Expense management application for Budgets: expense management application

Discover how the expense management application can streamline operations, boost ROI, and help Australian businesses choose the right tool.

Payly Team

February 2, 2026

At its core, an expense management application is a piece of of software that takes the headache out of tracking, submitting, and approving business-related spending. Think of it as a digital compass for Aussie business owners, helping you navigate away from messy spreadsheets and shoeboxes full of paper receipts toward a clean, organised system that gives you real financial clarity.

Conquering the Chaos of Business Spending

For too many Australian businesses, trying to manage expenses feels like sailing a ship with a torn map. You're constantly battling a storm of lost receipts, getting bogged down in tedious spreadsheet updates, and wasting countless hours on manual data entry. This chaos isn't just an administrative chore; it's a massive drain on your time, productivity, and your ability to see where your money is actually going.

This old-school approach forces you into a reactive position. You’re making financial decisions based on information that's already out of date. By the time you’ve pulled together the quarterly reports, the money's long gone, leaving you with no real chance to make smart adjustments or plan ahead.

The Reality of Manual Expense Tracking

The financial squeeze on Australian SMEs is getting tighter. With the rising cost of wages, energy, and supplies, every single dollar needs to be tracked with absolute precision. Despite this, a shocking 80% of Australian SMEs are still stuck using manual methods for their expenses, which creates huge inefficiencies across the board. You can dive deeper into these SME financial management trends in the full research from OFX.

For any business that manages a team, like digital agencies or professional services firms, the hidden cost is even higher. Every hour your team spends chasing up receipts or manually reconciling accounts is an hour they’re not billing clients or bringing in revenue. In today's market, clinging to these outdated methods is simply not sustainable.

An expense management application is more than just a tool; it's a fundamental shift from reactive bookkeeping to proactive financial control. It provides the clarity needed to navigate economic uncertainty and steer a business toward sustainable growth.

A Modern Compass for Financial Clarity

The solution is to step away from these disconnected, manual systems once and for all. Automating your expense management isn't just a nice-to-have anymore; it's crucial for survival and growth. An expense management application is that modern compass, giving you a clear path forward.

It gets you there by:

- Centralising all your spending data into one easy-to-access platform.

- Automating receipt capture and data entry, which frees up a huge amount of time.

- Giving you real-time visibility into your cash flow and what your team is spending.

By bringing this kind of tech into your business, you can finally get a handle on the spending chaos, turning a frustrating admin task into a real strategic advantage. This solid foundation of financial clarity is what allows you to make informed decisions and unlock your business’s true growth potential.

How an Expense Management Application Actually Works

So, what’s really going on under the hood of these applications? Let's peel back the curtain. Think of it less like a piece of software and more like a central nervous system for your company's spending. It’s designed to automate the entire lifecycle of an expense, from the moment an employee pays for something to the second it lands perfectly in your accounting books.

This system pulls everything out of overflowing shoeboxes, messy email chains, and chaotic spreadsheets. Instead of hunting for information, all your spending data lives in one place, organised, accessible, and updated in real-time.

