks; it's to maximise the hours you can actually invoice during that time. This is where diligent time tracking becomes absolutely essential.

For small agencies and freelancers, especially those using tools like Payly to manage invoicing, understanding this variability is everything. Pinpointing every billable hour can mean the difference between leaving money on the table and capturing it. Consider the 173 unpaid overtime hours many Australians work; that's like doing over 4.5 extra weeks of work for free each year, costing the average worker $7,930. You can dig into the official stats on Australian employee earnings and hours to see just how much untracked time can hurt your bottom line.

Here’s a simple way to turn a project scope into a realistic timeline.

Worked Example: A Freelancer's Website Quote

- Estimate Total Project Hours: A client wants a new website. You scope it out and estimate it will take 120 hours of solid work.

- Determine Your Weekly Billable Capacity: You know from experience that you can realistically bill for about 25 hours per week, once you factor in admin, marketing, and client chats.

- Calculate the Weeks Needed: 120 total hours ÷ 25 billable hours/week = 4.8 weeks.

- Give a Realistic Timeline: You can now confidently tell the client the project will take approximately 5 working weeks to complete.

This kind of practical calculation takes the guesswork out of quoting. It helps you set clear expectations from day one and bridges the gap between a vague idea of "working weeks" and the real-world demands of running a service business.

Finding the Hidden Weeks in Your Work Year

Beyond the obvious things like annual leave and public holidays, there are a few 'hidden' factors that can quietly warp your true number of working weeks. These often fly under the radar but can have a huge impact on your real capacity and, importantly, your annual revenue.

One of the biggest culprits? Unpaid overtime. Think of it as a slow leak in your business. Those small, untracked drips of extra time might not seem like much day-to-day, but over a year they add up to a massive loss of potential income. For freelancers and agencies, every hour that goes untracked is a missed chance to bill.

This has become even more of an issue with the massive shift to remote work. When your home is your office, the line between professional and personal time gets blurry, fast. Without clear boundaries and a bit of discipline, it's easy to accidentally pile weeks of unpaid labour onto your year.

The Impact of Ghost Weeks

All those untracked hours create what I like to call ‘ghost weeks’. These are chunks of time you’ve spent working that never make it onto an invoice or touch your bottom line. They exist in reality, but they vanish before they can turn into revenue.

This isn't a small problem. On average, Australian professionals put in an extra 3.6 hours of unpaid overtime each week. That might not sound like a crisis, but it adds up. Over a year, that's a staggering 173 extra hours, which is the equivalent of more than 4.5 full-time working weeks. You can read up on Australian weekly work trends to see how this time adds up. For an agency or freelancer who tracks time properly, this is billable gold just waiting to be claimed.

These ghost weeks are a silent killer for your financial health. If you’re not capturing and billing for this extra time, you're essentially giving away nearly a month of your expert services for free, every single year.

Why Precise Tracking is Your Best Defence

The only way to get this lost time back is through consistent, meticulous time tracking. This isn't about micromanaging yourself or your team. It's about making sure every minute of valuable work is accounted for and, ultimately, paid for.

This is especially critical in any service business where time is literally your inventory. By putting a reliable tracking system in place, you can:

- Find Hidden Billable Hours: You'll finally see all the extra time you spend on client calls, endless revisions, and those little project overruns.

- Quote with Confidence: Your project estimates will become far more accurate because they'll be based on real data about how long things actually take.

- Boost Your Profitability: Those ‘ghost weeks’ that used to disappear can now be turned directly into revenue, giving your annual income a healthy lift.

By simply plugging the leaks in your time management, you can completely change your understanding of the working weeks in a year and make sure your financial planning is based on reality, not just what the calendar says.

How to Turn Tracked Time into Faster Payments

All these calculations are great for figuring out your actual working weeks in a year, but they don’t mean much until you turn that time into money. The real challenge is moving from theory to practice: transforming your tracked hours into paid invoices. This is often where things get messy, especially if you’re juggling spreadsheets, timers, and invoicing apps.

That’s where a connected system can completely change the game. Instead of treating time tracking, invoicing, and getting paid as separate, painful steps, you can bring them all together. The whole point is to shrink the time between finishing the work and seeing the cash hit your bank account.

A Smooth Path from Hours to Invoices

Picture this: you track every single billable minute with a simple timer, whether you’re at your desk or on the move. That data isn't just a log; it's the raw material for your next invoice. A smart system can even automatically factor in state-specific public holidays, so your timesheets are always spot-on.

When it's time to bill, you can turn an approved timesheet into a professional, GST-compliant invoice in a single click. This completely gets rid of the soul-destroying (and error-prone) task of manually typing in hours, project details, and rates. For a deeper dive, check out our guide on how to send an invoice that clients actually pay on time.

When you link your time tracking directly to your invoicing, you build a system where every working hour is captured, accounted for, and ready to be billed. That efficiency is the secret to turning your time into revenue without getting bogged down in admin.

Modern tools can then take it even further. For Australian service businesses, a few features make all the difference in getting paid faster:

- Automated Payment Reminders: Let the system send gentle, automatic nudges to clients about upcoming or overdue payments. It saves you from having those awkward follow-up conversations.

- Accounting Integrations: Your invoice data can sync straight into platforms like Xero or MYOB, keeping your books accurate without you lifting a finger.

- Secure e-Signatures: Get contracts and project scope signed off digitally. It creates a clear, legally binding record before you even start the work.

This integrated approach helps you sidestep the administrative headaches, ensuring every calculated working hour finds its way onto an invoice and, more importantly, into your bank account.

Your Questions Answered

When you start digging into the details of calculating working weeks, a few common questions always pop up. Let's tackle them head-on so you can apply these ideas with confidence.

How Many Weeks Does a Full-Timer Really Work in a Year?

A calendar year has 52 weeks, but that’s not the number you should be using for your planning. For a typical full-time employee in Australia, the real figure is closer to 46 working weeks.

Why the difference? It comes down to taking out the standard four weeks of annual leave and about two weeks' worth of public holidays. Once you subtract that time off, you get a much more realistic number for actual work.

Does This Calculation Change if I'm Part-Time?

Yes, it definitely does. If you're working part-time, thinking in terms of "weeks" can be misleading. It’s far more accurate to shift your focus to your total annual hours.

Calculating your total hours gives you a crystal-clear picture of your actual work capacity. This is a game-changer for planning projects and forecasting your income, as it avoids trying to squeeze an irregular schedule into a standard full-time model.

What About All That Unpaid Overtime I Do?

This is a big one. Unpaid overtime creates "ghost weeks," which are chunks of time you've worked but haven't billed for. The only way to reclaim this lost revenue is to track every single hour you work, without exception.

By meticulously logging your time, you can shine a light on those hidden hours and turn them into what they should be: billable income. It gives you a true measure of your annual output.

Accurate time tracking is the only way to convert unpaid effort into tangible income. It reveals the true scope of your work year and ensures you are compensated for every hour of your expertise.

Getting into the habit of using tools like daily work log templates can make a huge difference. It helps you capture every minute, which makes invoicing a breeze and ensures your records are spot on.

Ready to stop juggling spreadsheets and start turning every working hour into revenue? Payly combines time tracking, invoicing, and e-signatures into one simple platform for Australian businesses. Start your free 14-day trial today and see how easy it is to get paid faster.

Payly Team

Sharing insights and strategies to help service businesses thrive. Follow Payly for more tips on time tracking, invoicing, and business operations.

Related Articles

Ready to streamline your business?

Join thousands of freelancers and agencies who use Payly to track time, send invoices, and get paid faster.