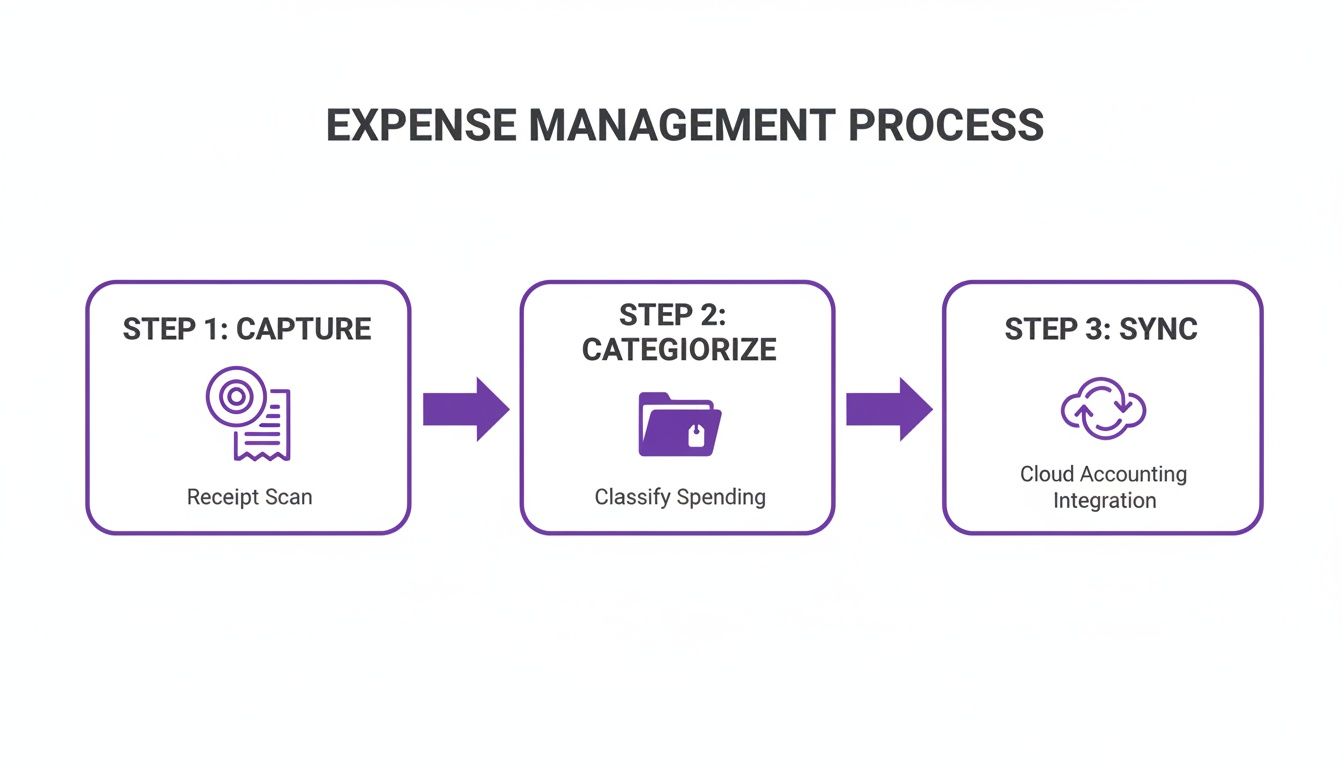

The Automated Expense Journey

At its heart, the process is beautifully simple but incredibly powerful. The goal is to cut out all the manual, repetitive work that makes old-school expense tracking such a nightmare of delays and mistakes. It all boils down to three key stages working in harmony.

- Digital Receipt Capture: It starts with an employee. They make a purchase, pull out their phone, and snap a quick photo of the receipt. The app’s Optical Character Recognition (OCR) technology instantly scans the image and pulls out the important details: who the vendor is, the date, and the total amount. No more manual typing.

- Intelligent Categorisation: Next, the software gets clever. Based on rules you’ve set, it automatically categorises the expense. A receipt from Officeworks gets tagged as ‘Office Supplies,’ while a charge from Qantas is filed under ‘Travel.’ It just knows.

- Real-Time Syncing: Finally, all this neat, categorised data syncs directly with your main dashboard and your accounting platform, whether that’s Xero, MYOB, or something else. Your books are always current, without anyone lifting a finger for data entry.

From Data Capture to Spending Control

But capturing data is just the starting point. The real magic happens when you use that information to take control of your spending before it gets out of hand. The application turns a simple stream of transactions into a framework for proactive financial management.

For example, you can build your company’s spending rules directly into the system. Set budgets for specific teams, projects, or even individual employees. If someone tries to claim an expense that pushes them over their limit, the system can automatically flag it or even block it for review. This is about stopping overspending at the source, not finding out about it weeks later when you're doing the books.

A big part of this control is implementing approval workflow software to ensure every dollar is signed off by the right person.

By embedding your company's spending policies directly into the software, an expense management application ensures compliance becomes the default, not an afterthought. It shifts your financial management from a reactive chore to a proactive strategy.

This means your finance team can finally stop playing detective, manually checking every single line item against policy documents. The application does the heavy lifting, routing expenses to the correct manager for approval based on the custom rules you’ve created. This frees up your team to focus on what really matters, like finding cost-saving opportunities or fine-tuning budgets, instead of just policing receipts. That’s the foundation that makes modern expense management so powerful.

Unlocking Efficiency with Core Features

The real power of an expense management application isn’t just about going paperless. It’s in the specific features that work together to replace a clunky, manual process with a smart, automated system. These aren't just minor conveniences; they're powerful tools that hand you back hours in your day and give you genuine control over your company's finances.

Each feature is designed to solve a particular headache in the old-school expense tracking workflow. From snapping a receipt on the go to getting a live look at spending, these capabilities deliver real results: less time wasted, fewer mistakes, and better adherence to your spending policies. This is where the change really happens.

Mobile Receipt Scanning with OCR

The days of hoarding a wallet full of faded receipts and then spending hours typing them into a spreadsheet are officially over. Modern apps use Optical Character Recognition (OCR) technology to do all the heavy lifting for you. An employee just snaps a photo of a receipt with their phone, and the app instantly reads and pulls out the key details: the vendor, date, and total amount.

Think about a consultant in Sydney who’s just paid for a client lunch. Instead of shoving the receipt in their pocket (where it will likely be forgotten for weeks), they can capture it in seconds, right there at the table. This immediate capture means no more lost receipts, and the data is in your system instantly, not just at the end of the month.

This simple flow shows just how powerfully an expense management app handles each transaction from start to finish.

The magic here is in the seamless automation. It wipes out manual data entry, ensuring the information is accurate and up-to-date from the moment the expense occurs.

Intelligent Expense Categorisation

Once the receipt data is captured, the app’s intelligence takes over. It automatically sorts expenses into the right categories based on your company's own chart of accounts. A charge from Bunnings gets tagged as 'Materials', while a software subscription is correctly filed under 'Technology'.

This removes the guesswork for employees and saves the finance team from the tedious job of reviewing and correcting every line item. It creates consistency across the board, which is absolutely vital for accurate reporting and realistic budgeting.

By automating categorisation, you create a clean, organised financial dataset without the manual effort. This consistency is the foundation for reliable financial reporting and smarter budgeting decisions.

This automated process also lays the groundwork for more advanced financial controls, like those needed for managing more complex processes. Take purchase orders, for example. You can learn more about how to streamline your procurement process in our detailed guide on purchase orders for Australian businesses.

Dynamic Spending Dashboards and Controls

Perhaps one of the most game-changing features is the ability to see spending as it happens. Real-time visibility is a top priority for Australian SMEs, with many admitting they often feel like they’re 'flying blind' until the quarterly reports come out. This delay means businesses can’t spot budget blowouts or unusual spending until it’s far too late. The Budgetly SME Spend Trends report highlights just how much finance teams are grappling with this challenge.

A dynamic dashboard gives you an immediate, visual snapshot of your company’s financial health. You can monitor spending by:

- Team or Department: See which teams are sticking to their budgets and which aren't.

- Project: Track expenses against specific client jobs to protect your profit margins.

- Vendor: Identify your top suppliers and spot opportunities to negotiate better rates.

This level of insight lets you shift from a reactive to a proactive financial strategy, making smart decisions based on what’s happening right now.

Customisable Approval Workflows

Finally, a good expense management app puts your approval process on autopilot. You can build custom workflows that automatically send expenses to the right manager for sign-off based on rules you define, like the dollar amount or expense category.

For instance, a marketing manager in Melbourne can approve her team’s campaign expenses directly from her phone. If an expense is over a certain limit, it can be automatically flagged and sent up the chain to a director for a second look. This ensures every dollar is properly authorised without creating frustrating bottlenecks, giving you both speed and control.

Choosing the Right Tool for Your Australian Business

Picking an expense management app isn't just about buying software. It’s a strategic move that has a real impact on how smoothly your business runs and whether you stay on the right side of the tax office. Not all platforms are created equal, and what works for a company in the US could be a complete disaster here in Australia.

To get this right, you have to look past the flashy marketing and zero in on the features that actually matter for Australian businesses. This guide is a no-nonsense checklist to help you find a solution that's genuinely built for our local rules and regulations. It’s about managing expenses the Australian way.

Must-Have Features for Australian Tax Compliance

Let's be blunt: Australia's tax system is complicated. Using a generic, one-size-fits-all expense tool is a recipe for headaches, leaving your finance team to manually patch up the compliance gaps later. You need a platform where local requirements are baked in from the start, not bolted on as an afterthought.

Key compliance features to look for:

- Automated GST Calculations: The app absolutely must be able to spot and calculate the Goods and Services Tax (GST) on every transaction, automatically. This feature alone will save you hours of pain when it's time to lodge your Business Activity Statements (BAS).

- Fringe Benefits Tax (FBT) Support: Anyone who's dealt with FBT on things like company cars or client entertainment knows how tricky it can be. A platform that helps you identify and track these benefits turns one of the most confusing parts of business tax into a simple, manageable process.

- Fuel Tax Credit Tools: If your business has vehicles on the road, you could be claiming back significant cash through fuel tax credits. A good app makes it easy to log fuel purchases and calculates the credits you’re entitled to, putting money straight back into your pocket.

These aren't just "nice-to-haves." They're fundamental for keeping clean records, maximising your tax claims, and avoiding the stress of an audit.

A Quick Checklist for Aussie Businesses

Finding the right fit means ticking the right boxes. Here’s a quick comparison to help you evaluate potential expense management platforms based on what truly matters for an Australian company.

Australian Business Feature Checklist

| Feature | Why It Matters for Australian Businesses | Payly Advantage |

|---|---|---|

| GST Calculation | Essential for accurate BAS lodgements and avoiding ATO penalties. Manual calculations are time-consuming and prone to error. | Payly automatically detects and calculates GST on all transactions, ensuring your records are always accurate and ready for reporting. |

| FBT Tracking | Fringe Benefits Tax is a complex area of Australian tax law. Proper tracking is crucial for compliance. | Our platform includes tools to help you identify and manage FBT-related expenses, simplifying a traditionally difficult task. |

| Fuel Tax Credits | A significant opportunity for businesses with vehicle fleets to reclaim money from the government. | Payly simplifies the process of logging fuel expenses and calculating your eligible credits, maximising your return. |

| Local Integrations | Seamless connection to Australian accounting software like Xero, MYOB, and QuickBooks is non-negotiable for efficiency. | We offer deep, pre-built integrations with all major Australian accounting platforms, ensuring a smooth, automated workflow. |

| Australian Data Hosting | Storing data locally is key for complying with Australian privacy laws (like the Privacy Act 1988) and often leads to better performance. | Your data is securely hosted right here in Australia, giving you peace of mind about security and legal compliance. |

This checklist isn't exhaustive, but it covers the core, non-negotiable features that any Australian business should demand from their expense management solution.

Seamless Integration with Your Accounting Software

Your expense management app should feel like a natural extension of your finance team, not another piece of isolated software that creates more work. The single most important factor here is how well it connects with the accounting system you already rely on.

In Australia, that means you need rock-solid, ready-to-go integrations with the platforms that dominate the market.

Your expense management tool should slot perfectly into your existing financial ecosystem. Without deep integration with platforms like Xero, MYOB, or QuickBooks, you're simply trading one manual data entry task for another.

A great integration means that once an expense is approved, all the categorised data flows straight into your general ledger without anyone having to lift a finger. No more downloading messy CSV files or manually punching in numbers. This is what real automation looks like.

Data Security and Local Compliance

When you're dealing with company financials, security is everything. You have a responsibility to protect your business and your employees, which means choosing a platform that understands and respects Australian data privacy laws.

Here are a few critical security questions to ask any potential provider:

- Data Sovereignty: Where will our financial data actually live? Always go for providers who host their data here in Australia. It's the simplest way to ensure you're compliant with local privacy regulations.

- Encryption Standards: The platform must use bank-level encryption (look for AES-256) to protect your information, both when it's being sent and when it's stored. This is the gold standard for financial data security.

- Compliance and Audits: Does the company get regular, independent security audits? This shows they take security seriously and are committed to protecting your sensitive information.

Getting clear answers to these questions will help you choose a tool that not only makes your life easier but also acts as a trustworthy guardian of your company's most important data.

Calculating the True Return on Your Investment

Thinking an expense management app just saves a bit of time on paperwork is missing the bigger picture. The real value comes from the strategic financial gains it unlocks, delivering a return on investment (ROI) that ripples through the entire business. Think of it less as a convenient tool and more as a direct investment in financial control.

Beyond just clawing back hours, these platforms deliver a powerful ROI by tightening compliance, sharpening budget accuracy, and strengthening your cash flow. They shine a light on the hidden costs of doing things the old way, turning what was once a financial black box into a source of clear, actionable data.

Beyond Time Savings: Uncovering Hidden Costs

Manual expense tracking is a minefield of costly problems, many of which you won’t see until the damage is done. These aren't just small annoyances; they're direct hits to your bottom line that an automated system is designed to stop in its tracks.

Here are the key areas where you’ll see immediate financial returns:

- Eliminating Duplicate Payments: It’s a classic, costly mistake in manual systems. AI-powered checks automatically flag and block the same receipt from being submitted twice.

- Reducing Fraudulent Claims: Automated policy rules and smart safeguards can spot unusual spending, drastically cutting the risk of dodgy claims getting paid.

- Maximising Tax Deductions: When every single expense is captured and categorised correctly, you can be sure you’re not missing out on legitimate deductions, including crucial GST and fuel tax credits.

By plugging these common financial leaks, the application can often pay for itself in direct cost savings alone, and that's before you even factor in the productivity boost.

The true ROI of an expense management application is measured not only in the hours it saves but in the costly errors it prevents and the financial opportunities it unlocks. It transforms expense management from a cost centre into a strategic asset.

ROI in Action: An Australian Agency Example

Let's make this real. Imagine a small digital agency in Sydney with 10 employees. Their old-school manual process was costing them a fortune in both wasted time and lost money.

After switching to an expense management app, the change was immediate. The platform automated everything from snapping a receipt to syncing with their accounting software, creating a crystal-clear ROI.

Productivity Gains:

- Employees used to spend about 2 hours per month wrestling with expense reports. Automation cut this down to just 15 minutes.

- The finance manager, who burned 10 hours a month chasing receipts and manually reconciling everything, now only needs 2 hours.

- That’s 25.5 hours of valuable time recovered every single month. Time the agency could now pour back into billable client work, directly boosting revenue.

Direct Financial Savings:

- The system flagged an average of $250 per month in duplicate or out-of-policy claims that had previously slipped through the cracks.

- It also helped them properly claim an extra $150 per month in GST that was being missed because of lost receipts.

- These savings added up to $400 per month, or a very tidy $4,800 annually, straight back to their bottom line.

This example really highlights how an expense management app delivers value from multiple angles. For a deeper dive into streamlining your finances, check out our guide on accounts payable automation software. The same principles of control and efficiency apply right across your financial operations. By ditching the manual grind, this agency didn't just save thousands; it gained the real-time financial clarity needed to make smarter business decisions, faster.

Why a Unified Platform Outperforms Single Tools

It’s easy to fall into the ‘app stacking’ trap. You get one tool for expenses, another for time tracking, a separate one for invoicing, and yet another for signing documents. Before you know it, you’re juggling a whole collection of single-purpose apps. It’s like trying to build something with a cluttered toolbox: you have a screwdriver for one job and a wrench for another, but you spend half your time just finding the right tool.

This disconnected approach often creates more headaches than it solves. You end up with frustrating data silos, where crucial information is locked away in one system and has to be manually re-entered into another. On top of that, you’re paying multiple subscription fees and forcing your team to constantly switch between different interfaces just to get basic tasks done.

The Hidden Cost of Disconnected Systems

This fragmentation isn't just an inconvenience; it's a serious financial drain. In fact, poor integration is causing Australian businesses to waste an estimated $1.4 billion a year on digital tools they aren't even using properly. For small and medium-sized businesses already wrestling with rising costs, this kind of hidden waste can really hurt the bottom line. You can dig into the numbers in this HubSpot growth report.

The problem starts when you patch together standalone solutions for every business need. An expense management app is a great start, but its real power is unlocked when it’s seamlessly connected to everything else.

The Power of a Single Source of Truth

This is where an all-in-one platform like Payly really changes the game. Think of it as that sleek multi-tool that has everything you need in one place. Instead of digital chaos, you get clarity and control. It connects the dots between all your operational tasks, creating a single, reliable source of truth for your business data.

Here’s what that looks like in practice:

- A team member tracks their billable hours and logs a project expense in the same system.

- Once approved, that data automatically populates a client invoice, no manual entry required.

- The invoice is then sent out and electronically signed by the client, all within the same platform.

That's the efficiency of a truly integrated system. It ties your expense management directly into the bigger picture of how your business runs. To take that a step further, you can check out our guide on choosing the right document management software for your Australian business.

A unified platform transforms disconnected tasks into a cohesive workflow. It eliminates the friction of manual data transfer, reduces the risk of errors, and provides a holistic view of your business operations in real time.

This cohesion ensures every dollar and every hour is accounted for accurately and is instantly accessible. A good all-in-one platform should also integrate smoothly with your existing financial systems, just as you’d expect from the best accounting software for small business. By breaking down the walls between your business functions, you’re not just saving time; you’re building a more efficient, profitable, and scalable operation.

Frequently Asked Questions

Choosing the right expense management app can feel like a big decision, and it’s natural to have a few questions. We’ve pulled together the most common ones we hear from Australian businesses to give you the clear, no-nonsense answers you need.

How Secure Is My Financial Data in an App?

This is usually the first question people ask, and for good reason. You need to know your financial data is safe. The short answer is yes, with the right provider, it’s incredibly secure.

Think of it this way: a quality expense platform protects your data with the same rigour as your bank. They use sophisticated tools like bank-level encryption (AES-256 is the standard) to keep your information locked down, both when it's moving and when it's sitting on their servers.

For Australian businesses, there’s one more critical piece to the puzzle: data sovereignty. Look for a provider that stores your data on Australian soil. This ensures they're playing by the rules of the Privacy Act 1988 and gives you an extra layer of protection. Don’t be shy about asking a potential provider where your data lives.

Will an Expense App Work with My Existing Software?

It absolutely has to. An expense app that doesn't talk to your other systems is more of a hindrance than a help. Modern platforms are built to plug straight into your existing financial toolkit.

The best ones offer seamless, pre-built integrations with the accounting software most Australian businesses rely on, like Xero, MYOB, and QuickBooks.

This means that as soon as an expense gets the green light, all the details, the category, the GST, the receipt, are automatically pushed into your accounting system. No more manual data entry, no more typos, and your books are always perfectly up-to-date.

An expense management app's real power comes from centralising your data and automating the boring stuff. If it can’t integrate tightly with your accounting software, you’re missing out on the biggest time-saving benefits.

Can a Small Business Justify the Cost?

It’s easy to look at the monthly fee and think of it as just another expense. But it's better to think of it as an investment, one that usually pays for itself surprisingly quickly. The real cost is often hidden in the manual way you're doing things now.

Think about the hours your team spends chasing receipts, manually entering data, or correcting errors. What about the occasional duplicate payment that slips through, or the out-of-policy lunch claim that gets approved by mistake? These things add up.

Even if the platform only saves a couple of hours of admin work each month or catches a single incorrect claim, it has often covered its own cost. For most small businesses, the savings in time, the reduction in errors, and the improved oversight make the monthly fee a bargain. The right tool doesn't just manage your spending; it actively puts money back into your business.

Ready to replace five different tools with one smart platform? Payly offers an all-in-one solution for time tracking, invoicing, e-signatures, and complete expense management, all tailored for Australian businesses. Start your free 14-day trial today.

Payly Team

Sharing insights and strategies to help service businesses thrive. Follow Payly for more tips on time tracking, invoicing, and business operations.

Related Articles

Ready to streamline your business?

Join thousands of freelancers and agencies who use Payly to track time, send invoices, and get paid faster.